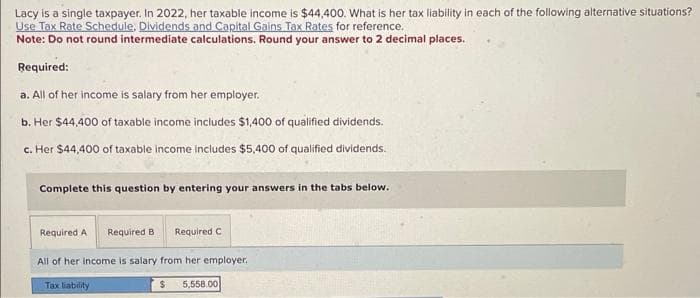

Lacy is a single taxpayer. In 2022, her taxable income is $44,400. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Required: a. All of her income is salary from her employer. b. Her $44,400 of taxable income includes $1,400 of qualified dividends. c. Her $44,400 of taxable income includes $5,400 of qualified dividends. Complete this question by entering your answers in the tabs below. Required A Required B Required C All of her income is salary from her employer. Tax liability $ 5,558.00

Lacy is a single taxpayer. In 2022, her taxable income is $44,400. What is her tax liability in each of the following alternative situations? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Required: a. All of her income is salary from her employer. b. Her $44,400 of taxable income includes $1,400 of qualified dividends. c. Her $44,400 of taxable income includes $5,400 of qualified dividends. Complete this question by entering your answers in the tabs below. Required A Required B Required C All of her income is salary from her employer. Tax liability $ 5,558.00

Chapter1: The Individual Income Tax Return

Section: Chapter Questions

Problem 8P

Related questions

Question

Q. 1

Transcribed Image Text:Lacy is a single taxpayer. In 2022, her taxable income is $44,400. What is her tax liability in each of the following alternative situations?

Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference.

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Required:

a. All of her income is salary from her employer.

b. Her $44,400 of taxable income includes $1,400 of qualified dividends.

c. Her $44,400 of taxable income includes $5,400 of qualified dividends.

Complete this question by entering your answers in the tabs below.

Required A Required B Required

All of her income is salary from her employer.

$ 5,558.00

Tax liability

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT