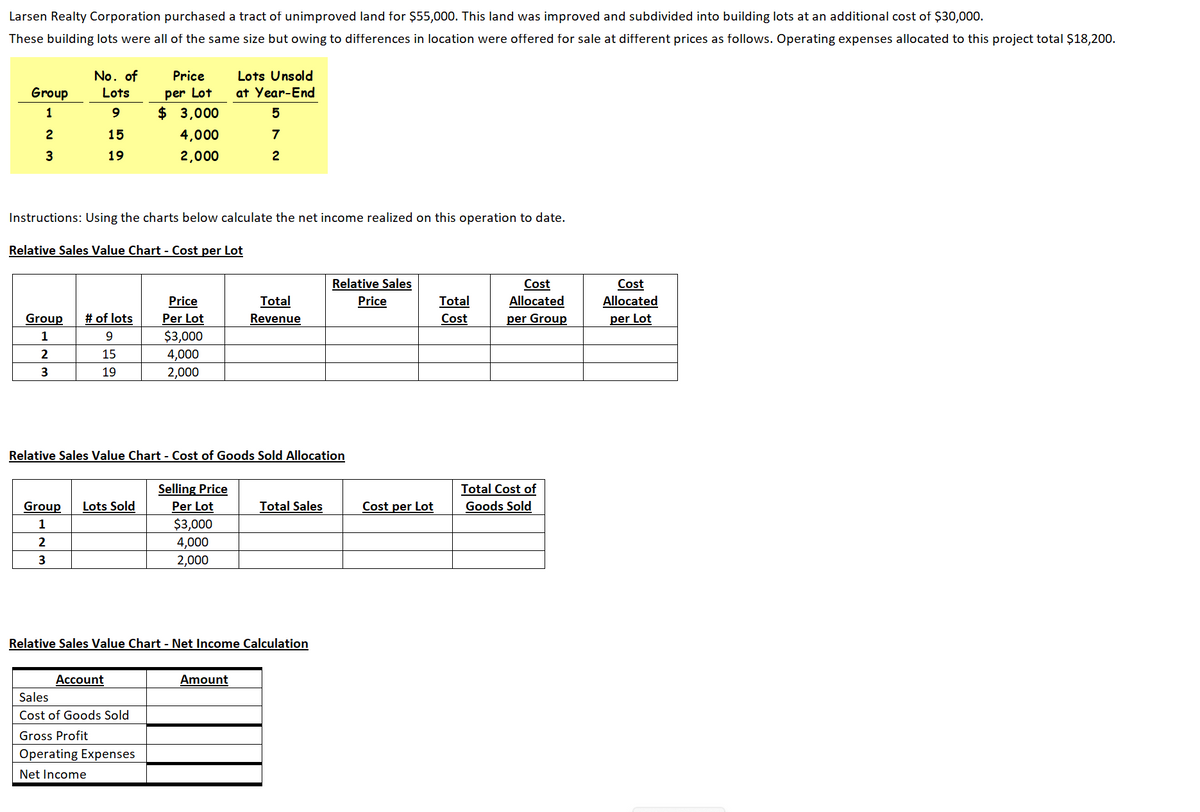

Larsen Realty Corporation purchased a tract of unimproved land for $55,000. This land was improved and subdivided into building lots at an additional cost of $30,000. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows. Operating expenses allocated to this project total $18,200. Group 1 2 3 No. of Lots 9 15 19 Price per Lot $3,000 4,000 2,000 Lots Unsold at Year-End 5 7 2

Larsen Realty Corporation purchased a tract of unimproved land for $55,000. This land was improved and subdivided into building lots at an additional cost of $30,000. These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows. Operating expenses allocated to this project total $18,200. Group 1 2 3 No. of Lots 9 15 19 Price per Lot $3,000 4,000 2,000 Lots Unsold at Year-End 5 7 2

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:Larsen Realty Corporation purchased a tract of unimproved land for $55,000. This land was improved and subdivided into building lots at an additional cost of $30,000.

These building lots were all of the same size but owing to differences in location were offered for sale at different prices as follows. Operating expenses allocated to this project total $18,200.

Group

1

2

3

No. of

Lots

9

15

19

Group # of lots

9

1

2

15

3

19

Instructions: Using the charts below calculate the net income realized on this operation to date.

Relative Sales Value Chart - Cost per Lot

Group Lots Sold

1

2

3

Price

per Lot

$ 3,000

4,000

2,000

Account

Price

Per Lot

$3,000

4,000

2,000

Sales

Cost of Goods Sold

Gross Profit

Operating Expenses

Net Income

Relative Sales Value Chart - Cost of Goods Sold Allocation

Selling Price

Per Lot

Lots Unsold

at Year-End

5

7

2

$3,000

4,000

Total

Revenue

Relative Sales Value Chart - Net Income Calculation

Amount

Total Sales

Relative Sales

Price

Cost per Lot

Total

Cost

Cost

Allocated

per Group

Total Cost of

Goods Sold

Cost

Allocated

per Lot

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT