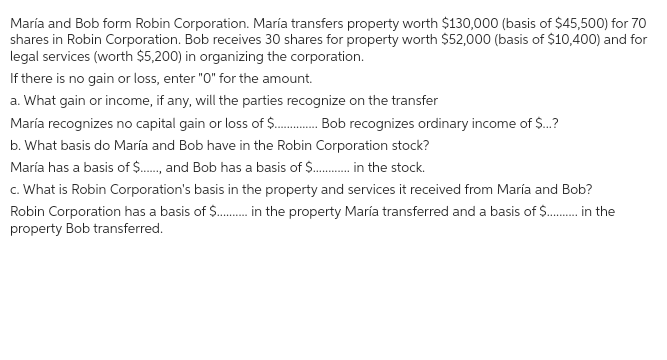

María and Bob form Robin Corporation. María transfers property worth $130,000 (basis of $45,500) for 70 shares in Robin Corporation. Bob receives 30 shares for property worth $52,000 (basis of $10,400) and for legal services (worth $5,200) in organizing the corporation. If there is no gain or loss, enter "O" for the amount. a. What gain or income, if any, will the parties recognize on the transfer María recognizes no capital gain or loss of $.............. Bob recognizes ordinary income of $...? b. What basis do María and Bob have in the Robin Corporation stock? María has a basis of $......., and Bob has a basis of $........... in the stock. c. What is Robin Corporation's basis in the property and services it received from María and Bob? Robin Corporation has a basis of $...........in the property María transferred and a basis of $......... in the property Bob transferred.

María and Bob form Robin Corporation. María transfers property worth $130,000 (basis of $45,500) for 70 shares in Robin Corporation. Bob receives 30 shares for property worth $52,000 (basis of $10,400) and for legal services (worth $5,200) in organizing the corporation. If there is no gain or loss, enter "O" for the amount. a. What gain or income, if any, will the parties recognize on the transfer María recognizes no capital gain or loss of $.............. Bob recognizes ordinary income of $...? b. What basis do María and Bob have in the Robin Corporation stock? María has a basis of $......., and Bob has a basis of $........... in the stock. c. What is Robin Corporation's basis in the property and services it received from María and Bob? Robin Corporation has a basis of $...........in the property María transferred and a basis of $......... in the property Bob transferred.

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 31P

Related questions

Question

Transcribed Image Text:María and Bob form Robin Corporation. María transfers property worth $130,000 (basis of $45,500) for 70

shares in Robin Corporation. Bob receives 30 shares for property worth $52,000 (basis of $10,400) and for

legal services (worth $5,200) in organizing the corporation.

If there is no gain or loss, enter "O" for the amount.

a. What gain or income, if any, will the parties recognize on the transfer

María recognizes no capital gain or loss of $............. Bob. recognizes ordinary income of $...?

b. What basis do María and Bob have in the Robin Corporation stock?

María has a basis of $....., and Bob has a basis of $..............the stock.

c. What is Robin Corporation's basis in the property and services it received from María and Bob?

Robin Corporation has a basis of $............ the property María transferred and a basis of $........ in the

property Bob transferred.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you