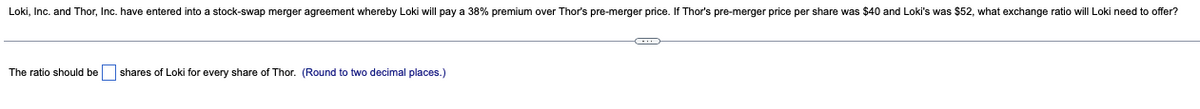

Loki, Inc. and Thor, Inc. have entered into a stock-swap merger agreement whereby Loki will pay a 38% premium over Thor's pre-merger price. If Thor's pre-merger price per share was $40 and Loki's was $52, what exchange ratio will Loki need to offer? The ratio should be shares of Loki for every share of Thor. (Round to two decimal places.)

Q: What are elements of financial reporting as per conceptual framework? Explain with example

A: The release of financial statements, which contain the income statement, balance sheet, and…

Q: Suppose the two-year interest rate is r2 with quarterly-compounding and 30/360 daycount. Suppose the…

A: Compounding is the method through which interest is added to both the principle balance already in…

Q: ELECTRON Computers just issued a bond that matures in 8 year equal to $1,000 and its coupon rate is…

A: Price of bond is present value of coupon payment and present value of par value of bond taken on the…

Q: when a house is purchased there is extra costs. land transfer tax 0.9% mortgage loan insurance…

A: When house is purchased there are many costs involved that are to be paid by the purchaser of the…

Q: When using the method of sealed bids, which of the following statements is true about the final…

A: The Statements Below are True, The player who bid the highest total value for the items must…

Q: A $1000 par floating rate note pays a coupon rate of 180-day LIBOR plus a quoted margin of 1.5%…

A: A floating rate note (FRN) is a bond in which the investor will receive coupons from the issuer at…

Q: Natalia , Oshane , Latoya and Shanice are being contradicted by Shavane , Gillian and Shienne to…

A:

Q: A mortgage for a condominium had a principal balance of $47,400 that had to be amortized over the…

A: Given: Particulars Amount Mortgage $47,400 Years 6 Interest rate 3.42% Monthly payment…

Q: Problem 1: Sandy wants to have an income of $8300 per year from investments. To that end she is…

A: Solution 1:- When an amount is invested somewhere, it earns interest on it. In case of simple…

Q: What is X in the formula: FV = X(1+r) ?

A: This relates to the concept of time value of money. As per the concept of time value of money to…

Q: a stock index fund that had an average APR of 11% over the last year. estment in 5 years and advise…

A: Information Provided: Investment = $10,000 Years = 5 Safe rate = 1.5% compounded monthly Risky rate…

Q: Year CF 100 dividend is exp nosh flows are reinvested at 7%, what is the total wealth after 3.25…

A: Future values includes the amount that is deposited and what is amount of interest that is being…

Q: The planned initial markup in a department, as indicated on the merchandise plan, is 42.5%. The…

A: OTB means option to buy , this strategy helpful for retailer to buy a product with estimated money…

Q: Phoenix Company is considering investments in projects C1 and C2. Both require an initial investment…

A: As per the given information: Initial investment - $330,000 Rate of return - 8%Net cash flowsProject…

Q: How does HanaTour use the data it collects from the audit to increase the security of its data?

A: HanaTour : It is the largest travel company in Korea. The main business of HanaTour is providing…

Q: to trade at par? A company releases a five-year bond with a face value of $1000 and coupons paid…

A: Face value or maturity value = Q = $1,000 Semiannual YTM = YTM = 0.03 (i.e. 0.06 / 2) Semiannual…

Q: a. A pension fund has to pay out $750,000 to the retirees at the end of every month for the next 50…

A: Time value of money (TVM) refers to the method or concept which is used to determine the amount of…

Q: Calculate the amount of simple interest payable if a person borrowed $25 500 at a simple interest…

A: Simple interest is the method of calculating interest when the interest earned does not get…

Q: Determine the? Black-Scholes value of a? one-year, at-the-money call option on Roslin stock. The?…

A: Information Provided: Volatility = 25% Stock price (S) = $70 Risk free rate (r) = 6% Time to expiry…

Q: low. What is the Benefit Cost of the 8 story @ 10%: Building Height 4 stories 8 stories Cast of…

A: The benefits cost ratio is the important parameter in the capital budgeting analysis and it must be…

Q: If the firm declares a 5 percent stock dividend, what will be the impact on the firm’s equity…

A: Information Provided: Common stock = $1,440,000 Contributed capital = 1,500,000 Retained earnings =…

Q: Lucas opens a bank account with 10000 and lets it accumulate at an annual nominal interest rate of…

A: Compound interest: It is the addition of interest to the principal sum of a loan or deposit and…

Q: O c. i, iii and iv

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: The Bensington Glass Company entered into a loan agreement with the firm's bank to finance the…

A: Rate of interest = Previous week interest rate + .27% basis points subject to minimum of 1.73%…

Q: he following spot FX rates were reported: Japanese Yen British Pound Australian Dollar US Dollar…

A: Japanese Yen British Pound Australian Dollar US Dollar 0.010267 1.616500 0.957900 The…

Q: Calculate the value of a bond that matures in 18years and has a $1,000 par value. The annual coupon…

A: A Bond refers to a concept that is defined as an instrument that represents the loan being made by…

Q: You are given the following data for a project that is to be evaluated using the APV method. Year 3…

A:

Q: The CFO of a US corporation is considering borrowing £500 million British pounds at a cost of 4% per…

A: As per our guidelines we are supposed to answer only the first 3 sub-parts. For remaining parts,…

Q: Xyz is considering a 5-year project. It plans to invest Kes.62,000 now and it forecasts cash flows…

A: Internal rate of return is an important capital budgeting tool. It is that rate at which NPV of a…

Q: Discuss the various timing risks a corporate CFO risks when raising funds via bonds or common stock…

A: Bond is referred as the fixed income instrument, which helps in representing the loans that are made…

Q: Why is it that oftentimes banks refuse to lend to many borrowers even though they offer high…

A: Analysis of the given option: i) To reduce the exposure to diversification risk Remark-By…

Q: Kuhn Co. is considering a new project that will require an initial investment of $4 million. It has…

A: As per the given information: Initial investment = $4 millionTarget structure = 58% debt, 6%…

Q: Suppose someone wants to accumulate $40,000 for a college fund over the next 15 years. Determine…

A: Given, The required amount is $40000. Term is 15 years

Q: Zenith Co. is expected to pay $4 dividend this year, $6 dividend next year, $9 dividend the…

A: The price of share can be computed as follows :- We can use the dividend discount model to solve the…

Q: the elements of a business plan are: the organization, marketing, and financial plans. List and…

A: The financial plan is a part of the business plan of a firm. A long term financial plan is an…

Q: Determine the purchase price at the indicated time before maturity of the following bond redeemed at…

A: Bond price is basically the discounted present value of future cash flow that the bond will…

Q: HERB, a pharmaceutical firm just paid a dividend of $5 per share. Being in an established industry,…

A: Dividend (D0) = $5 Growth Rate = 3% Risk-free rate = 5% Risk premium = 7%

Q: You get a $350,000 mortgage to buy a condo. If rates are at 6% and you will take thirty year fixed…

A: GivenPrice of Condo "P" = $350,000 Rate per year = 6% Rate per month "r" = 6%/12 Number of years =…

Q: Thornton borrowed $250,000 at a rate of 7.25%, simple interest, with interest paid at the end of…

A: Simple interest is simple interest that means there is interest on the principal amount only and…

Q: Wanda is thinking of buying stock X at the beginning of the year. By the end of the year, the market…

A: In the question, we have to calculate value of stock at the beginning of the year. Dividend discount…

Q: What is the current yield on a zero coupon bond with a remaining life of 16 years, a yield to…

A: Maturity period (m) = 16 years Yield to maturity (YTM) = 0.106 or 10.6% Face value or maturity value…

Q: grow under each of the following conditions. Do not round intermediate calculations. Round your…

A: *Answer: Initial investment (I) = $350 Period = 5 years Interest rate = 6% or 0.06 Future…

Q: Finance Companies A and B are each considering an unanticipated new investment opportunity that will…

A: As per the Net operating Income Approach Debt is the cheaper source of finance but increase in…

Q: Turnbull Co. is considering a project that requires an initial investment of $570,000. The firm will…

A: After tax cost of debt = Pretax cost of debt * (1 - tax rate) Weighted average cost of capital =…

Q: Answer the following: a. Explain why the interest parity condition must hold if the foreign exchange…

A: Foreign exchange market is referred as the market, where the different currencies used to get…

Q: The data presented below represents the expected returns on a financial asset in different seasons…

A: Data given: Season of year Probability Return(%) Spring 0.40 0.02 Summer 0.35 0.06 Winter…

Q: IBL Ltd went public by 5 million shares of common stock of $65 per share. The shares are currently…

A: WACC "Weighted Average Cost of Capital" The weighted average cost of capital (WACC), a crucial…

Q: onto 45. Bill borrowed PHP 10,000 from Mr. Will on July 11, 2018 and promised to pay it by December…

A: The question is related to the simple Interest. The Simple Interest is calculated with the help of…

Q: Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The…

A: Initial cash Flow (Year 0) = - $10,500,000 Cash flow (Year 1 - 6) = $4,000,000 Cash flow (Year 7) =…

Q: what is the difference between a call option and a put option?

A: There are two types of options one is call option and other is put option and both are derivative…

Step by step

Solved in 3 steps

- Loki, Inc. and Thor, Inc. have entered into a stock-swap merger agreement whereby Loki will pay a 39% premium over Thor's pre-merger price. If Thor's pre-merger price per share was $42 and Loki's was $51, what exchange ratio will Loki need to offer? a. 1.42 shares of Loki for each share of Thor b. 0.72 shares of Loki for each share of Thor c. 0.86 shares of Loki for each share of Thor d. 1.14 shares of Loki for each share of ThorFinance Loki Inc. and Thor Inc. have entered into a stock swap merger agreement whereby Loki will pay a 35% premium over Thor’s pre-merger price. A. If Thor’s pre-merger price per share was $37 and Loki’s was $52, what exchange ratio will Loki need to offer? B. On the day of the merger announcement, the increase in Thor (the target firm’s) stock price will be ______(higher/lower) than 35% (the takeover premium). C. Based on your answer in part B of this question, explain why you think Thor’s stock price increase will be higher or lower than the takeover premium at the time of the merger announcement.Denali Inc. is acquiring Whitney Corp. at an exchange ratio of 2:1. After the deal is announced, Denali’s stock price is $25 and Whitney’s stock price is $47. Create a trade that would take advantage of the merger arbitrage opportunity, starting with 100 shares of Whitney’s stock. Show in detail the profit from your portfolio if between today and the deal being completed, Denali’s stock price falls to $20.

- A merger between Minnie Corporation and Mickey Corporation is under consideration. The financial information for these firms is as follows: Minnie Corporation Mickey Corporation Total earnings $1,682,000 $2,581,000 Number of shares of stock outstanding 290,000 890,000 EPS $5.80 $2.90 P/E ratio 10X 20X Market price per share $58 $58 a. On a share-for-share exchange basis, what will the postmerger EPS be? (Round the final answer to 2 decimal places.) Postmerger earnings per share $ b. If Mickey Corporation pays a 25 percent premium over the market value of Minnie Corporation, how many shares will be issued? (Do not round intermediate calculations.) Shares issued shares c. With the 25 percent premium, what will the postmerger EPS be? (Do not round intermediate calculations. Round the final answer to 2 decimal places.) Postmerger earnings per share $Prior to the merger, Glassons has $1,250 in total earnings with 750 shares outstanding at a market price per share of $42. Country Road has $740 in total earnings with 220 shares outstanding at $18 per share. Assume Glassons acquires Country Road via an exchange of stock at a price of $20 for each share of Country Road's stock. Both Glassons and Country Road have no debt outstanding. What will the earnings per share of Glassons be after the merger?Warehouse Stationary is planning on merging with Whitcoulls. Warehouse's will pay Whitcoulls's shareholders the current value of their stock in shares of Warehouse's Equipment. Warehouse's currently has 4,600 shares of stock outstanding at a market price of $31 a share. Whitcoulls's has 1,600 shares outstanding at a price of $38 a share. What is the value per share of the merged firm assuming there is no synergy?

- Winsor Inc. recently purchased Holiday Corp., a large midwestern home painting corporation. One of the terms of the merger was that if Holiday's income for 2020 was $110,000 or more, 10,000 additional shares would be issued to Holiday's stockholders in 2021. Holiday's income for 2019 was $120,000. Instructions a. Would the contingent shares have to be considered in Winsor's 2019 earnings per share computations? b. Assume the same facts, except that the 10,000 shares are contingent on Holiday's achieving a net income of $130,000 in 2020. Would the contingent shares have to be considered in Winsor's earnings per share computations for 2019?The shareholders of Bread Company have voted in favor of a buyout offer from Butter Corporation. Information about each firm is given here: Bread Butter Price-earnings ratio 7.2 14.4 Shares outstanding 73,000 146,000 Earnings $ 210,000 $ 630,000 Bread’s shareholders will receive one share of Butter stock for every three shares they hold in Bread. a-1. What will the EPS of Butter be after the merger? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) a-2. What will the PE ratio be if the NPV of the acquisition is zero? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What must Butter feel is the value of the synergy between these two firms?ABC and XYZ have total equity values of P5,000,000 and P10,000,000 respectively. If they merged, a total of 30,000 P500-par value shares may be issued. Each share can provide investors a rate of return of 18%, a growth rate of 3% and annual dividends of P78 per share for the first year. What is the total value of synergy that the merger will provide?

- On January 1, 2031, PNB and Allied Bank entered into a contract of merger wherein PNB will issue 100,000 ordinary shares with par value of P10 and quoted price of P20 to the existing shareholders of Allied in exchange for the net assets of Allied Bank. Aside from that, PNB is required to pay the stockholders of Allied Bank of cash amounting to P891,000 on December 31, 2031. The effective interest rate of this contingent consideration is 10%. PNB paid acquisition related cost of business combination amounting to P100,000, indirect cost of P50,000 and stock issuance cost amounting to P200,000. As of December 31, 2030, PNB has total assets with book value of P50M and fair market value of P60M while Allied Bank has total assets with book value of P5M and fair market value of P4M. As of December 31, 2030, Allied Bank has total liabilities with book value of P2.4M with fair value of P2.5M. A contingent liability of Allied Bank on December 31, 2030 amounting to P300,000 has been…The shareholders of Bread Company have voted in favor of a buyout offer from Butter Corporation. Information about each firm is given here: Bread Butter Price-earnings ratio 16 23 Shares outstanding 96,000 230,000 Earnings $ 180,000 $ 900,000 Bread's shareholders will receive one share of Butter stock for every three shares they hold in Bread. a-1. What will the EPS of Butter be after the merger? (Do not round intermediate calculations and round your answer to 3 decimal places, e.g., 32.161.) a-2. What will the PE ratio be if the NPV of the acquisition is zero? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What must Butter feel is the value of the synergy between these two firms? a-1. EPS a-2. PE b. Synergy valueA limited is considering making a tender offer for B Ltd. The merger would result in economies of scale (Benefit of synergy) of Rs.20 lakh. The relevant financial information for B Ltd. is as follows: Number of shares outstanding 1,80,000 Earnings per share Rs.12 Market price per share Rs.76 A Limited intends to make a two-tier tender offer wherein it will offer Rs.82 for the first 1, 00,000 shares and Rs.75 for the remaining shares. a. If the tender is successful, how much should A Ltd pay to B Ltd.? b. If the Economies of merger is Rs.20, 00,000, How much of this goes to the Shareholders of A Ltd & B Ltd respectively? How much are the shareholders of A Ltd. And B Ltd. benefitting from the economies of merger?