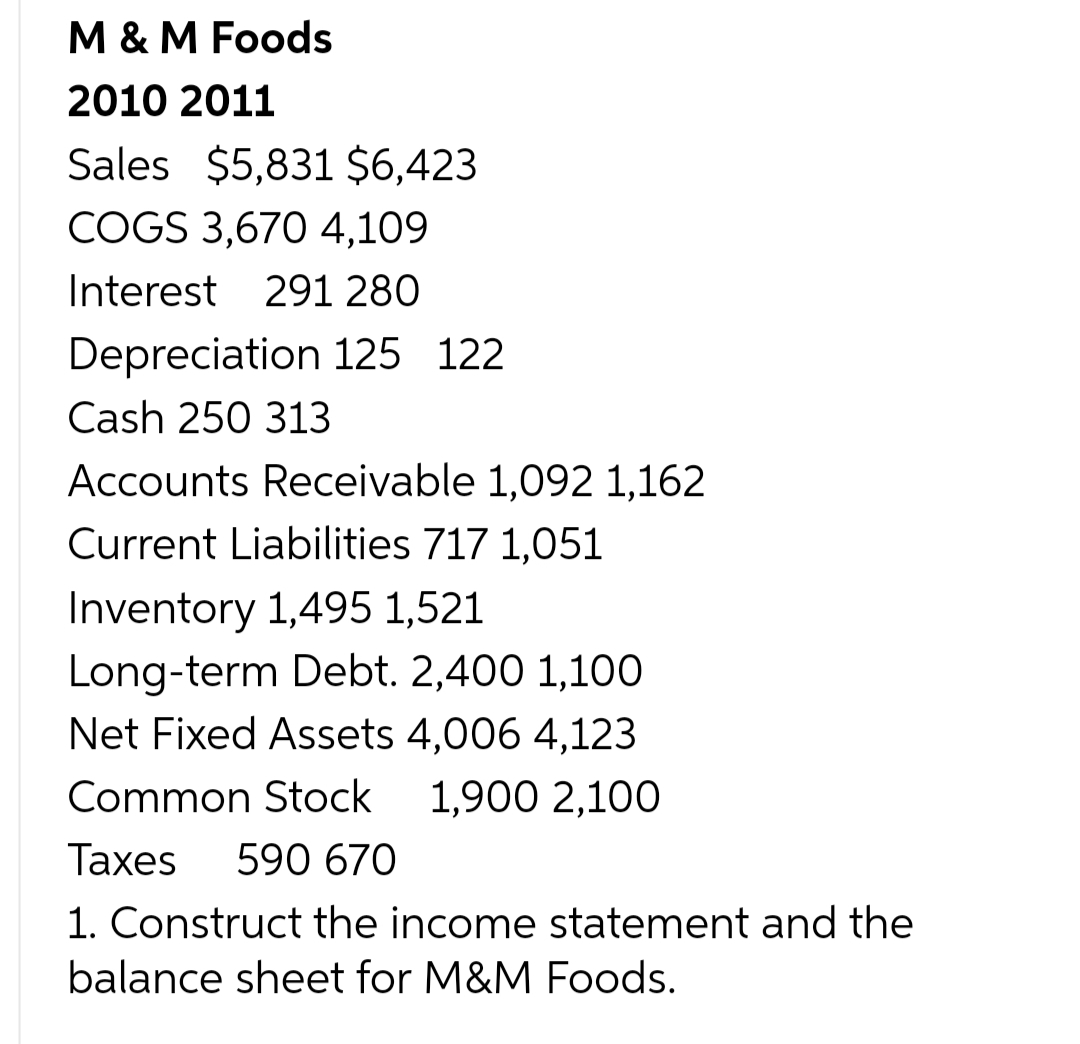

M & M Foods 2010 2011 Sales $5,831 $6,423 COGS 3,670 4,109 Interest 291 280 Depreciation 125 122 Cash 250 313 Accounts Receivable 1,092 1,162 Current Liabilities 717 1,051 Inventory 1,495 1,521 Long-term Debt. 2,400 1,100 Net Fixed Assets 4,006 4,123 Common Stock 1,900 2,100 Taxes 590 670 1. Construct the income statement and the balance sheet for M&M Foods.

Q: Robert started an accounting firm in 2022 and organized as a partnership. Performance of services…

A: Solution Partnership is an arrangement between two or more people who agrees to share profit with…

Q: Giblin’s Goodies pays employees weekly on Fridays. However, the company notices that March 31 is a…

A: Journal entry is a process of recording the business transaction into books of accounts initially.…

Q: On July 1, 2019, Killearn Company acquired 105,000 of the outstanding shares of Shaun Company for…

A: a. Step: 1 Equity Income 2019 A Basic equity accrual ($640,000 × 1/2 year × 40%)…

Q: What are the total variable manufacturing costs of the Deluxe paper product? Answer:

A: To calculate Total Variable Manufacturing Costs, first we have to calculate variable manufacturing…

Q: Cash and accounts receivable for Adams Company are provided below: Prior Year Cash $50,799 $41,300…

A: Comparative balance sheet analysis is used to compare two or more company financial statements. It…

Q: Sales..... Variable expenses.. Contribution margin ..... Fixed expenses.. Operating income.. Total $…

A: The contribution margin of a company is the amount of money that is left over from sales after…

Q: The West Point plan of Walkers Electronics Company has the following standards for component C91:…

A: * As per Bartleby policy, if multiple subparts are there then answer first three subparts only. 1.…

Q: For each of the following independent situations, enter the requested amounts in the associated…

A: The book value of the machine is the difference between the cost of the assets and the accumulated…

Q: tories in the records of W Limited on 30 June 2022 amount to R157 500. • Net realisable value of…

A: Journal entries refer to the concept of properly noting all the day-to-day transactions of a company…

Q: On January 1, 2011, BGA Company had a balance of $500,000 in its Bonds Payable account. During 2011,…

A: Cash flow from Financing activities: It include transactions relating to the debt, equity, and…

Q: The management of Nixon Corporation is investigating purchasing equipment that would cost $540,000…

A: A simple rate of return can be calculated by dividing the net income by total assets. It indicates…

Q: what is the importance of ethical conduct for auditors

A: The moral code that guides employees' behavior in terms of what is right and wrong in terms of…

Q: Our chapter this week touches on the subject of depreciation. Regarding depreciation, of the…

A: The business possesses multiple assets that are used in the business. The depreciation is charged…

Q: Calculate a markup matrix for next year's models. Select the correct choice below and, if necessary,…

A: It has been given for the current year regarding the prices of the cars at both ends which is at the…

Q: An invoice for $9156.86 is dated June 23, 2022 with terms 4/10, 2/20, n/60 ROG. The goods are…

A: Here 4/10 means 4% discount will be given if payment is made with in 10 days.

Q: How do I find Leases, Share-based compensation, Dilutive securities, and Revenue recognition for…

A: To find information on leases, share-based compensation, dilutive securities, and revenue…

Q: Hlayisani Ltd acquired 60% of the voting shares of the Mashele Ltd on 31 January 2014 for R65 000…

A: Goodwill/ Gain on Bargain purchase = Purchase Consideration - Fair value of the net asset Bargain…

Q: Owner Yang Wong is considering franchising her Noodle Time restaurant concept. She believes people…

A: The Break-even point indicates that total units are to be sold by the business entity to recover its…

Q: Consequences of Multiple Cash Distributions. At the beginning of the current (non-leap) year,…

A: Accumulated Earning and Profit The financial term "accumulated earnings and profits" (E&P)…

Q: Sandy wants to go on a trip in 10 years. If she invests $1,000 per year at the end of each year for…

A: Introduction Interest rate; A rate of interest indicates how expensive borrowing is or how…

Q: The Matrix Company has three product lines of belts-A, B, and C-with contribution margins of $7, $5,…

A: The Break-even point is a point at which a company cannot earn any profit. At this breaking point,…

Q: Manatee Corporation purchased a special conveyor system on December 31, 2025. The purchase agreement…

A: Present value: It implies to the current valuation of a future stream of cash flows, discounted at a…

Q: The three categories of inventories commonly found in many manufacturing companies are:

A: There are companies which make the goods and the products whose activities are involved into such…

Q: Year $51,129 84,836 ormation, what is the amount and percentage of increase or decrease I answers as…

A: Given information : Account payable Current = $51,129 Account payable Previous year = $74,100…

Q: IFRS requires annual reviews of long-lived assets (other than goodwill) for reversal indicators. A…

A: Accounting for Impairments From a GAAP perspective, the asset is recorded at its historical cost,…

Q: What are ethical principles in auditing

A: Financial statement audits or independent reviews and evaluations of a company's financial…

Q: Discuss: How have government accounting evolved since independence on Barbados. How has this country…

A: Since independence, government accounting in Barbados has evolved to become more sophisticated and…

Q: LO 4 Exercise 10-15A Straight-line amortization of a bond discount Farm Supplies, Inc., issued…

A: Introduction: while a corporation is preparing a bond to be issued/sold for investors than that may…

Q: The following financial statements were drawn from the records of Healthy Products Co. Assets Cash…

A: Cash flow statement is the financial statement which is prepared in order to check the cash position…

Q: how do you reduce information risk in auditing ?

A: Audit is the examination of and inspection of books of accounts of a company by an external auditor.…

Q: TAXATION in the Philippines DAILY 1 2 3 4 5 6 Compensation range 685 and below 685 - 1,095 1,096 -…

A: Taxation is the process through which a taxing body, frequently a government, imposes a financial…

Q: What would be the estimated loss in income from operations if the aloe vera hand lotion production…

A: a) Preperation of estimated income statement for February month(absorption costing) Sales price…

Q: Barney Stinson, a legal advisor at Goliath Bank, is under intense pressure at work to ensure that…

A: Target profit = $250,000 Target contribution margin = Target profit + Fixed cost Contribution…

Q: A section of IRC Incorporated's balance sheet appears as follows: IRC Incorporated Partial Balance…

A: Dividends are defined as part of the profit distributed among the shareholders of the company. Out…

Q: Cost of direct materials used in production Direct labor Factory overhead Work in process inventory,…

A: Cost of goods manufactured is based on total manufacturing costs added and inventories of work in…

Q: Determine the amount that pretax income would increase (decrease) in Year 2 as a result of the…

A: Given in the question: Date of Purchase January 1, Year 1 Number of Shares purchased…

Q: Following is a table for the present value of $1 at compound interest: Year 6% 10% 1 0.943 0.909 2…

A: The present value of a single future value amount is calculated by the following formula: If the…

Q: Revenue and expense data for Bluestem Company are as follows: Administrative expenses Cost of goods…

A: Gross margin = Sales - Cost of goods sold

Q: Using the table below, complete a Vertical Analysis. Round answers to 1 decimal place. Paragraph V…

A: VERTICAL ANALYSIS OF BALANCE SHEET Vertical Analysis of a Balance sheet provides the Percentage…

Q: The cost of printer paper on a college campus would be a direct cost to the college but would need…

A: Cost refers to the amount or monetary value which the business makes in order to acquire the…

Q: The Prince-Robbins partnership has the following capital account balances on January 1, 2021:…

A: There is the possibility that partners may earn a guaranteed wage, and any leftover profit or loss…

Q: Mastery Problem: Cost-Volume-Profit Analysis Cost Behavior Cover-to-Cover Company is a manufacturer…

A: “Since you have asked multiple question, we will solve the first question for you. If you want any…

Q: Tani Corporation's most recent balance sheet appears below: Comparative Balance Sheet Ending…

A: Cash flow from investing activities (CFI) is one of the sections of the cash flow statement that…

Q: Required: a) b) c) Journalise the above transactions in the appropriate special journals. Posting to…

A: Ledger Account A company's ledger account is a journal in which it keeps track of all transactions…

Q: a. Calculate the annual WCI (Workers Compensation Insurance) premium that each of these companies…

A: Introduction: Worker compensation insurance: Workers compensation insurance gives benefits for…

Q: Goodman, Pinkman, and White formed a partnership on January 1, 2020, and made capital contributions…

A: Partnership is the business form that is carried by two or more partners with a motive to earn…

Q: Cast Iron Grills, Incorporated, manufactures premium gas barbecue grills. The company reports…

A: Formula: Gross Profit=Sales–Cost of goods sold Gross Profit Ratio=Gross ProfitSales×100

Q: Damron, Incorporated, has 205,000 shares of stock outstanding. Each share is worth $79, so the…

A: Given data: Existing number of shares =205,000 shares exisiting market value = $16,195,000 new…

Q: Could you please answer in print? I can't understand the writing very well. Thank you

A: Financial statements are defined as reports that show the progress made by the company in a…

Q: Identify each cost as being variable, fixed, or mixed by writing the name of each cost under one of…

A: SOLUTION:- Variable cost Fixed cost Mixed cost Supervision…

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

- 2013 2014 Sales$4,500 $4,775 Depreciation7501050COGS24222430Interest180215Cash200400Accts Receivables200300Notes Payable100150Long-term debt29561850Net fixed assets80009200Accounts Payable50100Inventory18001600Dividends225275Tax rate35%35% 1. What is the cash flow from operating activities? 2. What is the cash flow from financing activities? What is the days sales in accounts receivable or the AR period?Total fixed assets 31420 OMR Total long term liabilities 9970 OMR Total current assets 18930 OMR Total current liabilities 4765 OMR Shareholders’ funds 35615 OMR Capital employed 45585 OMR Gross profit 175000 OMR Net profit 113950 OMR Return on capital employed 25% Current ratio 3.97 Liquid ratio 3.34 Return on Equity 3.191 Gross Profit Margin 53,03% Net Profit Margin 34.53% Q/Give a brief report on the financial position of the company based on the above figures?FBC statement of financial position (R millions) 2018 2017 Cash and equivalents R149 R83 Accounts receivable 295 265 Inventory 275 285 Total current assets R719 R633 Total fixed assets 3 909 3 856 Accounts payable 228 220 Notes payable 0 0 Total current liabilities 228 220 Long term debt 1 800 1 650 Total liabilities and shareholders equity 3 909 3 856 Number of shares outstanding (millions) 100 100 Additional information: Depreciation (2018): R483. The firm spent R250m in profitable projects during the course of 2018 WACC : 15% Cost of equity of the firm: 10% Tax rate : 40% Table 2: FBC statement of comprehensive income (R millions except for share data) 2018 2017 Total revenues R3 175 R3 075 EBIT 495 448 Interest expense 104 101 Net Income 235 208 Dividends per share R0.80…

- Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Balance Sheets for 2020 & 2021.Use the below information to answer the following questions: 20202021Sales$11,573$12,936Depreciation 1661 1736Cost of goods sold 3979 4707Other Expenses 846 924Interest Expense 776 926Cash 6067 6466Accounts Receivables 8034 9427Short-term Notes Payable 1171 1147Long-term debt 20,320 24,696Net fixed assets 50,888 54,273Accounts Payable 4384 4644Tax rate 26% 34%Inventory 14,283 15,288Payout ratio 33% 30% A. Create the Income Statements for 2020 and 2021 (including dividends paid and retained earnings).Windswept, Incorporated 2022 Income Statement (in millions) Net sales $ 9,430 Cost of goods sold 7,790 Depreciation 455 Earnings before interest and taxes $ 1,185 Interest paid 106 Taxable income $ 1,079 Taxes 378 Net income $ 701 Windswept, Incorporated 2021 and 2022 Balance Sheets (in millions) 2021 2022 2021 2022 Cash $ 230 $ 260 Accounts payable $ 1,390 $ 1,585 Accounts receivable 1,000 900 Long-term debt 1,120 1,310 Inventory 1,820 1,685 Common stock 3,380 3,020 Total $ 3,050 $ 2,845 Retained earnings 610 860 Net fixed assets 3,450 3,930 Total assets $ 6,500 $ 6,775 Total liabilities & equity $ 6,500 $ 6,775 What is the days' sales in receivables for 2022?

- Description FY10 FY11 FY12 FY13 FY14 Financial Statements GBP m GBP m GBP m GBP m GBP m Income Statements Revenue 4,390 3,624 3,717 8,167 11,366 Profit before interest & taxes (EBIT) 844 700 704 933 1,579 Net Interest Payable (80) (54) (98) (163) (188) Taxation (186) (195) (208) (349) (579) Miniorities (94) (99) (105) (125) (167) Profit for the year 484 352 293 296 645 Balance Sheet Fixed Assets 3,510 3,667 4,758 10,431 11,483…PROBLEM 8:Tomas Co. has the following balance sheet as of December 31, 2021.Current assets 180,000.00Fixed assets 120,000.00Total assets 300,000.00Accounts payable 40,000.00Accrued liabilities 20,000.00Notes payable 50,000.00Other Long-term debt 75,000.00Total Equity 115,000.00Total liabilities and equity 300,000.00 In 2021, Tomas Co. reported sales of P1,500,0000, net income of P30,000, and dividends of P18,000. The company expected its sales to increase by 20% by next year and its retention ratio will remain at 40%. Assume that Tomas Co. is operating at full capacity and it uses the AFN approach in determining the amount of external financing needed.How much is the sales for 2022? Using Problem 8, how much is the increase in retained earnings for the purpose of computing the AFN? Using Problem 8, how much external funds needed for the year 2022?Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…

- Patel Corporation Balance Sheet December 31, 2021 $ 630,000 189,000 275,000 1,875,000 Cash $ Accounts receivable ( net) Inventories Plant and equipment net of depreciation Patents Other intangible assets Total Assets $ 750,000 350,000 Accounts payable 1.950,000 Income taxes payable 2,439,000 Miscellaneous accrued payables Bonds payable (8% , due 2023) 1,963,000 Preferred slock ($100 par, 6% 261,000 cumulative nonparticipating) 75,000 Common stock (no par, 60,000 7,058.000 shares authorized, issued and outstanding) Retained earnings Treasury stock- - 1.500 shares of preferred Total Equities 1,125,000 2,439,000 (225,000) underline 5 7,058,000 Patel Corporation Income Statement Year ended December 31, 2021 Net sales $ Cose goods sold Gross profit Operating expenses (including bond interest expense) Income before income taxes Income tax Net income 9,000,000 6,000,000 3,000,000 1,500,000 1,500,000 450,000 1, 05 Additional information: There are no preferred dividends in arrears, the…Delta GMBH’s ROE is 8.9 percent. Sales are $2,956,000.00. Total debt ratio is 0.3743. Total debt is $964,000.00. Determine the return on assets (ROA).Marina Company Statement of Financial Position June 30, 2020 AssetsCurrent Assets Cash P 21,000.00 Accounts Receivables 160,000.00 Merchandise Inventory 300,000.00 Prepaid Expenses 9,000.00Total Current Assets P 490,000.00Property, Plant and Equipment 810,000.00Total Assets P 1,300,000.00 Liabilities and EquityLiabilities: Current Liabilities P 200,000.00 Bonds Payable, 10% 300,000.00Total Liabilities P 500,000.00Equity:…