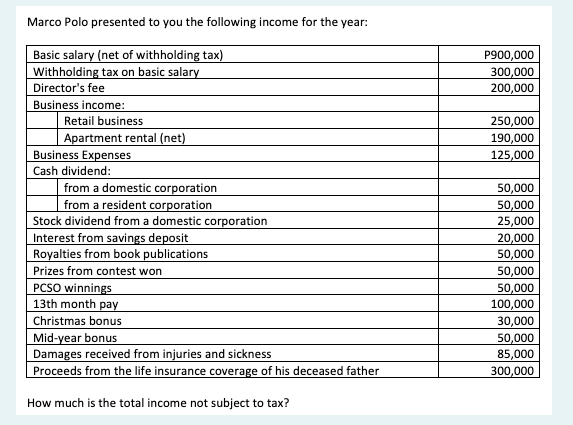

Marco Polo, How much is the total income not subject to tax?

Chapter28: Income Taxati On Of Trusts And Estates

Section: Chapter Questions

Problem 12CE

Related questions

Question

Marco Polo, How much is the total income not subject to tax?

Transcribed Image Text:Marco Polo presented to you the following income for the year:

Basic salary (net of withholding tax)

Withholding tax on basic salary

Director's fee

P900,000

300,000

200,000

Business income:

Retail business

250,000

Apartment rental (net)

Business Expenses

190,000

125,000

Cash dividend:

from a domestic corporation

from a resident corporation

Stock dividend from a domestic corporation

Interest from savings deposit

Royalties from book publications

Prizes from contest won

PCSO winnings

13th month pay

Christmas bonus

Mid-year bonus

Damages received from injuries and sickness

50,000

50,000

25,000

20,000

50,000

50,000

50,000

100,000

30,000

50,000

85,000

Proceeds from the life insurance coverage of his deceased father

300,000

How much is the total income not subject to tax?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT