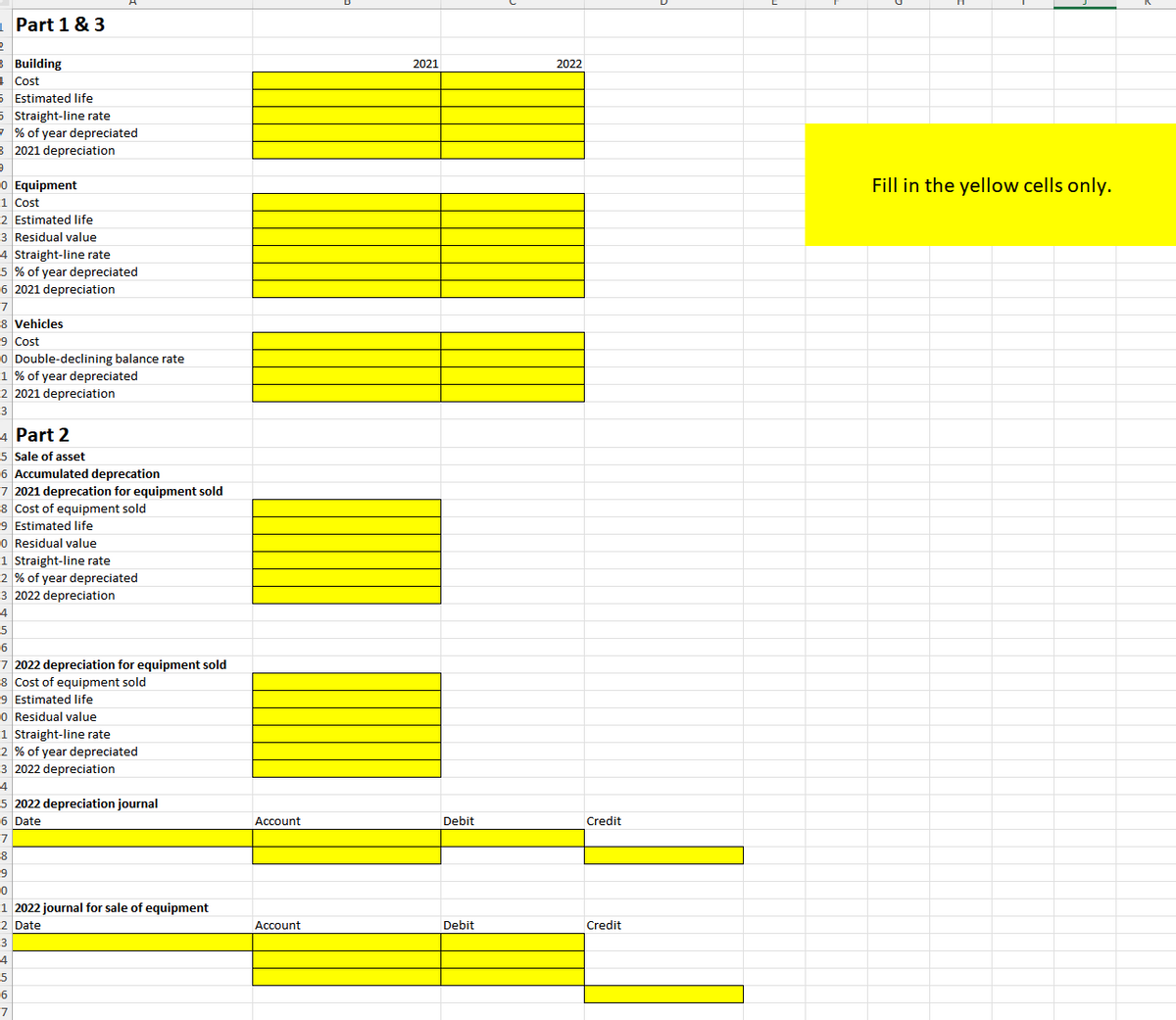

Part 1 & 3 Building Cost Estimated life Straight-line rate % of year depreciated B 2021 depreciation 0 Equipment 1 Cost 2 Estimated life 3 Residual value 4 Straight-line rate 5% of year depreciated 6 2021 depreciation 7 8 Vehicles 9 Cost 0 Double-declining balance rate 1% of year depreciated 2 2021 depreciation 3 4 Part 2 5 Sale of asset 6 Accumulated deprecation 7 2021 deprecation for equipment sold 8 Cost of equipment sold 9 Estimated life 0 Residual value 1 Straight-line rate 2 % of year depreciated 3 2022 depreciation 4 5 6 7 2022 depreciation for equipment sold 8 Cost of equipment sold 9 Estimated life 0 Residual value -1 Straight-line rate -2 % of year depreciated -3 2022 depreciation 2021 2022 4 5 2022 depreciation journal 6 Date Account Debit Credit -7 -8 9 0 -1 2022 journal for sale of equipment 2 Date 3 4 -5 6 -7 Account Debit Credit Fill in the yellow cells only. Land Building Equipment Vehicles Total Asset Additional information: Equipment sold 6/29/22 Original cost of equipment on 3/31/21 Depreciation method for buildings and equipment Depreciation method for vehicles Partial-year depreciation based on months in service COMPANY A Estimated Estimated Useful Cost Residual Value Life in Years 150,000 N/A N/A 750,000 none 25 360,000 10% of cost 8 240,000 $12,000 8 $ 1,500,000 $ 120,000 $ 150,000 Straight Line Double-declining-balance

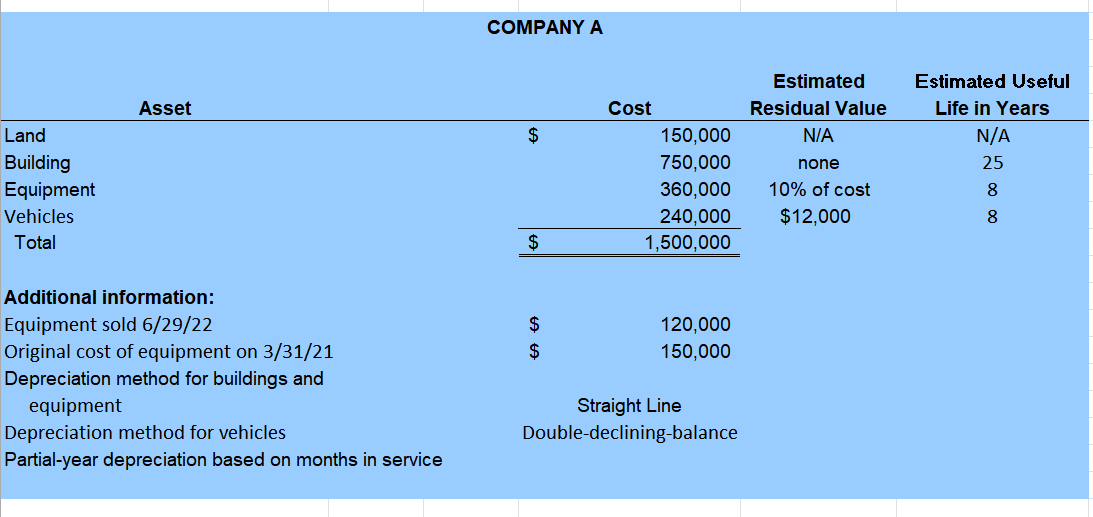

On March 31, 2021, Company A purchased a manufacturing facility along with vehicles and other equipment. The distribution of the total purchase price of $1,500,000 to the various types of assets, along with the estimated useful lives and residual values is as follows:

- The purchase on March 31, 2021 included equipment at the purchase cost of $150,000.

- The company sold equipment for $120,000 on June 29, 2022.

Company A uses the following

- straight-line depreciation method for buildings and equipment

- double-declining-balance method for vehicles

Company A calculates partial-year depreciation based on the number of months an asset is in service.

Company A

Asset & Cost

Land $150,000

Building $750,000

Equipment $360,000

Vehicles $240,000

Total $1,500,000

On June 29, 2022, equipment inculded in the March 31, 2021, purchase that cost $150,000 and was sold for $120,000. Company A uses the straight line depreciation method for buildings and equipment and the double-declining balance method for vehicles. Partial year depreciation is calculated based on the number of months an asset is in service.

Complete the following:

1. Find depreciation expense on the building, equipment, and vehicles for 2021.

2. Prepare the

3. Find depreciation expense on the building, remaining equipment and vehicles for 2022.

Trending now

This is a popular solution!

Step by step

Solved in 1 steps