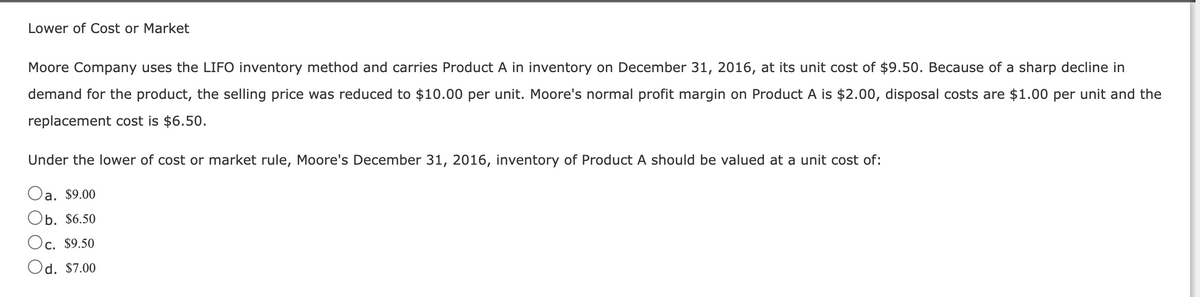

Lower of Cost or Market Moore Company uses the LIFO inventory method and carries Product A in inventory on December 31, 2016, at its unit cost of $9.50. Because of a sharp decline in demand for the product, the selling price was reduced to $10.00 per unit. Moore's normal profit margin on Product A is $2.00, disposal costs are $1.00 per unit and the replacement cost is $6.50. Under the lower of cost or market rule, Moore's December 31, 2016, inventory of Product A should be valued at a unit cost of: Oa. $9.00 Ob. $6.50 Oc. $9.50 Od. $7.00

Lower of Cost or Market Moore Company uses the LIFO inventory method and carries Product A in inventory on December 31, 2016, at its unit cost of $9.50. Because of a sharp decline in demand for the product, the selling price was reduced to $10.00 per unit. Moore's normal profit margin on Product A is $2.00, disposal costs are $1.00 per unit and the replacement cost is $6.50. Under the lower of cost or market rule, Moore's December 31, 2016, inventory of Product A should be valued at a unit cost of: Oa. $9.00 Ob. $6.50 Oc. $9.50 Od. $7.00

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 2MC: Moore Company uses the LIFO cost flow assumption and carries Product A in inventory on December 31,...

Related questions

Question

Transcribed Image Text:Lower of Cost or Market

Moore Company uses the LIFO inventory method and carries Product A in inventory on December 31, 2016, at its unit cost of $9.50. Because of a sharp decline in

demand for the product, the selling price was reduced to $10.00 per unit. Moore's normal profit margin on Product A is $2.00, disposal costs are $1.00 per unit and the

replacement cost is $6.50.

Under the lower of cost or market rule, Moore's December 31, 2016, inventory of Product A should be valued at a unit cost of:

a. $9.00

Ob. $6.50

Oc. $9.50

Od. $7.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning