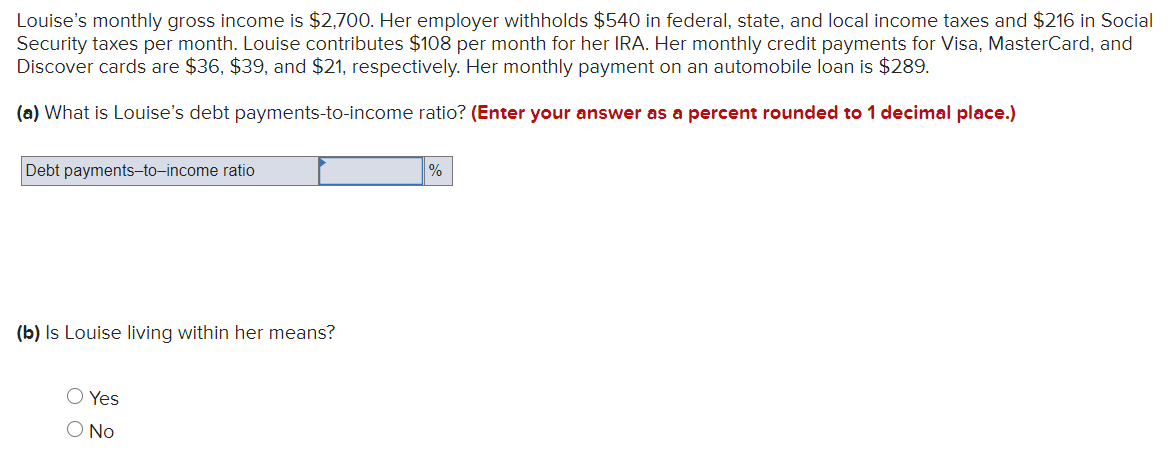

Louise's monthly gross income is $2,700. Her employer withholds $540 in federal, state, and local income taxes and $216 in Social Security taxes per month. Louise contributes $108 per month for her IRA. Her monthly credit payments for Visa, MasterCard, and Discover cards are $36, $39, and $21, respectively. Her monthly payment on an automobile loan is $289. (a) What is Louise's debt payments-to-income ratio? (Enter your answer as a percent rounded to 1 decimal place.) Debt payments-to–income ratio % (b) Is Louise living within her means? O Yes O No

Louise's monthly gross income is $2,700. Her employer withholds $540 in federal, state, and local income taxes and $216 in Social Security taxes per month. Louise contributes $108 per month for her IRA. Her monthly credit payments for Visa, MasterCard, and Discover cards are $36, $39, and $21, respectively. Her monthly payment on an automobile loan is $289. (a) What is Louise's debt payments-to-income ratio? (Enter your answer as a percent rounded to 1 decimal place.) Debt payments-to–income ratio % (b) Is Louise living within her means? O Yes O No

Chapter3: Income Sources

Section: Chapter Questions

Problem 51P

Related questions

Question

Transcribed Image Text:Louise's monthly gross income is $2,700. Her employer withholds $540 in federal, state, and local income taxes and $216 in Social

Security taxes per month. Louise contributes $108 per month for her IRA. Her monthly credit payments for Visa, MasterCard, and

Discover cards are $36, $39, and $21, respectively. Her monthly payment on an automobile loan is $289.

(a) What is Louise's debt payments-to-income ratio? (Enter your answer as a percent rounded to 1 decimal place.)

Debt payments-to-income ratio

%

(b) Is Louise living within her means?

O Yes

O No

Expert Solution

Step 1: Introduction

Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow.

Formula to calculate debt-to-income ratio:

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you