Maria Lowell inves

Chapter7: Losses—deductions And Limitations

Section: Chapter Questions

Problem 56P

Related questions

Question

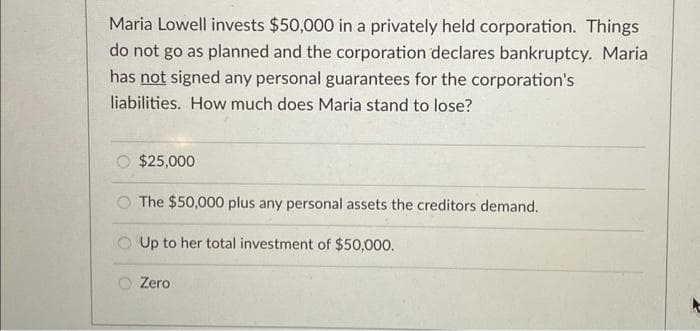

Transcribed Image Text:Maria Lowell invests $50,000 in a privately held corporation. Things

do not go as planned and the corporation declares bankruptcy. Maria

has not signed any personal guarantees for the corporation's

liabilities. How much does Maria stand to lose?

$25,000

The $50,000 plus any personal assets the creditors demand.

Up to her total investment of $50,000.

Zero

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT