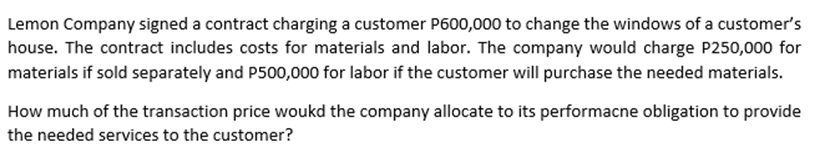

Lemon Company signed a contract charging a customer P600,000 to change the windows of a customer's house. The contract includes costs for materials and labor. The company would charge P250,000 for materials if sold separately and P500,000 for labor if the customer will purchase the needed materials. How much of the transaction price woukd the company allocate to its performacne obligation to provide the needed services to the customer?

Lemon Company signed a contract charging a customer P600,000 to change the windows of a customer's house. The contract includes costs for materials and labor. The company would charge P250,000 for materials if sold separately and P500,000 for labor if the customer will purchase the needed materials. How much of the transaction price woukd the company allocate to its performacne obligation to provide the needed services to the customer?

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 19E: Rix Company sells home appliances and provides installation and service for its customers. On April...

Related questions

Question

Transcribed Image Text:Lemon Company signed a contract charging a customer P600,000 to change the windows of a customer's

house. The contract includes costs for materials and labor. The company would charge P250,000 for

materials if sold separately and P500,000 for labor if the customer will purchase the needed materials.

How much of the transaction price woukd the company allocate to its performacne obligation to provide

the needed services to the customer?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT