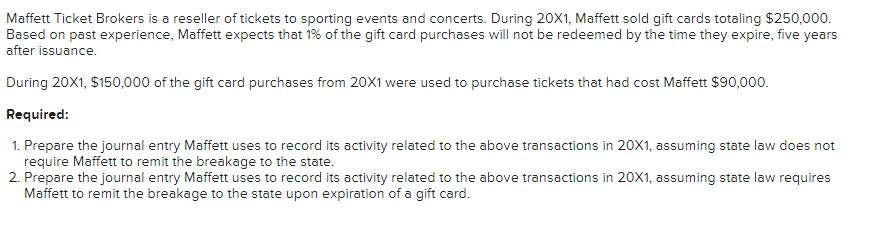

Maffett Ticket Brokers is a reseller of tickets to sporting events and concerts. During 20X1, Maffett sold gift cards totaling $250,000. Based on past experience, Maffett expects that 1% of the gift card purchases will not be redeemed by the time they expire, five years after issuance. During 20X1, $150,000 of the gift card purchases from 20X1 were used to purchase tickets that had cost Maffett $90,000. Required: 1. Prepare the journal entry Maffett uses to record its activity related to the above transactions in 20X1, assuming state law does not require Maffett to remit the breakage to the state. 2. Prepare the journal entry Maffett uses to record its activity related to the above transactions in 20X1, assuming state law requires Maffett to remit the breakage to the state upon expiration of a gift card.

Maffett Ticket Brokers is a reseller of tickets to sporting events and concerts. During 20X1, Maffett sold gift cards totaling $250,000. Based on past experience, Maffett expects that 1% of the gift card purchases will not be redeemed by the time they expire, five years after issuance. During 20X1, $150,000 of the gift card purchases from 20X1 were used to purchase tickets that had cost Maffett $90,000. Required: 1. Prepare the journal entry Maffett uses to record its activity related to the above transactions in 20X1, assuming state law does not require Maffett to remit the breakage to the state. 2. Prepare the journal entry Maffett uses to record its activity related to the above transactions in 20X1, assuming state law requires Maffett to remit the breakage to the state upon expiration of a gift card.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter21: Supply Chains And Working Capital Management

Section: Chapter Questions

Problem 6P

Related questions

Topic Video

Question

Transcribed Image Text:Maffett Ticket Brokers is a reseller of tickets to sporting events and concerts. During 20X1, Maffett sold gift cards totaling $250,000.

Based on past experience, Maffett expects that 1% of the gift card purchases will not be redeemed by the time they expire, five years

after issuance.

During 20X1, $150,000 of the gift card purchases from 20X1 were used to purchase tickets that had cost Maffett $90,000.

Required:

1. Prepare the journal entry Maffett uses to record its activity related to the above transactions in 20X1, assuming state law does not

require Maffett to remit the breakage to the state.

2. Prepare the journal entry Maffett uses to record its activity related to the above transactions in 20X1, assuming state law requires

Maffett to remit the breakage to the state upon expiration of a gift card.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College