Lom 17,200 Con Ac

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter15: Capital Investment Analysis

Section: Chapter Questions

Problem 15.5.3MBA

Related questions

Question

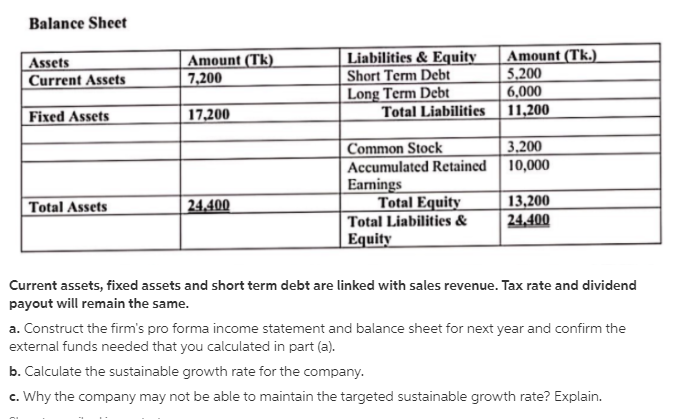

Transcribed Image Text:Balance Sheet

Liabilities & Equity

Short Term Debt

Long Term Debt

Total Liabilities

Amount (Tk.)

5,200

| 6,000

| 11,200

Amount (Tk)

7,200

Assets

Current Assets

Fixed Assets

17,200

Common Stock

3,200

Accumulated Retained 10,000

Earnings

Total Equity

13,200

|24,400

Total Assets

24,400

Total Liabilities &

Equity

Current assets, fixed assets and short term debt are linked with sales revenue. Tax rate and dividend

payout will remain the same.

a. Construct the firm's pro forma income statement and balance sheet for next year and confirm the

external funds needed that you calculated in part (a).

b. Calculate the sustainable growth rate for the company.

c. Why the company may not be able to maintain the targeted sustainable growth rate? Explain.

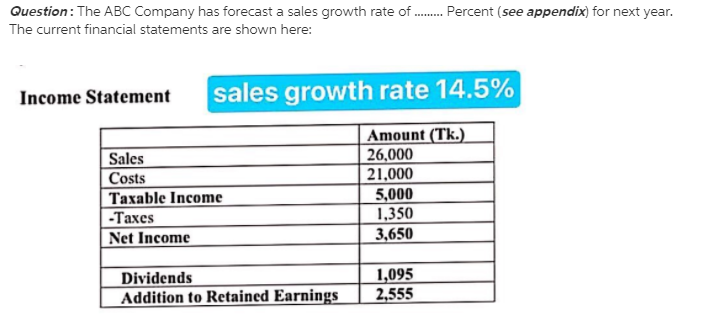

Transcribed Image Text:Question: The ABC Company has forecast a sales growth rate of . Percent (see appendix) for next year.

The current financial statements are shown here:

Income Statement

sales growth rate 14.5%

Amount (Tk.)

26,000

21,000

5,000

1,350

3,650

Sales

Costs

Taxable Income

-Taxes

Net Income

1,095

2,555

Dividends

Addition to Retained Earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT