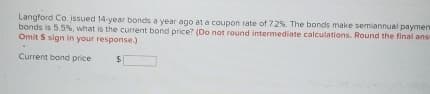

Langford Co. issued 14-year bonds a year ago at a coupon rate of 7.2%. The bonds make semiannual paymen bonds is 5.5%, what is the current bond price? (Do not round intermediate calculations. Round the final answ Omit S sign in your response.) Current bond price $

Langford Co. issued 14-year bonds a year ago at a coupon rate of 7.2%. The bonds make semiannual paymen bonds is 5.5%, what is the current bond price? (Do not round intermediate calculations. Round the final answ Omit S sign in your response.) Current bond price $

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 18MC: OShea Inc. issued bonds at a face value of $100,000, a rate of 6%, and a 5-year term for $98,000....

Related questions

Question

Langford ��. issued 14 -year bonds a year ago at a coupon fate of 7.2%. The bonds make semiannual paymen bonds is 5.5%, what is the current

Transcribed Image Text:Langford Co. issued 14-year bonds a year ago at a coupon rate of 7.2%. The bonds make semiannual paymen

bonds is 5.5%, what is the current bond price? (Do not round intermediate calculations. Round the final answ

Omit S sign in your response.)

Current bond price $

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning