lan and Sara Winthrop are a married couple who file a joint income tax return. They have two children, and they have legitimate itemized deductions totaling $26,750. Their total in =$307,100. Assume the following tax table is applicable: Iarried Couples Filing Joint Returns Your Taxable ncome is Up to $19,750 You Pay This Amount on the Base of the Bracket 19,750-$80,250 80,250-$171,050 171,050-$326,600 326,600-$414,700 414,700-$622,050 Over $622,050 What is their marginal tax rate? a. 32.0% b. 35.0% c. 12.0% $0.00 1,975.00 9,235.00 29,211.00 66,543.00 94,735.00 167,307.50 Plus This Percentage on the Excess over the Base 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20.4 22.8 26.9 37.0

lan and Sara Winthrop are a married couple who file a joint income tax return. They have two children, and they have legitimate itemized deductions totaling $26,750. Their total in =$307,100. Assume the following tax table is applicable: Iarried Couples Filing Joint Returns Your Taxable ncome is Up to $19,750 You Pay This Amount on the Base of the Bracket 19,750-$80,250 80,250-$171,050 171,050-$326,600 326,600-$414,700 414,700-$622,050 Over $622,050 What is their marginal tax rate? a. 32.0% b. 35.0% c. 12.0% $0.00 1,975.00 9,235.00 29,211.00 66,543.00 94,735.00 167,307.50 Plus This Percentage on the Excess over the Base 10.0% 12.0 22.0 24.0 32.0 35.0 37.0 Average Tax Rate at Top of Bracket 10.0% 11.5 17.1 20.4 22.8 26.9 37.0

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 26CE

Related questions

Question

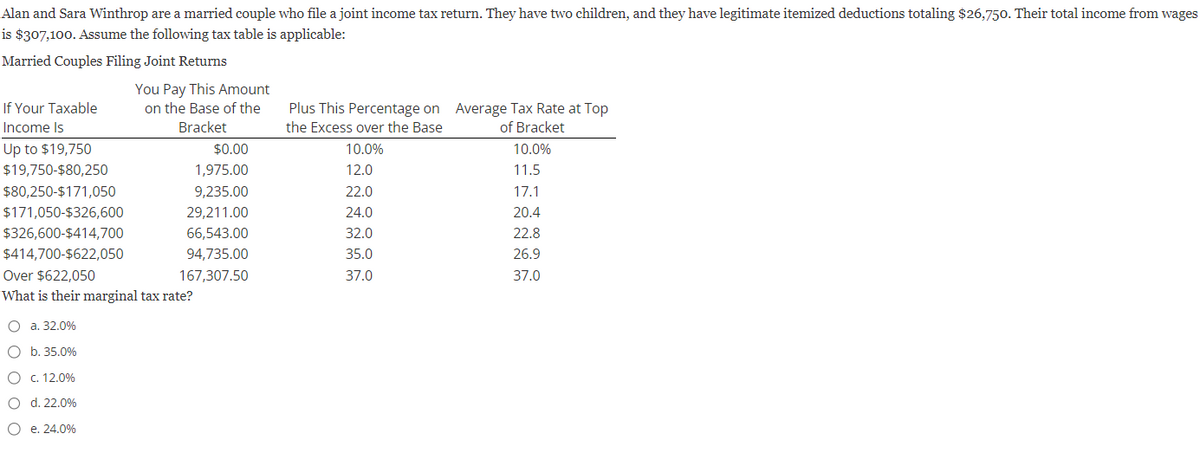

Transcribed Image Text:Alan and Sara Winthrop are a married couple who file a joint income tax return. They have two children, and they have legitimate itemized deductions totaling $26,750. Their total income from wages

is $307,100. Assume the following tax table is applicable:

Married Couples Filing Joint Returns

If Your Taxable

Income Is

Up to $19,750

$19,750-$80,250

$80,250-$171,050

$171,050-$326,600

$326,600-$414,700

$414,700-$622,050

Over $622,050

What is their marginal tax rate?

O a. 32.0%

O b. 35.0%

O c. 12.0%

O d. 22.0%

O

You Pay This Amount

on the Base of the

Bracket

e. 24.0%

$0.00

1,975.00

9,235.00

29,211.00

66,543.00

94,735.00

167,307.50

Plus This Percentage on Average Tax Rate at Top

the Excess over the Base

of Bracket

10.0%

12.0

22.0

24.0

32.0

35.0

37.0

10.0%

11.5

17.1

20.4

22.8

26.9

37.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT