Margoles Publishing recently completed its IPO. The stock was offered at $14.00 per share. On the first day of trading, the stock closed at $19.00 per share. a. What was the initial return on Margoles? b. Who benefited from this underpricing? Who lost, and why? a. What was the initial return on Margoles? The initial return was 1%. (Round to one decimal place.) b. Who benefited from this underpricing? (Select the best choice below.) OA. Owners of other shares outstanding (not part of the IPO) and underwriters. O B. The company and underwriters. O C. Investors who bought shares at the IPO price of $14.00/share and investment banks (indirectly from future business) O D. The company and owners of other shares outstanding (not part of the IPO). Who lost? (Select the best choice below.) 0 A. Owners of other shares outstanding (part of the IPO) O B. Owners of other shares outstanding (not part of the IPO) O C. Both of the above. 0 D. Investors who bought shares at the IPO price of $14.00/share and investment banks (indirectly from future business)

Margoles Publishing recently completed its IPO. The stock was offered at $14.00 per share. On the first day of trading, the stock closed at $19.00 per share. a. What was the initial return on Margoles? b. Who benefited from this underpricing? Who lost, and why? a. What was the initial return on Margoles? The initial return was 1%. (Round to one decimal place.) b. Who benefited from this underpricing? (Select the best choice below.) OA. Owners of other shares outstanding (not part of the IPO) and underwriters. O B. The company and underwriters. O C. Investors who bought shares at the IPO price of $14.00/share and investment banks (indirectly from future business) O D. The company and owners of other shares outstanding (not part of the IPO). Who lost? (Select the best choice below.) 0 A. Owners of other shares outstanding (part of the IPO) O B. Owners of other shares outstanding (not part of the IPO) O C. Both of the above. 0 D. Investors who bought shares at the IPO price of $14.00/share and investment banks (indirectly from future business)

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter12: Investing In Stocks And Bonds

Section: Chapter Questions

Problem 4FPE: The Castle Company recently reported net profits after taxes of $15.8 million. It has 2.5 million...

Related questions

Question

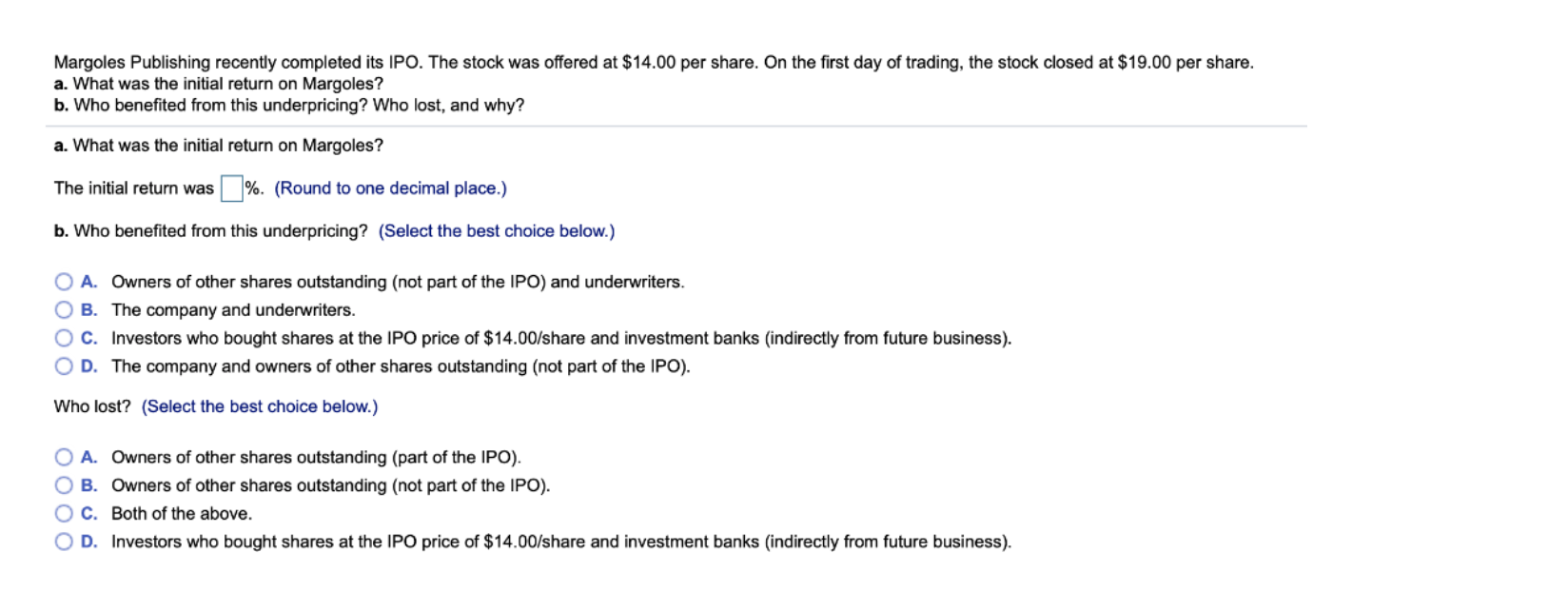

Transcribed Image Text:Margoles Publishing recently completed its IPO. The stock was offered at $14.00 per share. On the first day of trading, the stock closed at $19.00 per share.

a. What was the initial return on Margoles?

b. Who benefited from this underpricing? Who lost, and why?

a. What was the initial return on Margoles?

The initial return was 1%. (Round to one decimal place.)

b. Who benefited from this underpricing? (Select the best choice below.)

OA. Owners of other shares outstanding (not part of the IPO) and underwriters.

O B. The company and underwriters.

O C. Investors who bought shares at the IPO price of $14.00/share and investment banks (indirectly from future business)

O D. The company and owners of other shares outstanding (not part of the IPO).

Who lost? (Select the best choice below.)

0 A. Owners of other shares outstanding (part of the IPO)

O B. Owners of other shares outstanding (not part of the IPO)

O C. Both of the above.

0 D. Investors who bought shares at the IPO price of $14.00/share and investment banks (indirectly from future business)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning