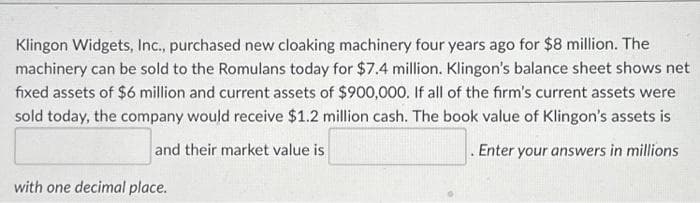

Klingon Widgets, Inc., purchased new cloaking machinery four years ago for $8 million. The machinery can be sold to the Romulans today for $7.4 million. Klingon's balance sheet shows net fixed assets of $6 million and current assets of $900,000. If all of the firm's current assets were sold today, the company would receive $1.2 million cash. The book value of Klingon's assets is and their market value is .Enter your answers in millions with one decimal place.

Klingon Widgets, Inc., purchased new cloaking machinery four years ago for $8 million. The machinery can be sold to the Romulans today for $7.4 million. Klingon's balance sheet shows net fixed assets of $6 million and current assets of $900,000. If all of the firm's current assets were sold today, the company would receive $1.2 million cash. The book value of Klingon's assets is and their market value is .Enter your answers in millions with one decimal place.

Chapter25: Taxation Of International Transact Ions

Section: Chapter Questions

Problem 25P

Related questions

Question

Transcribed Image Text:Klingon Widgets, Inc., purchased new cloaking machinery four years ago for $8 million. The

machinery can be sold to the Romulans today for $7.4 million. Klingon's balance sheet shows net

fixed assets of $6 million and current assets of $900,000. If all of the firm's current assets were

sold today, the company would receive $1.2 million cash. The book value of Klingon's assets is

and their market value is

.Enter your answers in millions

with one decimal place.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT