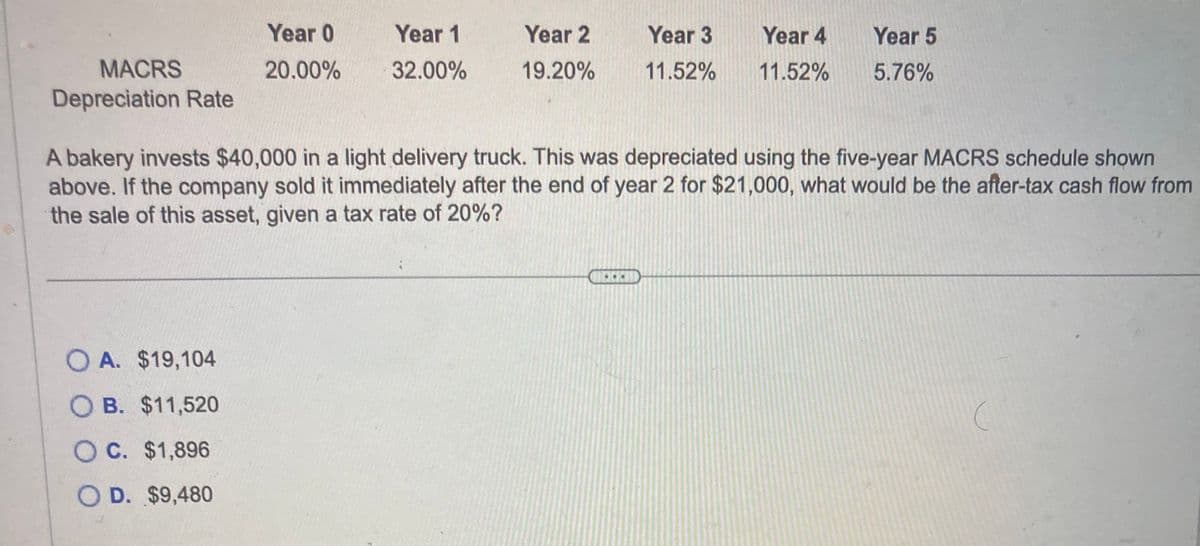

MACRS Depreciation Rate Year 0 20.00% A. $19,104 B. $11,520 OC. $1,896 D. $9,480 Year 1 32.00% Year 2 19.20% Year 3 11.52% RIEND Year 4 11.52% A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 20%? Year 5 5.76%

MACRS Depreciation Rate Year 0 20.00% A. $19,104 B. $11,520 OC. $1,896 D. $9,480 Year 1 32.00% Year 2 19.20% Year 3 11.52% RIEND Year 4 11.52% A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 20%? Year 5 5.76%

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

ChapterA: Methods Of Depreciation

Section: Chapter Questions

Problem 4P: Use the information in Problem A-1 to solve this problem. Assume that the van is five-year property...

Related questions

Question

Transcribed Image Text:MACRS

Depreciation Rate

Year 0

20.00%

OA. $19,104

OB. $11,520

OC. $1,896

OD. $9,480

Year 1

32.00%

Year 2

19.20%

Year 3

Year 4

11.52% 11.52%

Year 5

5.76%

A bakery invests $40,000 in a light delivery truck. This was depreciated using the five-year MACRS schedule shown

above. If the company sold it immediately after the end of year 2 for $21,000, what would be the after-tax cash flow from

the sale of this asset, given a tax rate of 20%?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning