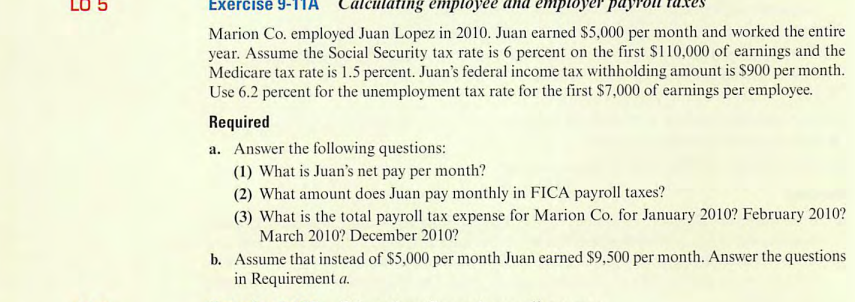

Marion Co. employed Juan Lopez in 2010. Juan earned $5,000 per month and worked the entire- year. Assume the Social Security tax rate is 6 percent on the first $110,000 of earnings and the Medicare tax rate is 1.5 percent. Juan's federal income tax withholding amount is $900 per month. Use 6.2 percent for the unemployment tax rate for the first $7,000 of earnings per employee. Required a. Answer the following questions: (1) What is Juan's net pay per month? (2) What amount does Juan pay monthly in FICA payroll taxes? (3) What is the total payroll tax expense for Marion Co. for January 2010? February 2010? March 2010? December 2010?

Marion Co. employed Juan Lopez in 2010. Juan earned $5,000 per month and worked the entire- year. Assume the Social Security tax rate is 6 percent on the first $110,000 of earnings and the Medicare tax rate is 1.5 percent. Juan's federal income tax withholding amount is $900 per month. Use 6.2 percent for the unemployment tax rate for the first $7,000 of earnings per employee. Required a. Answer the following questions: (1) What is Juan's net pay per month? (2) What amount does Juan pay monthly in FICA payroll taxes? (3) What is the total payroll tax expense for Marion Co. for January 2010? February 2010? March 2010? December 2010?

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 12EB: Reference Figure 12.15 and use the following information to complete the requirements. A. Determine...

Related questions

Question

Transcribed Image Text:Exercise 9-

culating employee

Marion Co. employed Juan Lopez in 2010. Juan earned $5,000 per month and worked the entire

year. Assume the Social Security tax rate is 6 percent on the first $110,000 of earnings and the

Medicare tax rate is 1.5 percent. Juan's federal income tax withholding amount is $900 per month.

Use 6.2 percent for the unemployment tax rate for the first $7,000 of earnings per employee.

Required

a. Answer the following questions:

(1) What is Juan's net pay per month?

(2) What amount does Juan pay monthly in FICA payroll taxes?

(3) What is the total payroll tax expense for Marion Co. for January 2010? February 2010?

March 2010? December 2010?

b. Assume that instead of $5,000 per month Juan earned $9,500 per month. Answer the questions

in Requirement a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning