Madison Company issued an interest-bearing note payable with a face amount of $25,800 and a stated interest rate of 8s to the Metropolitan Bark on August 1, Year 1. The note carried a one year term. Based on this information alone, the amount of total liablities appearing on Madisoris Year 1 balance sheet would be Select one O A $25,800 OB $27864 OC $26,660 OD $27,004 Denver Co. issued bonds with a face value of $79,000 and a stated interest rate of 7% The bonds have a life of five years and were sold at 103.50. If Denver amortizes discounts and premiums using the straight ine method, the amount of interest expense each full year would be Select one O A S6083. OB. $5530. OC S4977. OD $5724. Victor Company issued bonds with a $400,000 face value and a 3% stated rate of interest on January 1, Year 1. The bonds carried a Syear term and sold for 93. Victor uses the straight-line method of amortization. Interest is payable on December 31 of each year. The carrying value of the bond liability on the December 31, Year 3 balance sheet was: Select one OA $383,200. OB $388,800. OC $377,600. OD $394,400.

Madison Company issued an interest-bearing note payable with a face amount of $25,800 and a stated interest rate of 8s to the Metropolitan Bark on August 1, Year 1. The note carried a one year term. Based on this information alone, the amount of total liablities appearing on Madisoris Year 1 balance sheet would be Select one O A $25,800 OB $27864 OC $26,660 OD $27,004 Denver Co. issued bonds with a face value of $79,000 and a stated interest rate of 7% The bonds have a life of five years and were sold at 103.50. If Denver amortizes discounts and premiums using the straight ine method, the amount of interest expense each full year would be Select one O A S6083. OB. $5530. OC S4977. OD $5724. Victor Company issued bonds with a $400,000 face value and a 3% stated rate of interest on January 1, Year 1. The bonds carried a Syear term and sold for 93. Victor uses the straight-line method of amortization. Interest is payable on December 31 of each year. The carrying value of the bond liability on the December 31, Year 3 balance sheet was: Select one OA $383,200. OB $388,800. OC $377,600. OD $394,400.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

ChapterMB: Model-building Problems

Section: Chapter Questions

Problem 13M

Related questions

Question

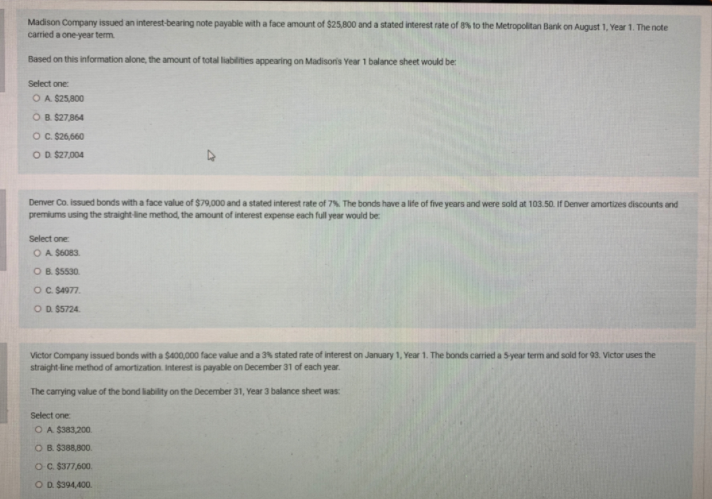

Transcribed Image Text:Madison Company issued an interest-bearing note payable with a face amount of $25,800 and a stated interest rate of 8s to the Metropolitan Bark on August 1, Year 1. The note

carried a one year term.

Based on this information alone, the amount of total liablities appearing on Madisoris Year 1 balance sheet would be

Select one

O A $25,800

OB $27864

OC $26,660

OD $27,004

Denver Co. issued bonds with a face value of $79,000 and a stated interest rate of 7% The bonds have a life of five years and were sold at 103.50. If Denver amortizes discounts and

premiums using the straight ine method, the amount of interest expense each full year would be

Select one

O A S6083.

OB. $5530.

OC S4977.

OD $5724.

Victor Company issued bonds with a $400,000 face value and a 3% stated rate of interest on January 1, Year 1. The bonds carried a Syear term and sold for 93. Victor uses the

straight-line method of amortization. Interest is payable on December 31 of each year.

The carrying value of the bond liability on the December 31, Year 3 balance sheet was:

Select one

OA $383,200.

OB $388,800.

OC $377,600.

OD $394,400.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning