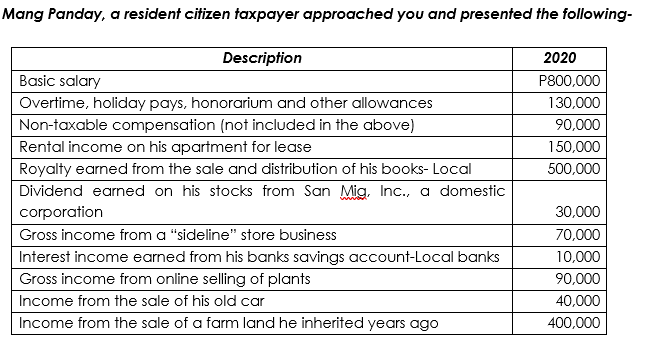

Mang Panday wants to determine the taxability of the foregoing. How much is the total amount of passive income which is subject to final tax?

Mang Panday wants to determine the taxability of the foregoing. How much is the total amount of passive income which is subject to final tax?

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 62P

Related questions

Question

Mang Panday wants to determine the taxability of the foregoing. How much is the total amount of passive income which is subject to final tax?

A. P690,000

B. P540,000

C. P530,000

D. P500,000

Transcribed Image Text:Mang Panday, a resident citizen taxpayer approached you and presented the following-

Description

2020

Basic salary

P800,000

Overtime, holiday pays, honorarium and other allowances

130,000

Non-taxable compensation (not included in the above)

90,000

Rental income on his apartment for lease

150,000

Royalty earned from the sale and distribution of his books- Local

500,000

Dividend earned on his stocks from San Mig, Inc., a domestic

corporation

30,000

Gross income from a "sideline" store business

70,000

Interest income earned from his banks savings account-Local banks

Gross income from online selling of plants

10,000

90,000

Income from the sale of his old car

40,000

Income from the sale of a farm land he inherited years ago

400,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT