le. 708,200. Her AMT exemption is $ le a joint tax return. Their AMTI is $1,121,600. Their AMT exem

le. 708,200. Her AMT exemption is $ le a joint tax return. Their AMTI is $1,121,600. Their AMT exem

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter9: Individuals As Taxpayers

Section: Chapter Questions

Problem 2CE

Related questions

Question

100%

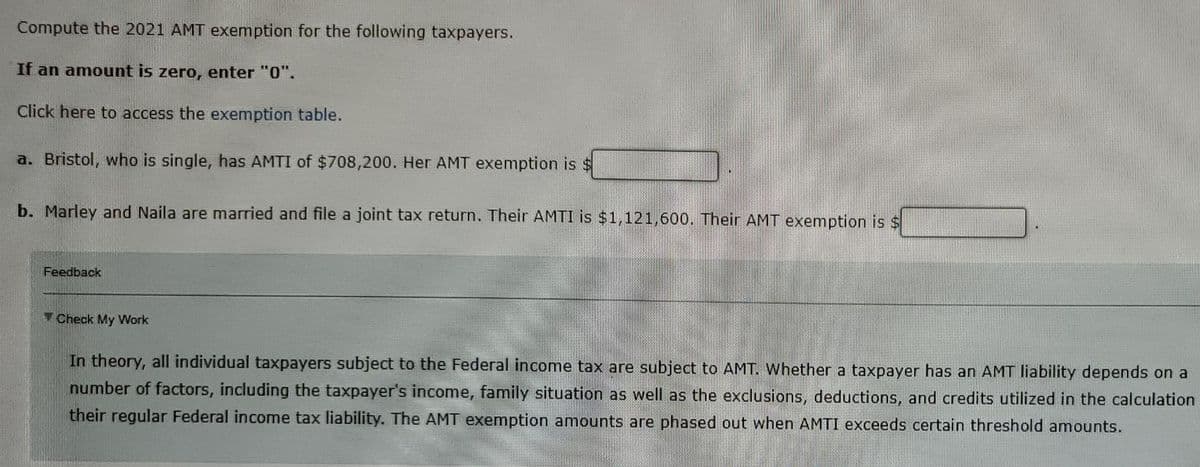

Transcribed Image Text:Compute the 2021 AMT exemption for the following taxpayers.

If an amount is zero, enter "0".

Click here to access the exemption table.

a. Bristol, who is single, has AMTI of $708,200. Her AMT exemption is $

b. Marley and Naila are married and file a joint tax return. Their AMTI is $1,121,600. Their AMT exemption is $

Feedback

Check My Work

In theory, all individual taxpayers subject to the Federal income tax are subject to AMT. Whether a taxpayer has an AMT liability depends on a

number of factors, including the taxpayer's income, family situation as well as the exclusions, deductions, and credits utilized in the calculation

their regular Federal income tax liability. The AMT exemption amounts are phased out when AMTI exceeds certain threshold amounts.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT