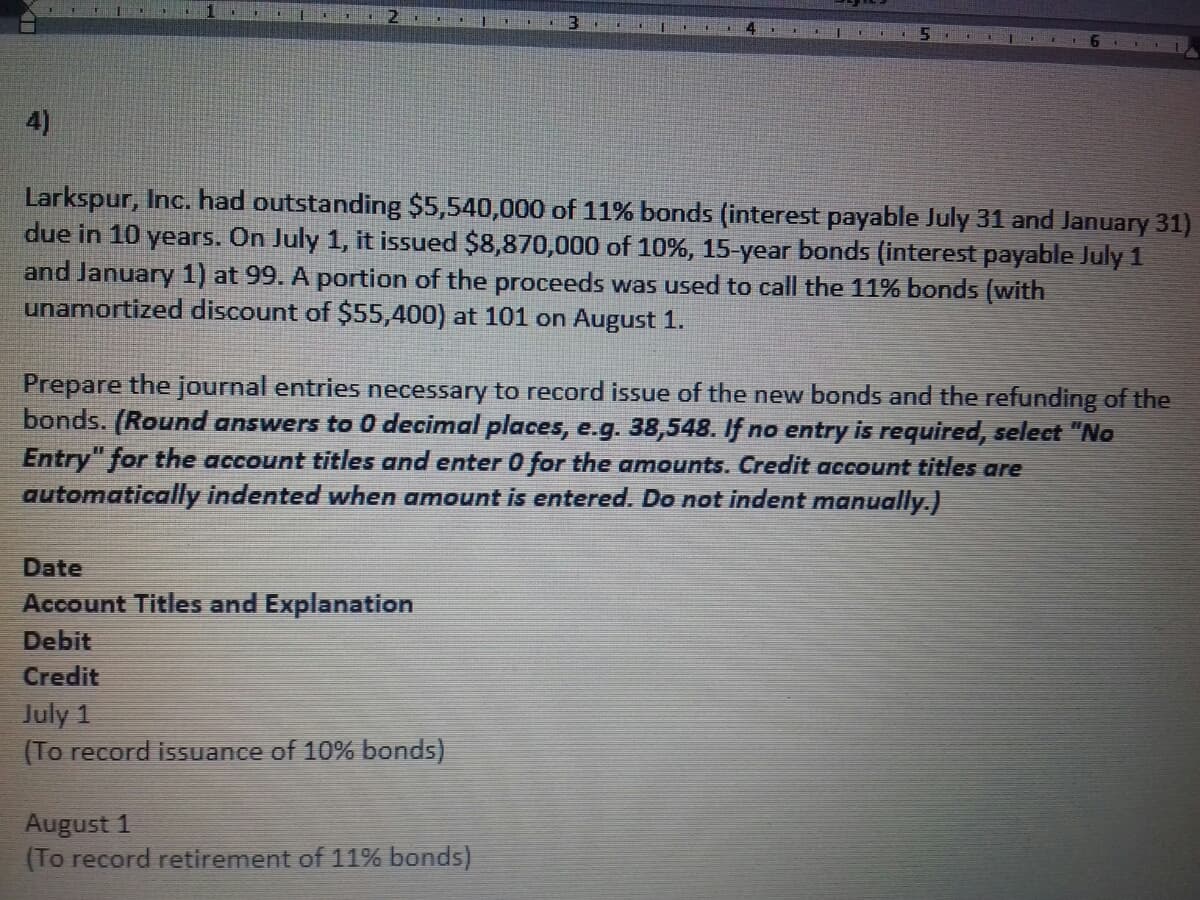

Larkspur, Inc. had outstanding $5,540,000 of 11% bonds (interest payable July 31 and January 31) due in 10 years. On July 1, it issued $8,870,000 of 10%, 15-year bonds (interest payable July 1 and January 1) at 99. A portion of the proceeds was used to call the 11% bonds (with unamortized discount of $55,400) at 101 on August 1. Prepare the journal entries necessary to record issue of the new bonds and the refunding of the bonds. (Round answers to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Larkspur, Inc. had outstanding $5,540,000 of 11% bonds (interest payable July 31 and January 31) due in 10 years. On July 1, it issued $8,870,000 of 10%, 15-year bonds (interest payable July 1 and January 1) at 99. A portion of the proceeds was used to call the 11% bonds (with unamortized discount of $55,400) at 101 on August 1. Prepare the journal entries necessary to record issue of the new bonds and the refunding of the bonds. (Round answers to 0 decimal places, e.g. 38,548. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 15MCQ

Related questions

Question

100%

Transcribed Image Text:4)

Larkspur, Inc. had outstanding $5,540,000 of 11% bonds (interest payable July 31 and January 31)

due in 10 years. On July 1, it issued $8,870,000 of 10%, 15-year bonds (interest payable July 1

and January 1) at 99. A portion of the proceeds was used to call the 11% bonds (with

unamortized discount of $55,400) at 101 on August 1.

Prepare the journal entries necessary to record issue of the new bonds and the refunding of the

bonds. (Round answers to 0 decimal places, e.g. 38,548. If no entry is required, select "No

Entry" for the account titles and enter 0 for the amounts. Credit account titles are

automatically indented when amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

July 1

(To record isSuance of 10% bonds)

August 1

(To record retirement of 11% bonds)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College