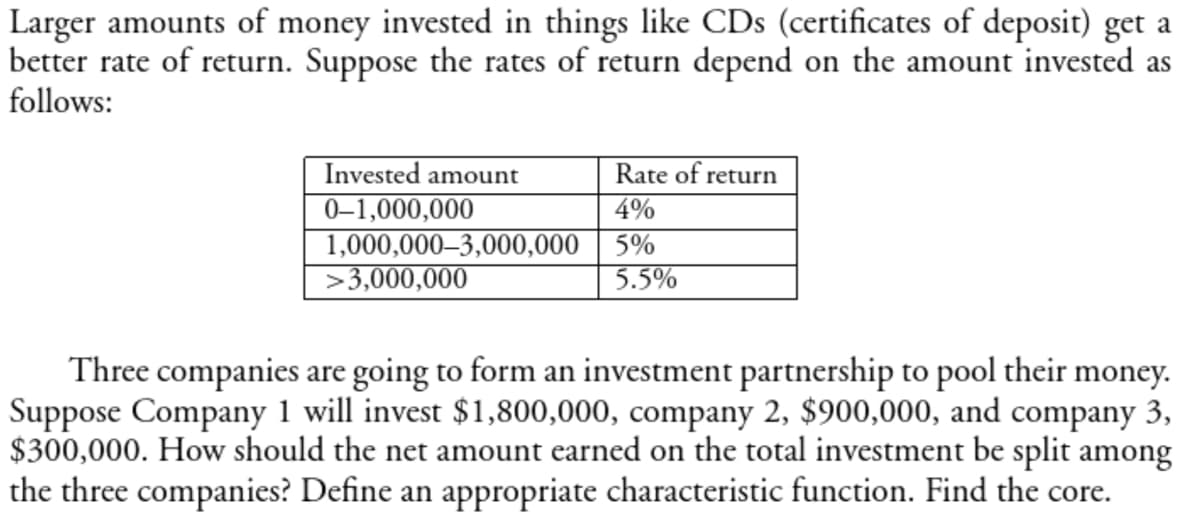

Larger amounts of money invested in things like CDs (certificates of deposit) get a better rate of return. Suppose the rates of return depend on the amount invested as follows: Invested amount Rate of return 0-1,000,000 4% 1,000,000–3,000,000 5% >3,000,000 5.5% Three companies are going to form an investment partnership to pool their money. Suppose Company 1 will invest $1,800,000, company 2, $900,000, and company 3, $300,000. How should the net amount earned on the total investment be split among the three companies? Define an appropriate characteristic function. Find the core.

Larger amounts of money invested in things like CDs (certificates of deposit) get a better rate of return. Suppose the rates of return depend on the amount invested as follows: Invested amount Rate of return 0-1,000,000 4% 1,000,000–3,000,000 5% >3,000,000 5.5% Three companies are going to form an investment partnership to pool their money. Suppose Company 1 will invest $1,800,000, company 2, $900,000, and company 3, $300,000. How should the net amount earned on the total investment be split among the three companies? Define an appropriate characteristic function. Find the core.

Chapter3: Evaluation Of Financial Performance

Section: Chapter Questions

Problem 8P

Question

Transcribed Image Text:Larger amounts of money invested in things like CDs (certificates of deposit) get a

better rate of return. Suppose the rates of return depend on the amount invested as

follows:

Invested amount

Rate of return

0-1,000,000

4%

1,000,000–3,000,000 5%

>3,000,000

5.5%

Three companies are going to form an investment partnership to pool their money.

Suppose Company 1 will invest $1,800,000, company 2, $900,000, and company 3,

$300,000. How should the net amount earned on the total investment be split among

the three companies? Define an appropriate characteristic function. Find the core.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning