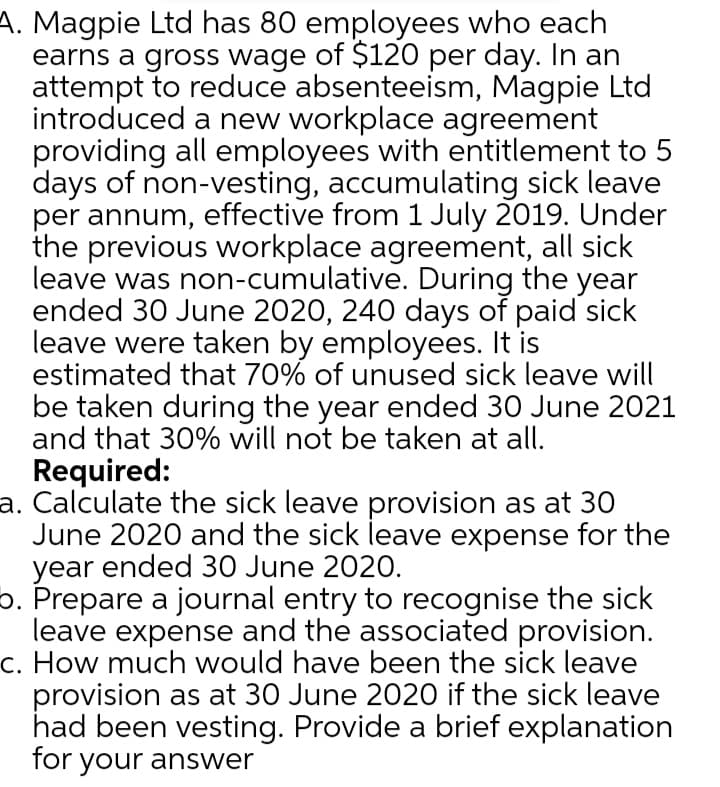

Magpie Ltd has 80 employees who each earns a gross wage of $120 per day. In an attempt to reduce absenteeism, Magpie Ltd introduced a new workplace agreement providing all employees with entitlement to 5 days of non-vesting, accumulating sick leave per annum, effective from 1 July 2019. Under the previous workplace agreement, all sick leave was non-cumulative. During the year ended 30 June 2020, 240 days of paid sick leave were taken by employees. It is estimated that 70% of unused sick leave will be taken during the year ended 30 June 2021 and that 30% will not be taken at all. Required: Calculate the sick leave provision as at 30 June 2020 and the sick leave expense for the year ended 30 June 2020. Prepare a journal entry to recognise the sick leave expense and the associated provision. How much would have been the sick leave provision as at 30 June 2020 if the sick leave had been vesting. Provide a brief explanation for your answer

Magpie Ltd has 80 employees who each earns a gross wage of $120 per day. In an attempt to reduce absenteeism, Magpie Ltd introduced a new workplace agreement providing all employees with entitlement to 5 days of non-vesting, accumulating sick leave per annum, effective from 1 July 2019. Under the previous workplace agreement, all sick leave was non-cumulative. During the year ended 30 June 2020, 240 days of paid sick leave were taken by employees. It is estimated that 70% of unused sick leave will be taken during the year ended 30 June 2021 and that 30% will not be taken at all. Required: Calculate the sick leave provision as at 30 June 2020 and the sick leave expense for the year ended 30 June 2020. Prepare a journal entry to recognise the sick leave expense and the associated provision. How much would have been the sick leave provision as at 30 June 2020 if the sick leave had been vesting. Provide a brief explanation for your answer

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter9: Current Liabilities And Contingent Obligations

Section: Chapter Questions

Problem 6MC

Related questions

Question

Transcribed Image Text:A. Magpie Ltd has 80 employees who each

earns a gross wage of $120 per day. In an

attempt to reduce absenteeism, Magpie Ltd

introduced a new workplace agreement

providing all employees with entitlement to 5

days of non-vesting, accumulating sick leave

per annum, effective from 1 July 2019. Under

the previous workplace agreement, all sick

leave was non-cumulative. During the year

ended 30 June 2020, 240 days of paid sick

leave were taken by employees. It is

estimated that 70% of unused sick leave will

be taken during the year ended 30 June 2021

and that 30% will not be taken at all.

Required:

a. Calculate the sick leave provision as at 30

June 2020 and the sick leave expense for the

year ended 30 June 2020.

o. Prepare a journal entry to recognise the sick

leave expense and the associated provision.

c. How much would have been the sick leave

provision as at 30 June 2020 if the sick leave

had been vesting. Provide a brief explanation

for your answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT