Make a Proforma Income Statement and ProForma Balance Sheet. Use 15% as the Sales Growth Rate, all other data remain the same.

Make a Proforma Income Statement and ProForma Balance Sheet. Use 15% as the Sales Growth Rate, all other data remain the same.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 19SP

Related questions

Question

Make a Proforma Income Statement and ProForma

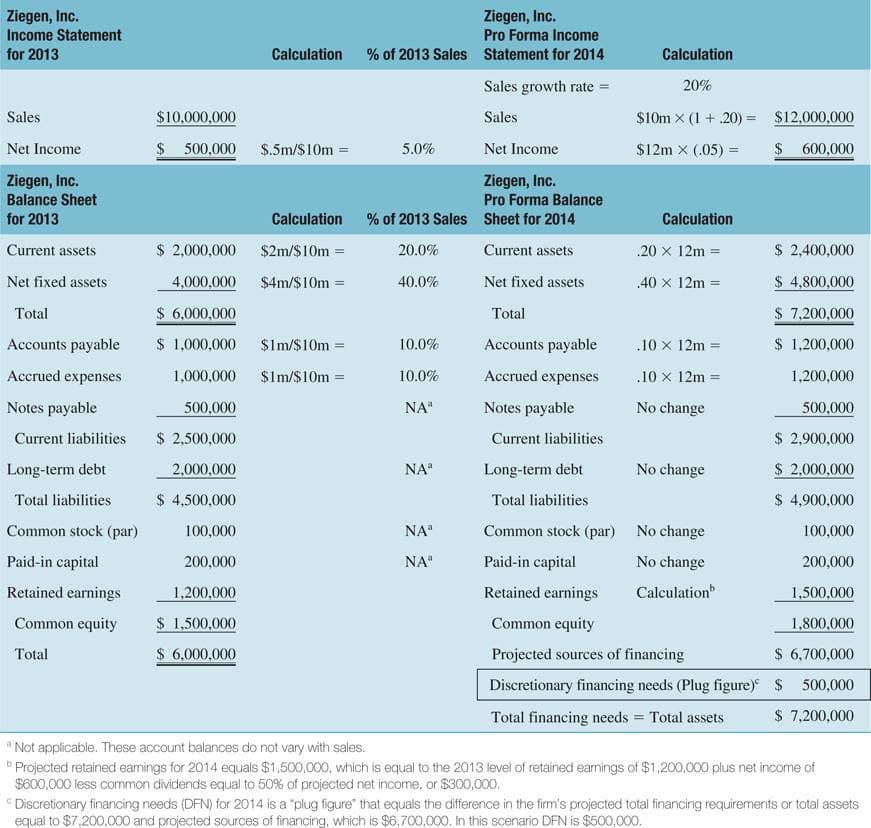

Transcribed Image Text:Ziegen, Inc.

Income Statement

for 2013

Sales

Net Income

Ziegen, Inc.

Balance Sheet

for 2013

Current assets

Net fixed assets

Total

Accounts payable

Accrued expenses

Notes payable

Current liabilities

Long-term debt

Total liabilities

Common stock (par)

Paid-in capital

Retained earnings

Common equity

Total

$10,000,000

$ 500,000

$ 2,000,000

4,000,000

$6,000,000

$ 1,000,000

1,000,000

500,000

$ 2,500,000

2,000,000

$ 4,500,000

100,000

200,000

1,200,000

$1,500,000

$ 6,000,000

Calculation

$.5m/$10m =

Calculation

$2m/$10m =

$4m/$10m =

$1m/$10m =

$1m/$10m =

Ziegen, Inc.

Pro Forma Income

% of 2013 Sales Statement for 2014

5.0%

% of 2013 Sales

20.0%

40.0%

10.0%

10.0%

NAⓇ

NAⓇ

ΝΑ"

NA"

Calculation

20%

Sales growth rate =

Sales

Net Income

Ziegen, Inc.

Pro Forma Balance

Sheet for 2014

Current assets

Net fixed assets

Total

Accounts payable

Accrued expenses

Notes payable

Current liabilities

Long-term debt

Total liabilities

Common stock (par)

Paid-in capital

Retained earnings

Common equity

Projected sources of financing

Discretionary financing needs (Plug figure)

Total financing needs = Total assets

$10m X (1+20) = $12,000,000

$12m X (.05) =

$ 600,000

Calculation

.20 x 12m =

.40 x 12m =

.10 × 12m =

.10 x 12m =

No change

No change

No change

No change

Calculation

$ 2,400,000

$ 4,800,000

$ 7,200,000

$ 1,200,000

1,200,000

500,000

$ 2,900,000

$ 2,000,000

$ 4,900,000

100,000

200,000

1,500,000

1,800,000

$ 6,700,000

$ 500,000

$ 7,200,000

"Not applicable. These account balances do not vary with sales.

Projected retained earnings for 2014 equals $1,500,000, which is equal to the 2013 level of retained earnings of $1,200,000 plus net income of

$600,000 less common dividends equal to 50% of projected net income, or $300,000.

Discretionary financing needs (DFN) for 2014 is a "plug figure that equals the difference in the firm's projected total financing requirements or total assets

equal to $7,200,000 and projected sources of financing, which is $6,700,000. In this scenario DFN is $500,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning