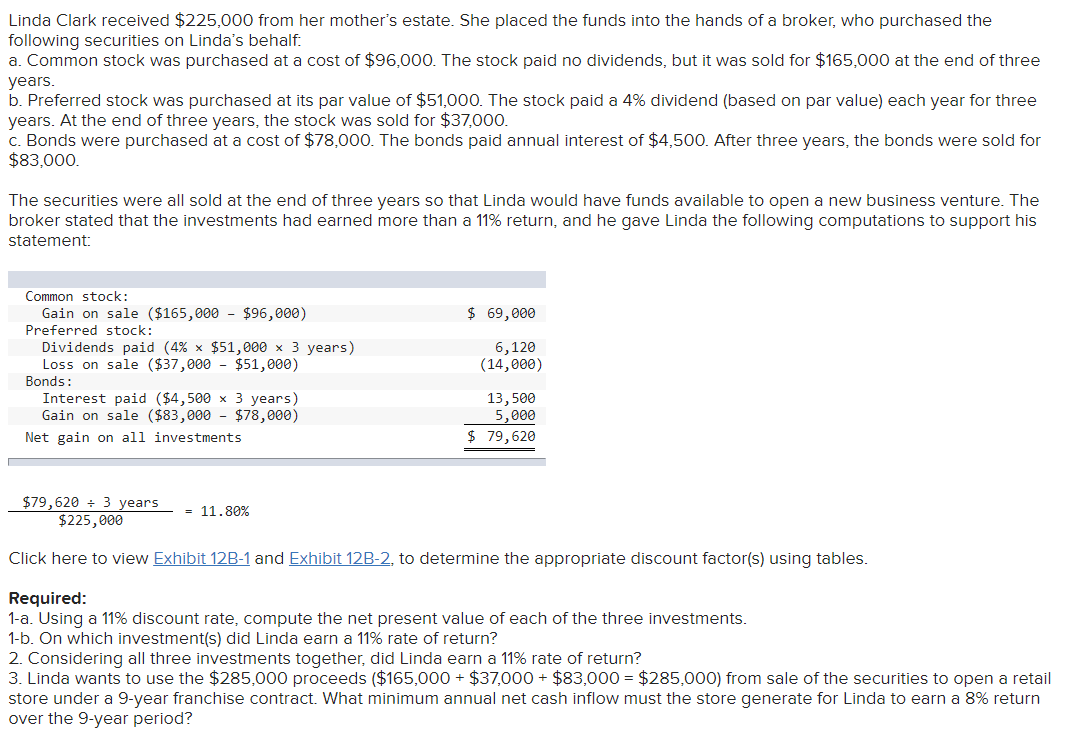

Linda Clark received $225,000 from her mother's estate. She placed the funds into the hands of a broker, who purchased the following securities on Linda's behalf: a. Common stock was purchased at a cost of $96,000. The stock paid no dividends, but it was sold for $165,000 at the end of three years. b. Preferred stock was purchased at its par value of $51,000. The stock paid a 4% dividend (based on par value) each year for three years. At the end of three years, the stock was sold for $37,000. c. Bonds were purchased at a cost of $78,000. The bonds paid annual interest of $4,500. After three years, the bonds were sold for $83,000. The securities were all sold at the end of three years so that Linda would have funds available to open a new business venture. The broker stated that the investments had earned more than a 11% return, and he gave Linda the following computations to support his statement: Common stock: Gain on sale ($165,000 - $96,000) $ 69,000 Preferred stock: Dividends paid (4% x $51,000 x 3 years) Loss on sale ($37,000 - $51,000) Bonds: 6,120 (14,000) Interest paid ($4,500 x 3 years) Gain on sale ($83,000 - $78,000) 13,500 5,000 $ 79,620 Net gain on all investments $79,620 + 3 years $225,000 = 11.80% Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: 1-a. Using a 11% discount rate, compute the net present value of each of the three investments. 1-b. On which investment(s) did Linda earn a 11% rate of return? 2. Considering all three investments together, did Linda earn a 11% rate of return? 3. Linda wants to use the $285,000 proceeds ($165,000 + $37,000 + $83,000 = $285,000) from sale of the securities to open a retail store under a 9-year franchise contract. What minimum annual net cash inflow must the store generate for Linda to earn a 8% return over the 9-year period?

Linda Clark received $225,000 from her mother's estate. She placed the funds into the hands of a broker, who purchased the following securities on Linda's behalf: a. Common stock was purchased at a cost of $96,000. The stock paid no dividends, but it was sold for $165,000 at the end of three years. b. Preferred stock was purchased at its par value of $51,000. The stock paid a 4% dividend (based on par value) each year for three years. At the end of three years, the stock was sold for $37,000. c. Bonds were purchased at a cost of $78,000. The bonds paid annual interest of $4,500. After three years, the bonds were sold for $83,000. The securities were all sold at the end of three years so that Linda would have funds available to open a new business venture. The broker stated that the investments had earned more than a 11% return, and he gave Linda the following computations to support his statement: Common stock: Gain on sale ($165,000 - $96,000) $ 69,000 Preferred stock: Dividends paid (4% x $51,000 x 3 years) Loss on sale ($37,000 - $51,000) Bonds: 6,120 (14,000) Interest paid ($4,500 x 3 years) Gain on sale ($83,000 - $78,000) 13,500 5,000 $ 79,620 Net gain on all investments $79,620 + 3 years $225,000 = 11.80% Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables. Required: 1-a. Using a 11% discount rate, compute the net present value of each of the three investments. 1-b. On which investment(s) did Linda earn a 11% rate of return? 2. Considering all three investments together, did Linda earn a 11% rate of return? 3. Linda wants to use the $285,000 proceeds ($165,000 + $37,000 + $83,000 = $285,000) from sale of the securities to open a retail store under a 9-year franchise contract. What minimum annual net cash inflow must the store generate for Linda to earn a 8% return over the 9-year period?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter18: Comparative Forms Of Doing Business

Section: Chapter Questions

Problem 19P

Related questions

Question

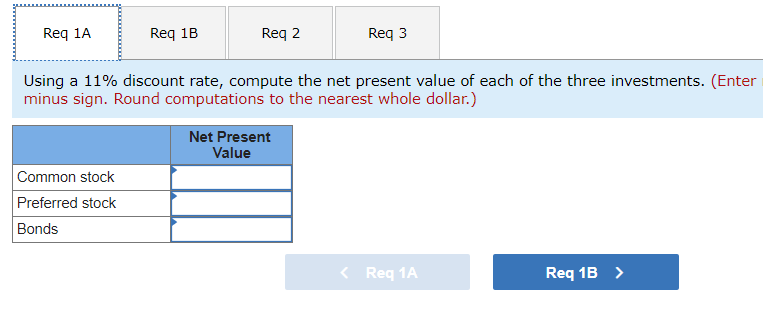

Transcribed Image Text:Req 1A

Req 1B

Req 2

Req 3

Using a 11% discount rate, compute the net present value of each of the three investments. (Enter

minus sign. Round computations to the nearest whole dollar.)

Net Present

Value

Common stock

Preferred stock

Bonds

< Req 1A

Req 1B >

Transcribed Image Text:Linda Clark received $225,000 from her mother's estate. She placed the funds into the hands of a broker, who purchased the

following securities on Linda's behalf:

a. Common stock was purchased at a cost of $96,000. The stock paid no dividends, but it was sold for $165,000 at the end of three

years.

b. Preferred stock was purchased at its par value of $51,000. The stock paid a 4% dividend (based on par value) each year for three

years. At the end of three years, the stock was sold for $37,000.

c. Bonds were purchased at a cost of $78,000. The bonds paid annual interest of $4,500. After three years, the bonds were sold for

$83,000.

The securities were all sold at the end of three years so that Linda would have funds available to open a new business venture. The

broker stated that the investments had earned more than a 11% return, and he gave Linda the following computations to support his

statement:

Common stock:

Gain on sale ($165,000 - $96,000)

$ 69,000

Preferred stock:

Dividends paid (4% x $51,000 x 3 years)

Loss on sale ($37,000 - $51,000)

Bonds:

6,120

(14,000)

Interest paid ($4,500 x 3 years)

Gain on sale ($83,000 - $78,000)

13,500

5,000

$ 79,620

Net gain on all investments

$79,620 + 3 years

$225,000

= 11.80%

Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using tables.

Required:

1-a. Using a 11% discount rate, compute the net present value of each of the three investments.

1-b. On which investment(s) did Linda earn a 11% rate of return?

2. Considering all three investments together, did Linda earn a 11% rate of return?

3. Linda wants to use the $285,000 proceeds ($165,000 + $37,000 + $83,000 = $285,000) from sale of the securities to open a retail

store under a 9-year franchise contract. What minimum annual net cash inflow must the store generate for Linda to earn a 8% return

over the 9-year period?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT