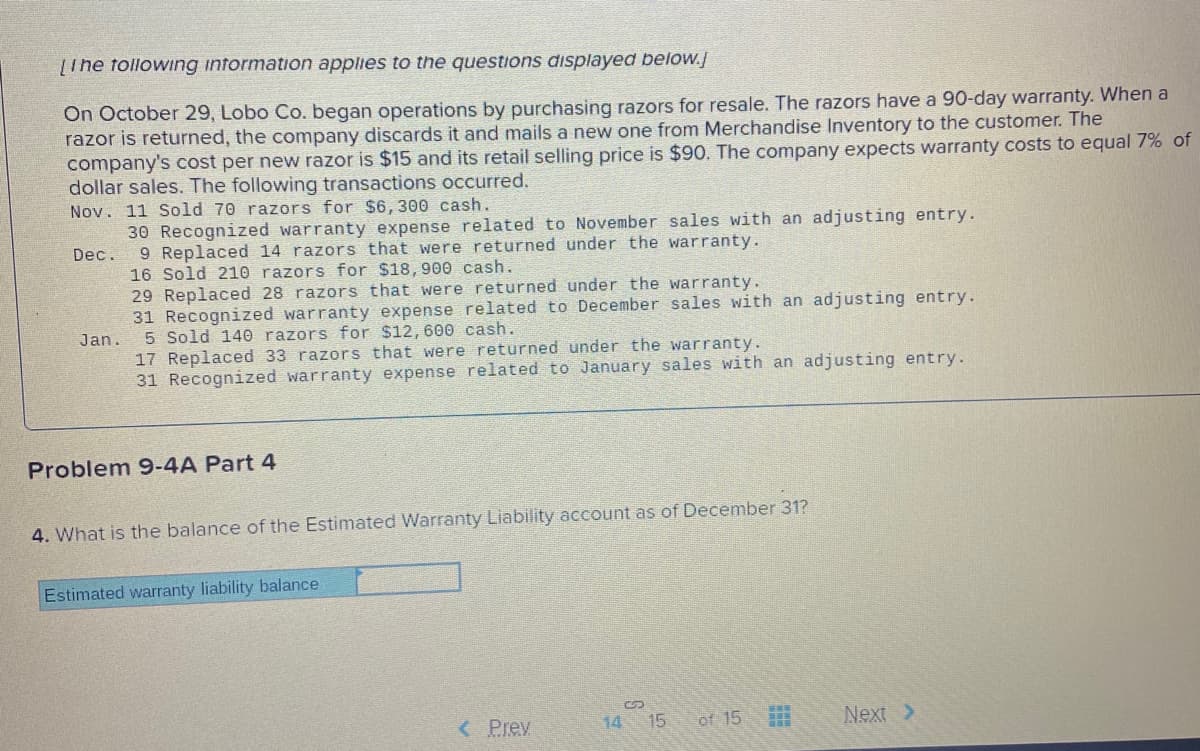

LIhe tollowing intormation applies to the questions displayed below. On October 29, Lobo Co. began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 7% of dollar sales. The following transactions occurred. Nov. 11 Sold 70 razors for $6, 300 cash. 30 Recognized warranty expense related to November sales with an adjusting entry. 9 Replaced 14 razors that were returned under the warranty. 16 Sold 210 razors for $18,900 cash. 29 Replaced 28 razors that were returned under the warranty. 31 Recognized warranty expense related to December sales with an adjusting entry. 5 Sold 140 razors for $12, 600 cash. 17 Replaced 33 razors that were returned under the warranty. 31 Recognized warranty expense related to January sales with an adjusting entry. Dec. Jan. Problem 9-4A Part 4 4. What is the balance of the Estimated Warranty Liability account as of December 31? Estimated warranty liability balance < Piev 14 15 of 15 Next >

LIhe tollowing intormation applies to the questions displayed below. On October 29, Lobo Co. began operations by purchasing razors for resale. The razors have a 90-day warranty. When a razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 7% of dollar sales. The following transactions occurred. Nov. 11 Sold 70 razors for $6, 300 cash. 30 Recognized warranty expense related to November sales with an adjusting entry. 9 Replaced 14 razors that were returned under the warranty. 16 Sold 210 razors for $18,900 cash. 29 Replaced 28 razors that were returned under the warranty. 31 Recognized warranty expense related to December sales with an adjusting entry. 5 Sold 140 razors for $12, 600 cash. 17 Replaced 33 razors that were returned under the warranty. 31 Recognized warranty expense related to January sales with an adjusting entry. Dec. Jan. Problem 9-4A Part 4 4. What is the balance of the Estimated Warranty Liability account as of December 31? Estimated warranty liability balance < Piev 14 15 of 15 Next >

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 56BE

Related questions

Question

I need help with this

Transcribed Image Text:[The tollowing intormation applies to the questions displayed below.

On October 29, Lobo Co. began operations by purchasing razors for resale. The razors have a 90-day warranty. When a

razor is returned, the company discards it and mails a new one from Merchandise Inventory to the customer. The

company's cost per new razor is $15 and its retail selling price is $90. The company expects warranty costs to equal 7% of

dollar sales. The following transactions occurred.

Nov. 11 Sold 70 razors for $6, 300 cash.

30 Recognized warranty expense related to November sales with an adjusting entry.

9 Replaced 14 razors that were returned under the warranty.

16 Sold 210 razors for $18,900 cash.

29 Replaced 28 razors that were returned under the warranty.

31 Recognized warranty expense related to December sales with an adjusting entry.

5 Sold 140 razors for $12,600 cash.

17 Replaced 33 razors that were returned under the warranty.

31 Recognized warranty expense related to January sales with an adjusting entry.

Dec.

Jan.

Problem 9-4A Part 4

4. What is the balance of the Estimated Warranty Liability account as of December 31?

Estimated warranty liability balance

< Piev

of 15

Next >

14 15

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning