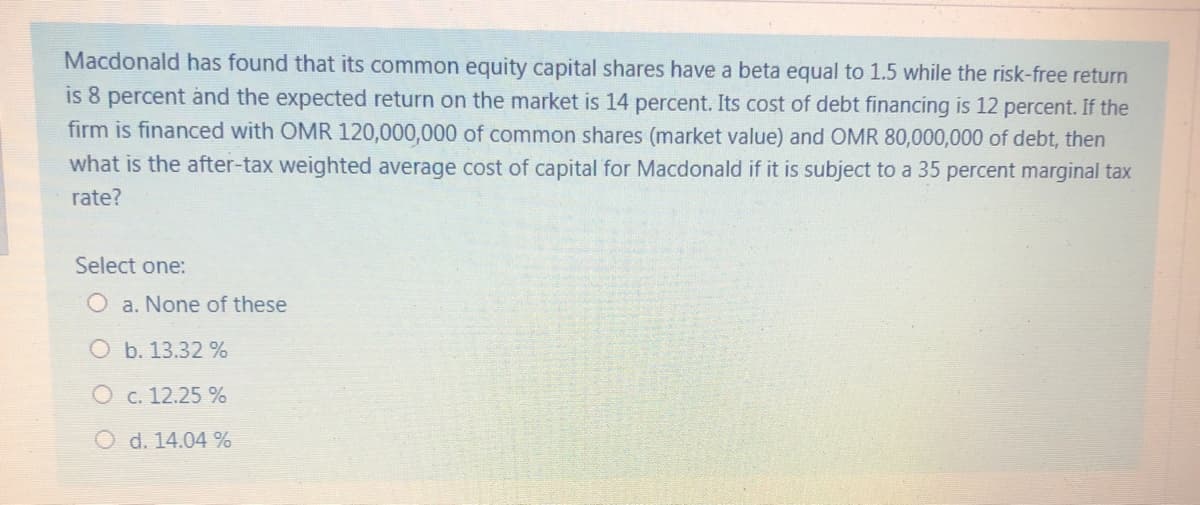

Macdonald has found that its common equity capital shares have a beta equal to 1.5 while the risk-free return is 8 percent and the expected return on the market is 14 percent. Its cost of debt financing is 12 percent. If the firm is financed with OMR 120,000,000 of common shares (market value) and OMR 80,000,000 of debt, then what is the after-tax weighted average cost of capital for Macdonald if it is subject to a 35 percent marginal tax rate? Select one: O a. None of these O b. 13.32 % O c. 12.25 % O d. 14.04 %

Macdonald has found that its common equity capital shares have a beta equal to 1.5 while the risk-free return is 8 percent and the expected return on the market is 14 percent. Its cost of debt financing is 12 percent. If the firm is financed with OMR 120,000,000 of common shares (market value) and OMR 80,000,000 of debt, then what is the after-tax weighted average cost of capital for Macdonald if it is subject to a 35 percent marginal tax rate? Select one: O a. None of these O b. 13.32 % O c. 12.25 % O d. 14.04 %

Foundations of Business - Standalone book (MindTap Course List)

4th Edition

ISBN:9781285193946

Author:William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:William M. Pride, Robert J. Hughes, Jack R. Kapoor

Chapter15: Using Management And Accounting Information

Section: Chapter Questions

Problem 4DQ

Related questions

Question

100%

Please solve it

Transcribed Image Text:Macdonald has found that its common equity capital shares have a beta equal to 1.5 while the risk-free return

is 8 percent and the expected return on the market is 14 percent. Its cost of debt financing is 12 percent. If the

firm is financed with OMR 120,000,000 of common shares (market value) and OMR 80,000,000 of debt, then

what is the after-tax weighted average cost of capital for Macdonald if it is subject to a 35 percent marginal tax

rate?

Select one:

O a. None of these

Ob. 13.32 %

O c. 12.25 %

O d. 14.04 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, operations-management and related others by exploring similar questions and additional content below.Recommended textbooks for you

Foundations of Business - Standalone book (MindTa…

Marketing

ISBN:

9781285193946

Author:

William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:

Cengage Learning

Foundations of Business (MindTap Course List)

Marketing

ISBN:

9781337386920

Author:

William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:

Cengage Learning

Foundations of Business - Standalone book (MindTa…

Marketing

ISBN:

9781285193946

Author:

William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:

Cengage Learning

Foundations of Business (MindTap Course List)

Marketing

ISBN:

9781337386920

Author:

William M. Pride, Robert J. Hughes, Jack R. Kapoor

Publisher:

Cengage Learning