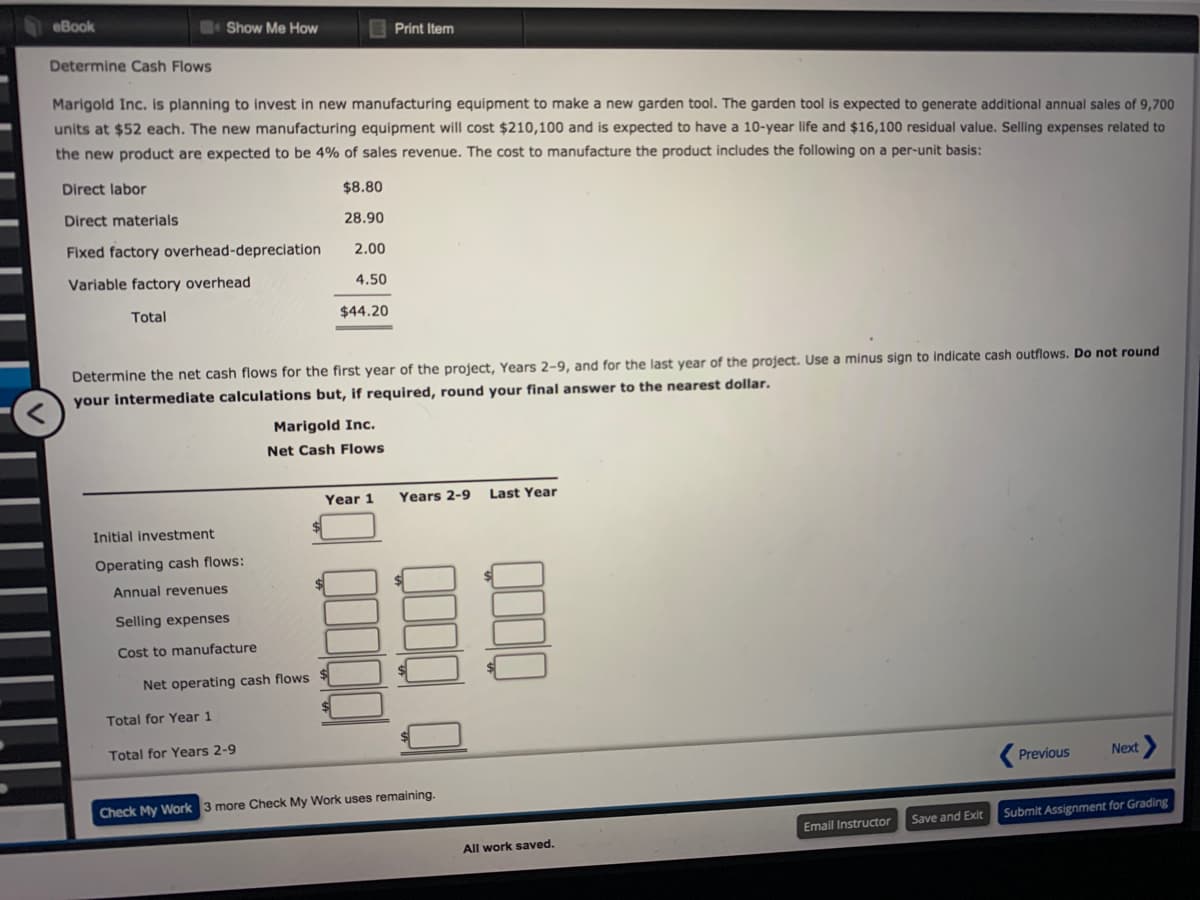

Marigold Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The garden tool is expected to generate additional annual sales of 9,700 units at $52 each. The new manufacturing equipment will cost $210,100 and is expected to have a 10-year life and $16,100 residual value. Selling expenses related to the new product are expected to be 4% of sales revenue. The cost to manufacture the product includes the following on a per-unit basis: Direct labor $8.80 Direct materials 28.90 Fixed factory overhead-depreciation 2.00 Variable factory overhead 4.50 Total $44.20 Determine the net cash flows for the first year of the project, Years 2-9, and for the last year of the project. Use a minus sign to indicate cash outflows. Do not round your intermediate calculations but, if required, round your final answer to the nearest dollar. Marigold Inc. Net Cash Flows Year 1 Years 2-9 Last Year Initial investment Operating cash flows: Annual revenues Selling expenses Cost to manufacture Net operating cash flows Total for Year 1 Total for Years 2-9 Previous Next

Marigold Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The garden tool is expected to generate additional annual sales of 9,700 units at $52 each. The new manufacturing equipment will cost $210,100 and is expected to have a 10-year life and $16,100 residual value. Selling expenses related to the new product are expected to be 4% of sales revenue. The cost to manufacture the product includes the following on a per-unit basis: Direct labor $8.80 Direct materials 28.90 Fixed factory overhead-depreciation 2.00 Variable factory overhead 4.50 Total $44.20 Determine the net cash flows for the first year of the project, Years 2-9, and for the last year of the project. Use a minus sign to indicate cash outflows. Do not round your intermediate calculations but, if required, round your final answer to the nearest dollar. Marigold Inc. Net Cash Flows Year 1 Years 2-9 Last Year Initial investment Operating cash flows: Annual revenues Selling expenses Cost to manufacture Net operating cash flows Total for Year 1 Total for Years 2-9 Previous Next

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 4E: Determine cash flows Natural Foods Inc. is planning to invest in new manufacturing equipment to make...

Related questions

Question

Transcribed Image Text:eBook

Show Me How

Print Item

Determine Cash Flows

Marigold Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The garden tool is expected to generate additional annual sales of 9,700

units at $52 each. The new manufacturing equipment will cost $210,100 and is expected to have a 10-year life and $16,100 residual value. Selling expenses related to

the new product are expected to be 4% of sales revenue. The cost to manufacture the product includes the following on a per-unit basis:

Direct labor

$8.80

Direct materials

28.90

Fixed factory overhead-depreciation

2.00

Variable factory overhead

4.50

Total

$44.20

Determine the net cash flows for the first year of the project, Years 2-9, and for the last year of the project. Use a minus sign to indicate cash outflows. Do not round

your intermediate calculations but, if required, round your final answer to the nearest dollar.

Marigold Inc.

Net Cash Flows

Year 1

Years 2-9

Last Year

Initial investment

Operating cash flows:

Annual revenues

Selling expenses

Cost to manufacture

Net operating cash flows

Total for Year 1

Total for Years 2-9

Previous

Next

Check My Work 3 more Check My Work uses remaining.

Save and Exit

Submit Assignment for Grading

Email Instructor

All work saved.

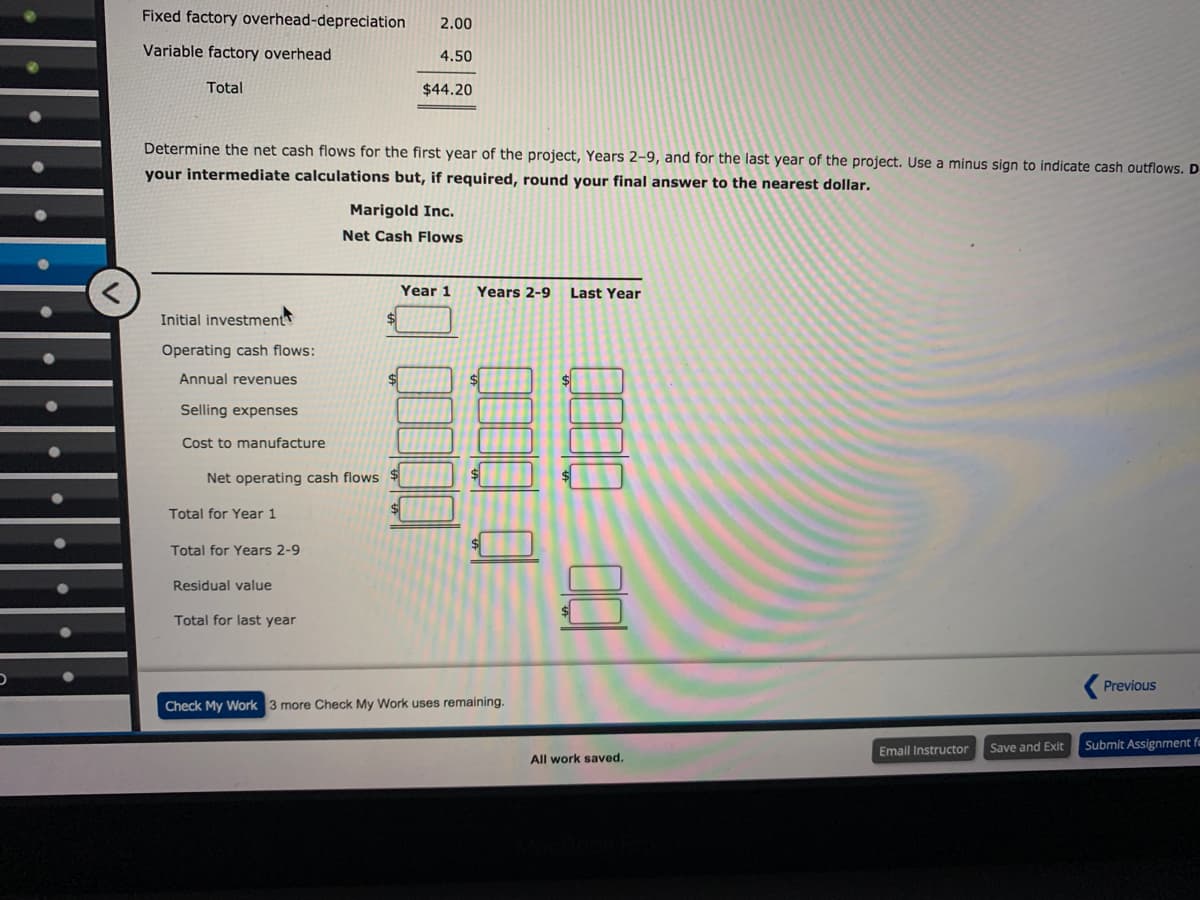

Transcribed Image Text:Fixed factory overhead-depreciation

2.00

Variable factory overhead

4.50

Total

$44.20

Determine the net cash flows for the first year of the project, Years 2-9, and for the last year of the project. Use a minus sign to indicate cash outflows. D

your intermediate calculations but, if required, round your final answer to the nearest dollar.

Marigold Inc.

Net Cash Flows

Year 1

Years 2-9

Last Year

Initial investment

Operating cash flows:

Annual revenues

Selling expenses

Cost to manufacture

Net operating cash flows

Total for Year 1

Total for Years 2-9

Residual value

Total for last year

Previous

Check My Work 3 more Check My Work uses remaining.

Save and Exit

Submit Assignment fe

Email Instructor

All work saved.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning