Learning Objectives 2, 3 Appendix 6A P6A-32A Accounting for inventory using the periodic inventory system FIFO, LIFO, and weighted-average, and comparing FIFO, LIFO, and weighted-average 1. LIFO Ending Merch. Inv., $6 Futuristic Electronic Center began October with 65 units of merchandise inventory that cost $82 each. During October, the store made the following purchases: 25 units @ $ 90 each Oct. 3 30 units @ $ 90 each 12 35 units @ $ 96 each 18 Futuristic uses the periodic inventory system, and the physical count at October 31 indicates that 80 units of merchandise inventory are on hand. Requirements 1. Determine the ending merchandise inventory and cost of goods sold amounts for the October financial statements using the FIFO, LIFO, and weighted-average inventory costing methods. 2. Net sales revenue for October totaled $28,000. Compute Futuristic's gross profit for October using each method. 3. Which method will result in the lowest income taxes for Futuristic? Why? Which method will result in the highest net income for Futuristic? Why?

Learning Objectives 2, 3 Appendix 6A P6A-32A Accounting for inventory using the periodic inventory system FIFO, LIFO, and weighted-average, and comparing FIFO, LIFO, and weighted-average 1. LIFO Ending Merch. Inv., $6 Futuristic Electronic Center began October with 65 units of merchandise inventory that cost $82 each. During October, the store made the following purchases: 25 units @ $ 90 each Oct. 3 30 units @ $ 90 each 12 35 units @ $ 96 each 18 Futuristic uses the periodic inventory system, and the physical count at October 31 indicates that 80 units of merchandise inventory are on hand. Requirements 1. Determine the ending merchandise inventory and cost of goods sold amounts for the October financial statements using the FIFO, LIFO, and weighted-average inventory costing methods. 2. Net sales revenue for October totaled $28,000. Compute Futuristic's gross profit for October using each method. 3. Which method will result in the lowest income taxes for Futuristic? Why? Which method will result in the highest net income for Futuristic? Why?

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter6: Inventories

Section: Chapter Questions

Problem 6.3APR

Related questions

Question

Questions are on image

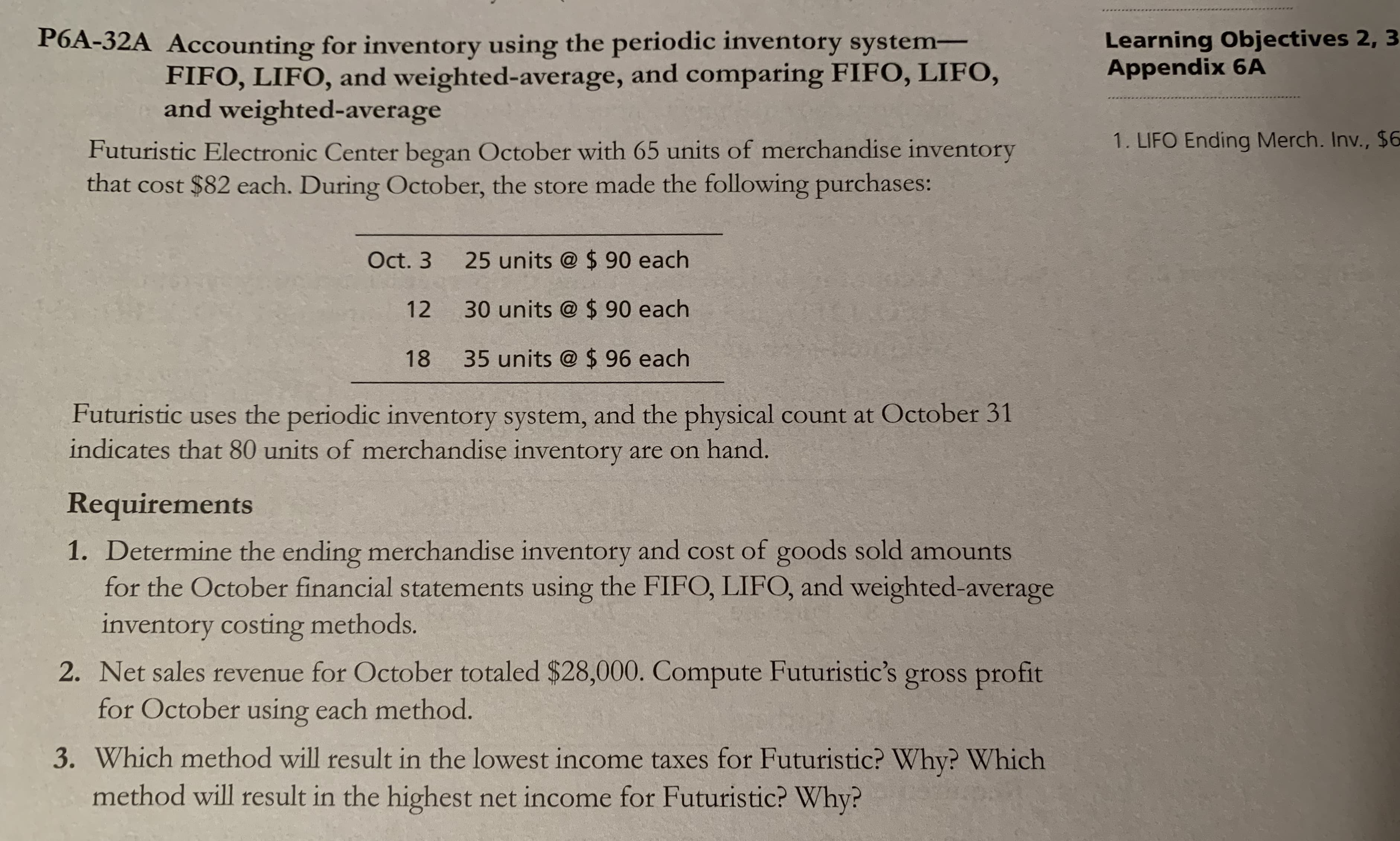

Transcribed Image Text:Learning Objectives 2, 3

Appendix 6A

P6A-32A Accounting for inventory using the periodic inventory system

FIFO, LIFO, and weighted-average, and comparing FIFO, LIFO,

and weighted-average

1. LIFO Ending Merch. Inv., $6

Futuristic Electronic Center began October with 65 units of merchandise inventory

that cost $82 each. During October, the store made the following purchases:

25 units @ $ 90 each

Oct. 3

30 units @ $ 90 each

12

35 units @ $ 96 each

18

Futuristic uses the periodic inventory system, and the physical count at October 31

indicates that 80 units of merchandise inventory are on hand.

Requirements

1. Determine the ending merchandise inventory and cost of goods sold amounts

for the October financial statements using the FIFO, LIFO, and weighted-average

inventory costing methods.

2. Net sales revenue for October totaled $28,000. Compute Futuristic's gross profit

for October using each method.

3. Which method will result in the lowest income taxes for Futuristic? Why? Which

method will result in the highest net income for Futuristic? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning