Many persons prepare for retirement by making monthly contributions to a savings program. Suppose that $2,400 is set aside each year and invested in a savings account that pays 8% interest per year, compounded continuously. a. Determine the accumulated savings in this account at the end of 28 years. b. In Part (a), suppose that an annuity will be withdrawn from savings that have been accumulated at the EOY 28. The annuity will extend from the EOY 29 to the EOY 37. What is the value of this annuity if the interest rate and compounding frequency in Part (a) do not change? E Click the icon to view the interest and annuity table for continuous compounding when i = 8% per year. a. The accumulated savings amount t the end of 28 years will be S 241915. (Round to the nearest dollar.) b. The value of the annuity will be S. (Round to the nearest dollar.)

Many persons prepare for retirement by making monthly contributions to a savings program. Suppose that $2,400 is set aside each year and invested in a savings account that pays 8% interest per year, compounded continuously. a. Determine the accumulated savings in this account at the end of 28 years. b. In Part (a), suppose that an annuity will be withdrawn from savings that have been accumulated at the EOY 28. The annuity will extend from the EOY 29 to the EOY 37. What is the value of this annuity if the interest rate and compounding frequency in Part (a) do not change? E Click the icon to view the interest and annuity table for continuous compounding when i = 8% per year. a. The accumulated savings amount t the end of 28 years will be S 241915. (Round to the nearest dollar.) b. The value of the annuity will be S. (Round to the nearest dollar.)

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 3PB: Use the tables in Appendix B to answer the following questions. A. If you would like to accumulate...

Related questions

Question

Just Part B

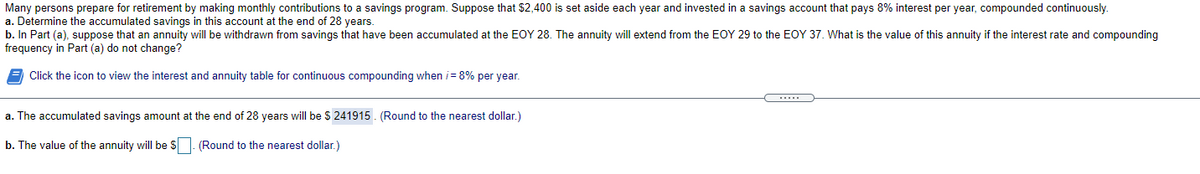

Transcribed Image Text:Many persons prepare for retirement by making monthly contributions to a savings program. Suppose that $2,400 is set aside each year and invested in a savings account that pays 8% interest per year, compounded continuously.

a. Determine the accumulated savings in this account at the end of 28 years.

b. In Part (a), suppose that an annuity will be withdrawn from savings that have been accumulated at the EOY 28. The annuity will extend from the EOY 29 to the EOY 37. What is the value of this annuity if the interest rate and compounding

frequency in Part (a) do not change?

Click the icon to view the interest and annuity table for continuous compounding when i= 8% per year.

.....

a. The accumulated savings amount at the end of 28 years will be $ 241915. (Round to the nearest dollar.)

b. The value of the annuity will be S. (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning