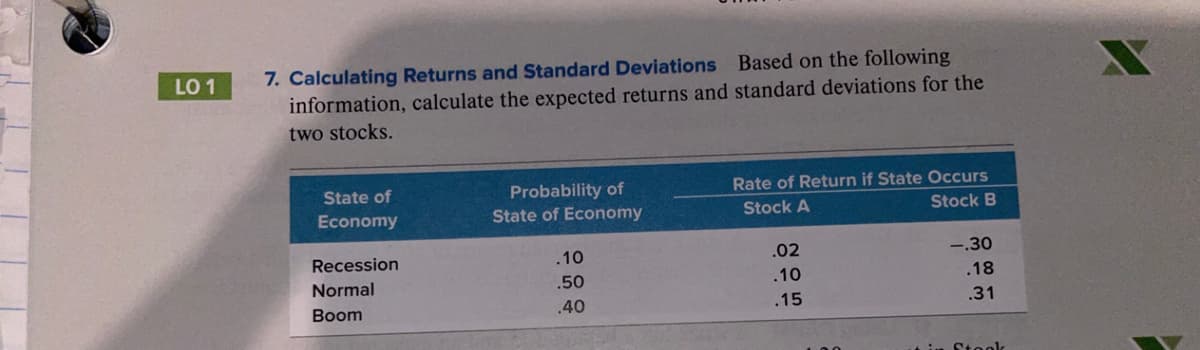

LO 1 7. Calculating Returns and Standard Deviations Based on the following information, calculate the expected returns and standard deviations for the two stocks. State of Rate of Return if State Occurs Probability of State of Economy Economy Stock A Stock B Recession .10 .02 -.30 Normal .50 .10 .18 Boom .40 .15 .31

Q: On the Milan bourse, Fiat Chrysler stock recently traded at €13.82 per share. Fiat Chrysler also…

A: Given: Price of Fiat Chrysler = €13.82 1 share = 1 ADR Current spot rate $/€ = $1.12/EUR1.00

Q: The Gable Inn is an all-equity firm with 16,000 shares outstanding at a value per share of $14.50.…

A: Number of shares outstanding before debt issue = 16,000 Value per share = $14.5 Value of firm =…

Q: . HighGrowth Company has a stock price of $19. The firm will pay a dividend next year of $0.88, and…

A: Next dividend (D1) = 0.88 Current price (P0) = $19 Growth rate (G) = 4.1%

Q: Calculate the following ratios 1. current ratio 2. Quick Liquidity Ratio 3. cash ratio,

A: As you have asked a multiple subpart question, we will answer the first three subparts for you. To…

Q: 2. The Jones Company has just completed the third year of a five-year MACRS recovery period for a…

A: Book value is the value of an asset after depreciation is recorded on it. When an asset is sold,…

Q: You want to start to save for a major purchase. You can invest ₱320 every three months for 3 years…

A: If a payment or deposit of equal amount is made at equal intervals of time, for a fixed number of…

Q: Please explain if a company has already taken too much debt (exceeded the amount that they can…

A: A leveraged buyout happens when a business acquires another company nearly completely using borrowed…

Q: xplain the diff

A: A bond refers to the fixed income instrument which represents the loan made by an investor to the…

Q: Identify the firm’s three major capital structure components and give their respective component…

A: To meet the financial requirements of the business, companies raise funds from external sources.…

Q: A firm has a cost of debt of 7 percent and a cost of equity of 15 percent. The debt-asset ratio is…

A: Cost of debt = 7% Cost of equity = 15% Debt-asset ratio = 0.40 Equity-asset ratio = 1-0.40 = 0.60

Q: Robinson Co. is interested in purchasing a new delivery vehicle so it can become a subcontractor…

A: Net Present Value: It is applied to series of cash flows happening at various times and represent…

Q: For this assignment, you are to construct a diagram of the Fraud Triangle and clearly label each…

A: The fraud triangle is a concept that auditors use to explain why someone might choose to conduct a…

Q: Hassle-Free Web is bidding to provide web hosting services for Hotel Lisbon. Hotel Lisbon pays its…

A: Here, Cost of Current Provider is $10,200 per year Cost to Purchase Equipment is $15,200 Cost per…

Q: Your company is considering purchasing an expensive plece of equipment. The manufacturer of the…

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at…

Q: 19. An investment of P300 is made at the beginning of each month for 4 years and 3 months. How much…

A: A stream of equal cash flows (CF) paid or received periodically is termed as annuity. Annuity is…

Q: Lucinda placed $12,000 in a 16-month term deposit paying 5.05% simple interest. How much will the…

A: Deposit amount = $12000 Period = 16 Months Interest rate = 5.05%

Q: Using the sinking fund formula or a financial calculator, complete the following: (Do not round…

A: Amount required (FV) = $26,000 Quarterly period (n) = 20 (i.e. 5 years * 4) Quarterly interest rate…

Q: Stock W has the following returns for various states of the economy: State of the Economy…

A: Expected Return and Standard deviation of the Stock is determined using the below formula: Expected…

Q: Profitability ratios describe – A. Organization's profit В. Organization's debt C. Organization's…

A: As per Bartleby guidelines, If multiple questions are posted , only first 1 question will be…

Q: 1. Develop a revenue plan that will allow VGU to pay the interest and principal of the bonds. (How…

A: Bond valuation refers to a method which is used to compute the current value or present value (PV)…

Q: A company has cost estimates associated with operating and maintaining the currently owned filter…

A: Given, In this question we have to determine the cost of retention and the annual worth of the…

Q: You have received $200,000 from the PowerBall Lottery and want to have half that amount available…

A: Total lottary amount = $200,000 Amount required at retirement (FV) = $200,000/2 = $100,000 Interest…

Q: If you are to give your assessment on the value of Artificial Intelligence in business strategy, at…

A: Artificial intelligence (AI) is the ability of a computer or a computer-controlled robot to do tasks…

Q: Which one of the following dates is the date on which the board of directors votes to pay a…

A: Record Date is the date used as a reference to understand which shareholder will get the dividend…

Q: nterpreting beta A firm wishes to assess the impact of changes in the market return on annasset that…

A: In finance beta is a measure of volatility or systematic risk. Beta shows the volatility of returns…

Q: Consider the table. Sales on Toaster Ovens 2004 2005 2006 2007 2008 Super Deluxe $86,100 $140,500…

A: Sales revenue is the revenue earned from day to day operations of the company. The sales revenue is…

Q: Payback Period and NPV of Alternative Automobile Purchase Wendy Li decided to purchase a new Honda…

A: Payback Period: It is a measure of time expected to recover the expense of an underlying venture.…

Q: 8. Growth Company's current share price is $20.00 and it is expected to pay a $1.30 dividend per…

A: “Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: Based on the net present value method of capital budgeting, should management undertake this…

A: Net present value (NPV) of an alternative/project refers to the variance between the initial…

Q: Everyone thought he was being foolish again when, 65 years ago, great-great-uncle Crazy Louie…

A: Future Value refers to the value of the current asset or investment or of cash flows at a specified…

Q: Discuss the steps of loan structuring.

A: Loan structuring is defined as the components, which used to make the loan, like term loan, rate of…

Q: Assume that the risk-free rate is 4% and the required return on the market is 11%. What is the…

A: Risk free rate = 4% Market return = 11% Beta = 1.39

Q: 11. Calculating Portfolio Betas You own a stock portfolio invested 15 percent in Stock Q, 25 percent…

A: Beta: Beta coefficient shows the systematic risk of the assets. In simple words, the beta…

Q: Which of the following is NOT relevant to the evaluation of a proposed project? Incremental cash…

A: While eveluating a project all the initial cash flows and subsequent cash flows are considered. All…

Q: the real risk-free rate is 3.50% and the future rate of inflation is expected to be constant at…

A: The below answer is given by two methods , but the appropriate is fist method which is simple rate…

Q: Determine the range of the following set of values. 48 42 55 28 112 79 95 27 36 14 96 193 191

A: The range is basically the measure of dispersion. It is the dispersion which is equal to the…

Q: a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an…

A: Net present value (NPV) of an alternative/project refers to the variance between the initial…

Q: Calvin Johnson has a $4,500 debt balance on his Visa card that charges 13.3 percent APR compounded…

A: Here, Debt Amount of Credit Card is $4,500 APR is 13.3% Compounding Period (m) is Monthly i.e 12…

Q: hen hopes to eventually replace his old bicycle with a new one. The type of bicyclehe wants has a…

A: Hi There, thanks for posting the question. But as per Q&A guidelines, we must answer the first…

Q: Five years ago, you entered into a 10-year investment with a simple interest of 4% per annum and a…

A: One time principal = P Simple interest for first 5 years (r) = 4% Compounded interest for next 3…

Q: Suppose a firm has a retention ratio of 60 percent, net income of $8 million, and 4 million shares…

A: Retention ratio = 60% Net income = $8 million Number of shares = 4 million

Q: 13 years ago, Sallie invested \$23{,}000.00$23,000.00 into a savings account. She now has…

A: Compounding: A compounding is the interest charged on interest. When any investment is made for…

Q: Analyze the change control process for the retail project's software configuration management. Your…

A: Any Development Project that retails merchandise, generally without transformation, and renders…

Q: What does the inventory turnover ratio mean?

A: Inventory turnover ratio gives the days required for the company from the date of its purchase to…

Q: If debt and equity can be modeled as options on the firm’s assets, then the firm's shareholders have…

A: If debt and equity can be modeled as options on the firm’s assets, then the firm's shareholders have…

Q: MacВос esc 000 GOO F1 F2 F3 F4 F5 #3 $ % 4 Q W E R T tab A S F G caps lock ift C V alt

A: MACRS stands for modified accelerated cost recovery system. MACRS depreciation is the system used to…

Q: Stock W has the following returns for various states of the economy: State of the Economy…

A: State of the Economy Probability Stock W's Return Recession 0.15 -10% Below Average 0.2 5%…

Q: 8. Find the net present value of the cash flows shown below.

A: Net present value (NPV) of an alternative/project refers to the variance between the initial…

Q: Calculate the tax rate if the tax amount is $ 64.50 on a purchase of $780?

A: Tax amount = $64.50 Purchase = $780

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

- An analyst has modeled the stock of a company using the Fama-French three-factor model. The market return is 10%, the return on the SMB portfolio (rSMB) is 3.2%, and the return on the HML portfolio (rHML) is 4.8%. If ai = 0, bi = 1.2, ci = 20.4, and di = 1.3, what is the stock’s predicted return?You are comparing Stock A to Stock B. Given the following information, what is the difference in the expected returns of these two securities? State of Economy Probability of State of Economy Rate of Return if State Occurs Stock A Stock B Normal .75 .13 .16 Recession .25 −.05 −.21(1) if stock 1 provides 10% rate of return and stock 2 expects 30% rate of return. what can we say about this scenerio regarding the consistency in the efficent market hypo? which stock (if any) is more risky?

- You are given the following information: State ofEconomy Return onStock A Return onStock B Bear .112 −.055 Normal .105 .158 Bull .083 .243 Assume each state of the economy is equally likely to happen. a. Calculate the expected return of each stock. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation of each stock. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) c. What is the covariance between the returns of the two stocks? (A negative answer should be indicated by a minus sign, Do not round intermediate calculations and round your answer to 6 decimal places, e.g., .161616.) d. What is the correlation between the returns of the two stocks? (A negative answer should be indicated by a minus sign, Do not round intermediate calculations and round your answer to 4…An investment Analysist provide the following data regarding the possible future returns on AmDa’s common stock State of economy Probability ReturnRecession 0.25 -1.4%Normal 0.45 9.4%Boom 0.30 15.4%i. Compute the expected return on the security? ii. Compute the standard deviation on the security? iii. Compute the Coefficient of variationConsider the following information: Economy Probability of State of Economy Rate of Return if State Occurs Stock A Stock B Recession .20 .010 −.35 Normal .55 .090 .25 Boom .25 .240 .48 Calculate the expected return for the two stocks. Calculate the standard deviation for the two stocks.

- USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM Stock Rit Rmt ai Beta C 12 10 0 0.8 E 10 8 0 1.1 Rit = return for stock i during period t Rmt = return for the aggregate market during period t What is the abnormal rate of return for Stock C during period t using only the aggregate market return (ignore differential systematic risk)?Assume you know the expected and required rate of returns of the following stocks. Explainwhich of the following stocks are undervalued, overvalued and fairly valued. Stock Expected rate of return Required rate of return Evaluation X 10 12 ? Y 6 5 ? Z 4 4 ?Consider the following information about Stocks I and II: State of Economy Probability of State of Economy Rate of Return if State Occurs Stock I Stock II Recession .20 .05 −.22 Normal .55 .20 .09 Irrational exuberance .25 .08 .42 The market risk premium is 8 percent, and the risk-free rate is 6 percent. (Do not round intermediate calculations. Enter your standard deviation answers as a percent rounded to 2 decimal places, e.g., 32.16. Round your beta answers to 2 decimal places, e.g., 32.16.)

- Questions: Refer to the data of Omani common stock at below table, answer the following questions: Calculate the required rate of return (RRR) of stock. If beta coefficient decreases from 1.5 t0 0.5, what is the affect required rate of return. Build a theoretical framework depends on result of above questions. Beta Coefficient Stock Market Return Risk-free Return 1.5 10% 6%You have been given the following information: Rate of Return If State Occurs State of Probability of Economy State of Economy Stock A Stock B Recession .25 .06 − .20 Normal .55 .07 .13 Boom .20 .11 .33 a. Calculate the expected return for the two stocks. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation for the two stocks. (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)XYZ stock's returns will have the following probability distribution during the possible states of the economy.a. Calculate the expected return on XYZ stock.b. Calculate the standard devivation of XYZ stock returns.c. Calculate the coefficient of variation of XYZ stock.State of Economy Probability Return Boom 15% 22.75% Normal 70% 12.60% Recession 15% -15.20% Expected Return: % Standard Deviation: Coefficient of Variation: