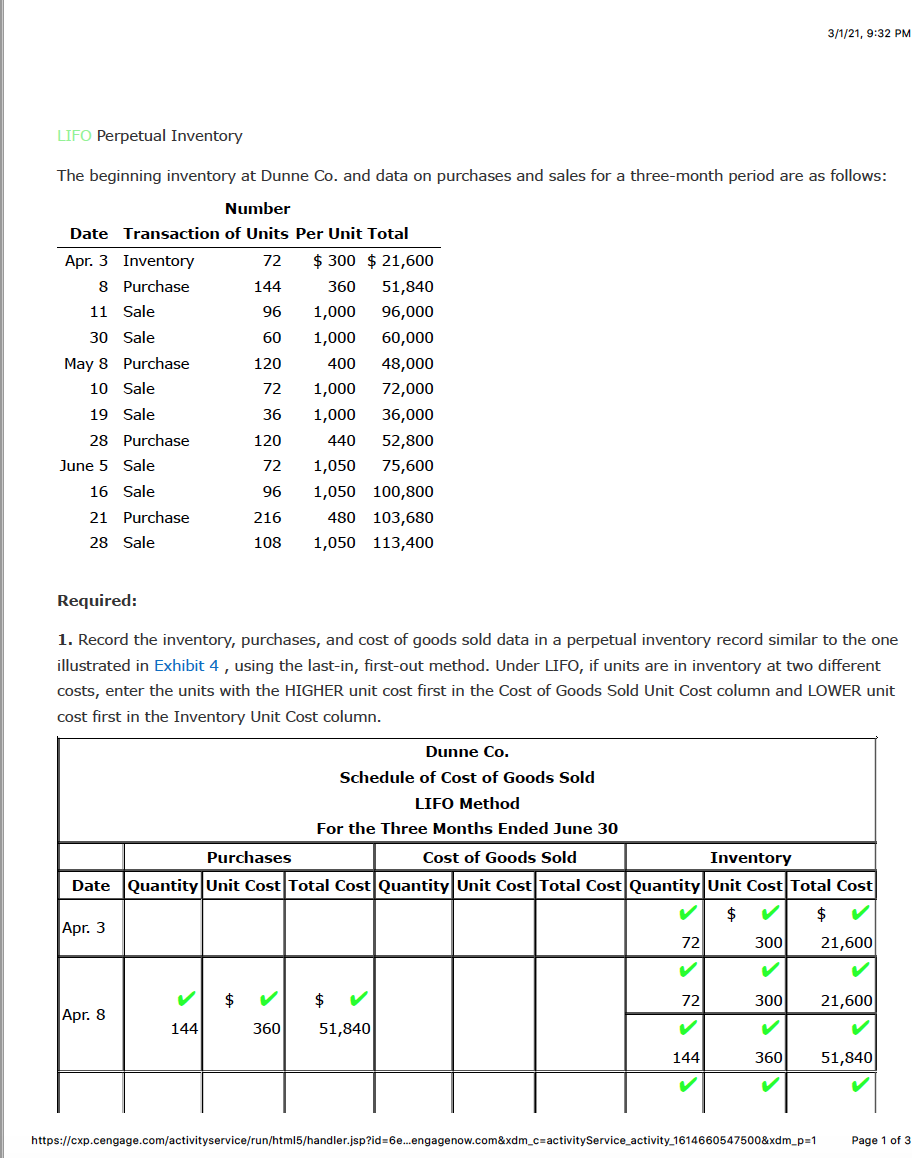

LIFO Perpetual Inventory The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period are as follows: Number Date Transaction of Units Per Unit Total Apr. 3 Inventory 72 $ 300 $ 21,600 8 Purchase 144 360 51,840 11 Sale 96 1,000 96,000 30 Sale 60 1,000 60,000 May 8 Purchase 120 400 48,000 10 Sale 72 1,000 72,000 19 Sale 36 1,000 36,000 28 Purchase 120 440 52,800 June 5 Sale 72 1,050 75,600 16 Sale 96 1,050 100,800 21 Purchase 216 480 103,680 28 Sale 108 1,050 113,400 Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4 , using the last-in, first-out method. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column.

LIFO Perpetual Inventory The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period are as follows: Number Date Transaction of Units Per Unit Total Apr. 3 Inventory 72 $ 300 $ 21,600 8 Purchase 144 360 51,840 11 Sale 96 1,000 96,000 30 Sale 60 1,000 60,000 May 8 Purchase 120 400 48,000 10 Sale 72 1,000 72,000 19 Sale 36 1,000 36,000 28 Purchase 120 440 52,800 June 5 Sale 72 1,050 75,600 16 Sale 96 1,050 100,800 21 Purchase 216 480 103,680 28 Sale 108 1,050 113,400 Required: 1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one illustrated in Exhibit 4 , using the last-in, first-out method. Under LIFO, if units are in inventory at two different costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit cost first in the Inventory Unit Cost column.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter6: Inventories

Section: Chapter Questions

Problem 2PB: LIFO perpetual inventory The beginning inventory for Dunne Co. and data on purchases and sales for a...

Related questions

Topic Video

Question

Transcribed Image Text:3/1/21, 9:32 PM

LIFO Perpetual Inventory

The beginning inventory at Dunne Co. and data on purchases and sales for a three-month period are as follows:

Number

Date Transaction of Units Per Unit Total

Apr. 3 Inventory

72

$ 300 $ 21,600

8 Purchase

144

360

51,840

11 Sale

96

1,000

96,000

30 Sale

60

1,000

60,000

May 8 Purchase

120

400

48,000

10 Sale

72

1,000

72,000

19 Sale

36

1,000

36,000

28 Purchase

120

440

52,800

June 5 Sale

72

1,050

75,600

16 Sale

96

1,050 100,800

21

Purchase

216

480

103,680

28 Sale

108

1,050 113,400

Required:

1. Record the inventory, purchases, and cost of goods sold data in a perpetual inventory record similar to the one

illustrated in Exhibit 4 , using the last-in, first-out method. Under LIFO, if units are in inventory at two different

costs, enter the units with the HIGHER unit cost first in the Cost of Goods Sold Unit Cost column and LOWER unit

cost first in the Inventory Unit Cost column.

Dunne Co.

Schedule of Cost of Goods Sold

LIFO Method

For the Three Months Ended June 30

Purchases

Cost of Goods Sold

Inventory

Date Quantity Unit CostTotal Cost Quantity Unit Cost Total Cost Quantity Unit Cost Total Cost

$

$

Apr. 3

72

300

21,600

$

72

300

21,600

Apr. 8

144

360

51,840

144

360

51,840

https://cxp.cengage.com/activityservice/run/html5/handler.jsp?id%=6e.engagenow.com&xdm_c=activityService_activity_1614660547500&xdm_p=1

Page 1 of 3

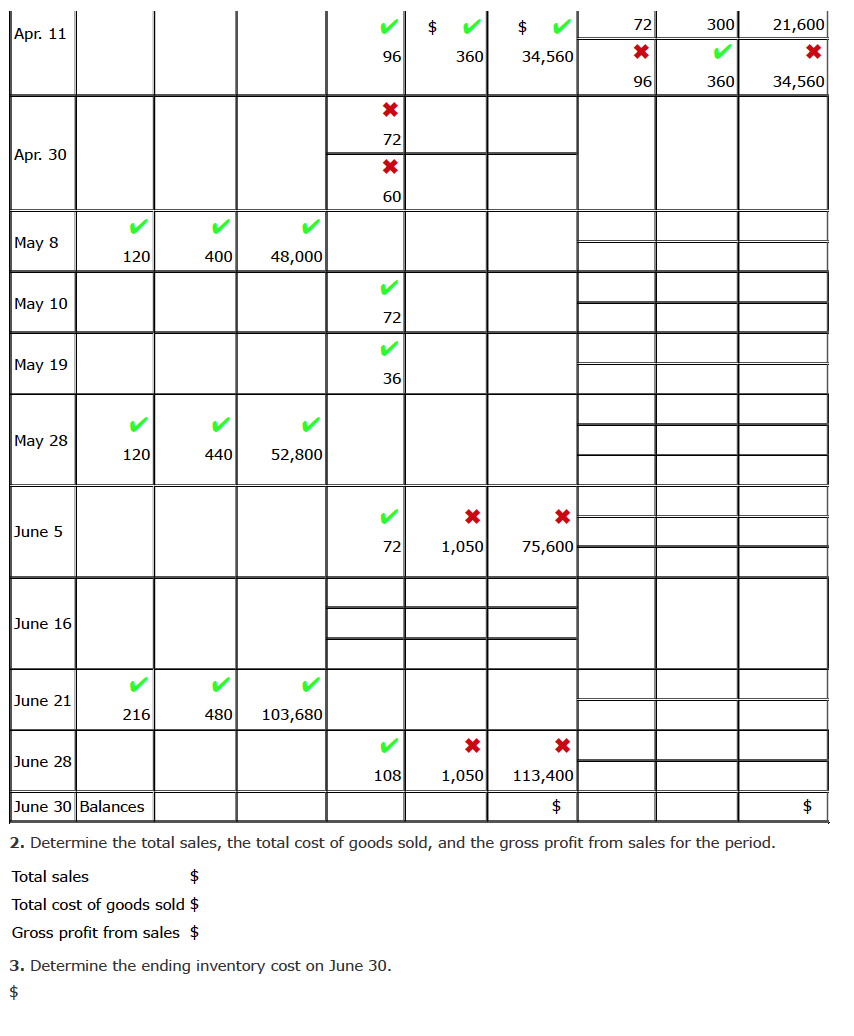

Transcribed Image Text:$

$

72

300

21,600

Apr. 11

96

360

34,560

96

360

34,560

72

Apr. 30

60

May 8

120

400

48,000

May 10

72

May 19

36

May 28

120

440

52,800

June 5

72

1,050

75,600

June 16

June 21

216

480

103,680

June 28

108

1,050

113,400

June 30 Balances

$

2. Determine the total sales, the total cost of goods sold, and the gross profit from sales for the period.

Total sales

Total cost of goods sold $

Gross profit from sales $

3. Determine the ending inventory cost on June 30.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning