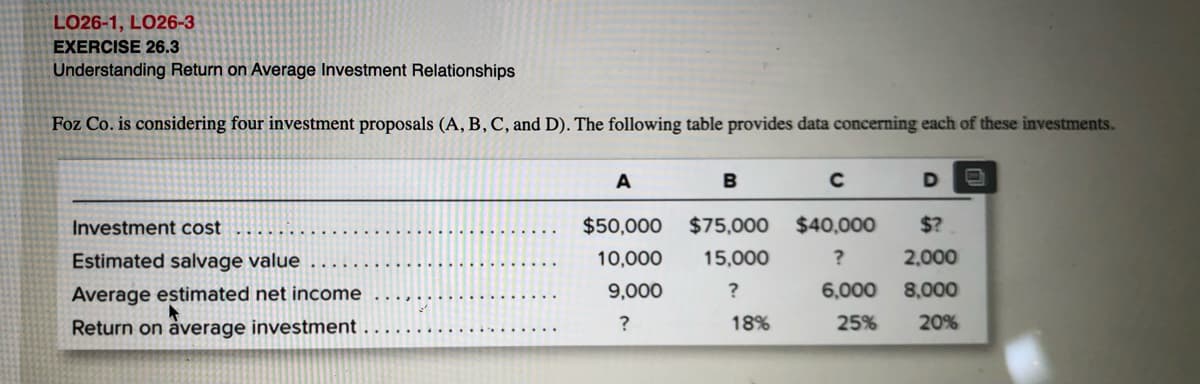

LO26-1, LO26-3 EXERCISE 26.3 Understanding Return on Average Investment Relationships Foz Co. is considering four investment proposals (A, B, C, and D). The following table provides data concerning each of these investments. B Investment cost $50,000 $75,000 $40,000 $? Estimated salvage value 10,000 15,000 2,000 Average estimated net income 9,000 6,000 8,000 Return on average investment ? 18% 25% 20%

LO26-1, LO26-3 EXERCISE 26.3 Understanding Return on Average Investment Relationships Foz Co. is considering four investment proposals (A, B, C, and D). The following table provides data concerning each of these investments. B Investment cost $50,000 $75,000 $40,000 $? Estimated salvage value 10,000 15,000 2,000 Average estimated net income 9,000 6,000 8,000 Return on average investment ? 18% 25% 20%

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 26.20EX

Related questions

Question

Solve for the missing information pertaining to each investment proposal.

Using the tables in Exhibit 26–3 determine the present value of the following cash flows, discounted at an annual rate of 15 percent.

$40,000 to be received 20 years from today.

$24,000 to be received annually for 10 years.

$16,000 to be received annually for five years, with an additional $20,000 salvage value expected at the end of the fifth year.

$30,000 to be received annually for the first three years, followed by $20,000 received annually for the next two years (total of five years in which cash is received)

Transcribed Image Text:LO26-1, LO26-3

EXERCISE 26.3

Understanding Return on Average Investment Relationships

Foz Co. is considering four investment proposals (A, B, C, and D). The following table provides data concerning each of these investments.

A

B

Investment cost

$50,000

$75,000

$40,000

$?

Estimated salvage value

10,000

15,000

2,000

Average estimated net income

9,000

6,000

8,000

Return on åverage investment

18%

25%

20%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning