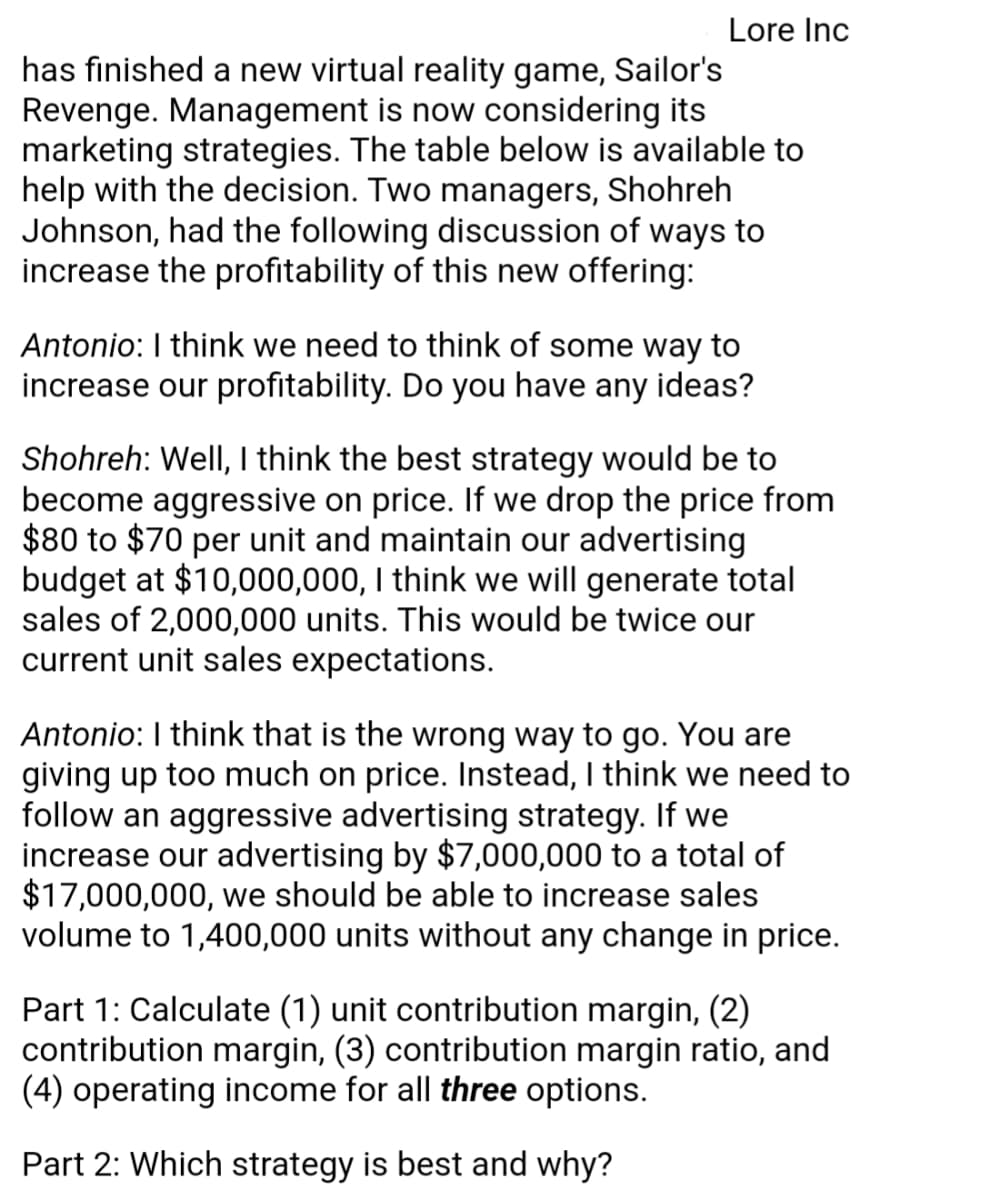

Lore Inc has finished a new virtual reality game, Sailor's Revenge. Management is now considering its marketing strategies. The table below is available to help with the decision. Two managers, Shohreh Johnson, had the following discussion of ways to increase the profitability of this new offering: Antonio: I think we need to think of some way to increase our profitability. Do you have any ideas? Shohreh: Well, I think the best strategy would be to become aggressive on price. If we drop the price from $80 to $70 per unit and maintain our advertising budget at $10,000,000, I think we will generate total sales of 2,000,000 units. This would be twice our current unit sales expectations. Antonio: I think that is the wrong way to go. You are giving up too much on price. Instead, I think we need to follow an aggressive advertising strategy. If we increase our advertising by $7,000,000 to a total of $17,000,000, we should be able to increase sales volume to 1,400,000 units without any change in price. Part 1: Calculate (1) unit contribution margin, (2) contribution margin, (3) contribution margin ratio, and (4) operating income for all three options.

Lore Inc has finished a new virtual reality game, Sailor's Revenge. Management is now considering its marketing strategies. The table below is available to help with the decision. Two managers, Shohreh Johnson, had the following discussion of ways to increase the profitability of this new offering: Antonio: I think we need to think of some way to increase our profitability. Do you have any ideas? Shohreh: Well, I think the best strategy would be to become aggressive on price. If we drop the price from $80 to $70 per unit and maintain our advertising budget at $10,000,000, I think we will generate total sales of 2,000,000 units. This would be twice our current unit sales expectations. Antonio: I think that is the wrong way to go. You are giving up too much on price. Instead, I think we need to follow an aggressive advertising strategy. If we increase our advertising by $7,000,000 to a total of $17,000,000, we should be able to increase sales volume to 1,400,000 units without any change in price. Part 1: Calculate (1) unit contribution margin, (2) contribution margin, (3) contribution margin ratio, and (4) operating income for all three options.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter20: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 4TIF: Profitability strategies Somerset Inc. has finished a new video game, Snowboard Challenge....

Related questions

Question

100%

KSAs: Understand processes and concepts of cost-volume-profit.

How to Calculate unit contribution margin, contribution margin, contribution margin ratio, and operating income?

Transcribed Image Text:Lore Inc

has finished a new virtual reality game, Sailor's

Revenge. Management is now considering its

marketing strategies. The table below is available to

help with the decision. Two managers, Shohreh

Johnson, had the following discussion of ways to

increase the profitability of this new offering:

Antonio: I think we need to think of some way to

increase our profitability. Do you have any ideas?

Shohreh: Well, I think the best strategy would be to

become aggressive on price. If we drop the price from

$80 to $70 per unit and maintain our advertising

budget at $10,000,000, I think we will generate total

sales of 2,000,000 units. This would be twice our

current unit sales expectations.

Antonio: I think that is the wrong way to go. You are

giving up too much on price. Instead, I think we need to

follow an aggressive advertising strategy. If we

increase our advertising by $7,000,000 to a total of

$17,000,000, we should be able to increase sales

volume to 1,400,000 units without any change in price.

Part 1: Calculate (1) unit contribution margin, (2)

contribution margin, (3) contribution margin ratio, and

(4) operating income for all three options.

Part 2: Which strategy is best and why?

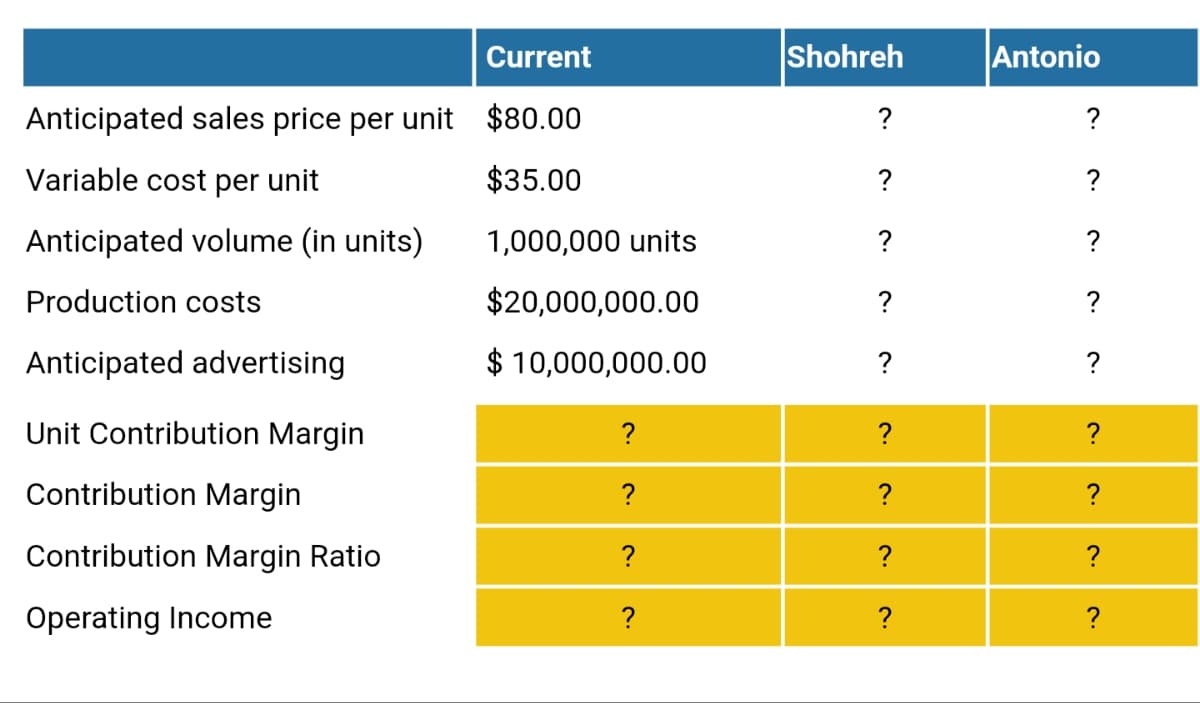

Transcribed Image Text:Current

Shohreh

Antonio

Anticipated sales price per unit $80.00

?

?

Variable cost per unit

$35.00

?

?

Anticipated volume (in units)

1,000,000 units

?

?

Production costs

$20,000,000.00

?

?

Anticipated advertising

$ 10,000,000.00

?

?

Unit Contribution Margin

?

?

?

Contribution Margin

?

?

?

Contribution Margin Ratio

?

?

?

Operating Income

?

?

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College