Leach Inc. experienced the following events for the first two years of its operations: Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $80,000 of services on account. 3. Provided $25,000 of services and received cash. 4. Collected $55,000 cash from accounts receivable. 5. Paid $16,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 8 percent of the ending accounts receivable balance will be uncollectible.

Leach Inc. experienced the following events for the first two years of its operations: Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $80,000 of services on account. 3. Provided $25,000 of services and received cash. 4. Collected $55,000 cash from accounts receivable. 5. Paid $16,000 of salaries expense for the year. 6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 8 percent of the ending accounts receivable balance will be uncollectible.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter3: The Basics Of Record Keeping And Financial Statement Preparation: Income Statement

Section: Chapter Questions

Problem 36P

Related questions

Question

Answer only please.

![Required information

[The following information applies to the questions displayed below.]

Leach Inc. experienced the following events for the first two years of its operations:

Part 2 of 4

Year 1:

1. Issued $10,000 of common stock for cash.

2. Provided $80,000 of services on account.

3. Provided $25,000 of services and received cash.

4. Collected $55,000 cash from accounts receivable.

5. Paid $16,000 of salaries expense for the year.

6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 8 percent

of the ending accounts receivable balance will be uncollectible.

oints

eBook

Year 2:

1. Wrote off an uncollectible account for $730.

2. Provided $100,000 of services on account.

3. Provided $20,000 of services and collected cash.

4. Collected $82,000 cash from accounts receivable.

5. Paid $30,000 of salaries expense for the year.

6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 8 percent of the

ending accounts receivable balance will be uncollectible.](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fbac5cd56-9885-4a25-8e51-dfc1bb78a29e%2F2335eb5a-aadc-4457-bd9f-842e9b7e79af%2Fjf5a8mv_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Leach Inc. experienced the following events for the first two years of its operations:

Part 2 of 4

Year 1:

1. Issued $10,000 of common stock for cash.

2. Provided $80,000 of services on account.

3. Provided $25,000 of services and received cash.

4. Collected $55,000 cash from accounts receivable.

5. Paid $16,000 of salaries expense for the year.

6. Adjusted the accounting records to reflect uncollectible accounts expense for the year. Leach estimates that 8 percent

of the ending accounts receivable balance will be uncollectible.

oints

eBook

Year 2:

1. Wrote off an uncollectible account for $730.

2. Provided $100,000 of services on account.

3. Provided $20,000 of services and collected cash.

4. Collected $82,000 cash from accounts receivable.

5. Paid $30,000 of salaries expense for the year.

6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 8 percent of the

ending accounts receivable balance will be uncollectible.

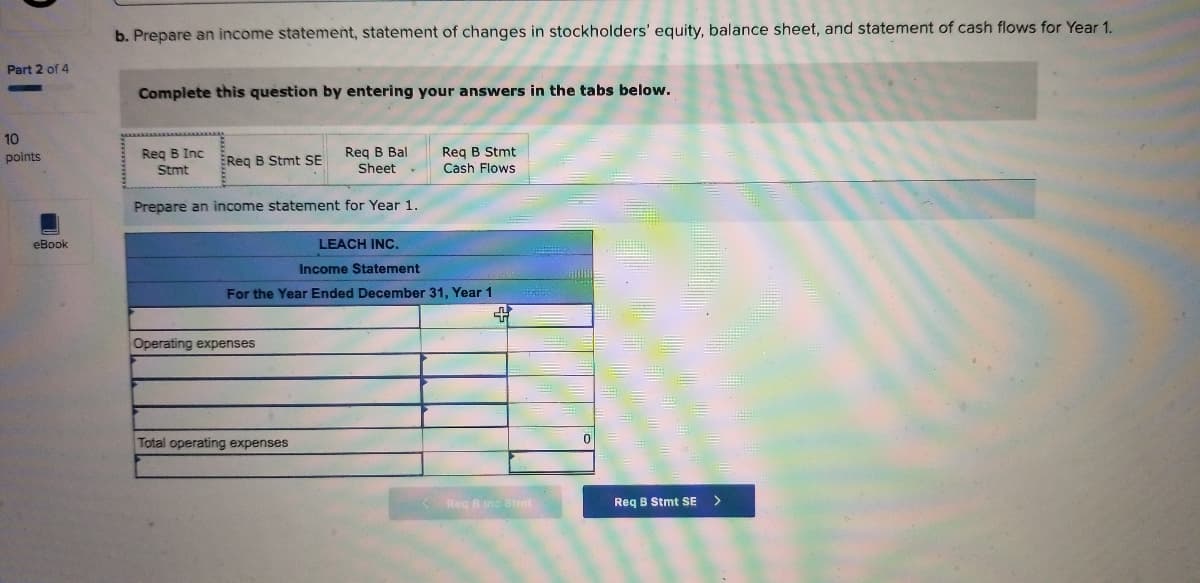

Transcribed Image Text:b. Prepare an income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Year 1.

Part 2 of 4

Complete this question by entering your answers in the tabs below.

10

Reg B Bal

Sheet

Reg B Stmt

Cash Flows

points

Reg B Inc

EReg B Stmt SE

Stmt

Prepare an income statement for Year 1.

eBook

LEACH INC.

Income Statement

For the Year Ended December 31, Year 1

Operating expenses

Total operating expenses

Reg B inc Strmt

Req B Stmt SE

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning