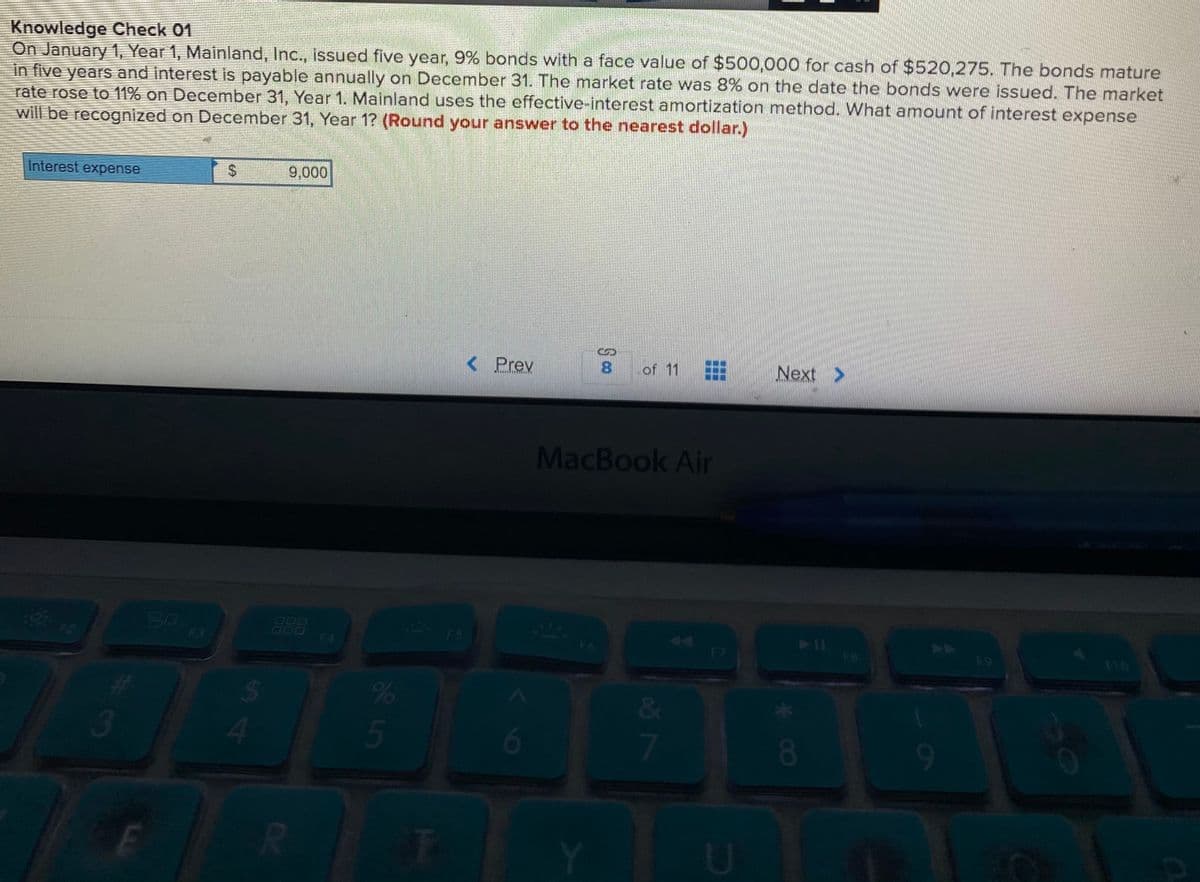

Knowledge Check 01 On January 1, Year 1, Mainland, Inc., issued five year, 9% bonds with a face value of $500,000 for cash of $520,275. The bonds mature in five years and interest is payable annually on December 31. The market rate was 8% on the date the bonds were issued. The market rate rose to 11% on December 31, Year 1. Mainland uses the effective-interest amortization method. What amount of interest expense will be recognized on December 31, Year 1? (Round your answer to the nearest dollar.) Interest expense 9,000

Knowledge Check 01 On January 1, Year 1, Mainland, Inc., issued five year, 9% bonds with a face value of $500,000 for cash of $520,275. The bonds mature in five years and interest is payable annually on December 31. The market rate was 8% on the date the bonds were issued. The market rate rose to 11% on December 31, Year 1. Mainland uses the effective-interest amortization method. What amount of interest expense will be recognized on December 31, Year 1? (Round your answer to the nearest dollar.) Interest expense 9,000

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 2PB: Charleston Inc. issued $200,000 bonds with a stated rate of 10%. The bonds had a 10-year maturity...

Related questions

Question

Transcribed Image Text:Knowledge Check 01

On January 1, Year 1, Mainland, Inc., issued five year, 9% bonds with a face value of $500,000 for cash of $520,275. The bonds mature

in five years and interest is payable annually on December 31. The market rate was 8% on the date the bonds were issued. The market

rate rose to 11% on December 31, Year 1. Mainland uses the effective-interest amortization method. What amount of interest expense

will be recognized on December 31, Year 1? (Round your answer to the nearest dollar.)

Interest expense

9,000

<Prev

8

of 11

Next

>

MacBook Air

F2

BO

F3

F5

411

F4

F6

F7

F8

F9

&

R

* CO

..

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning