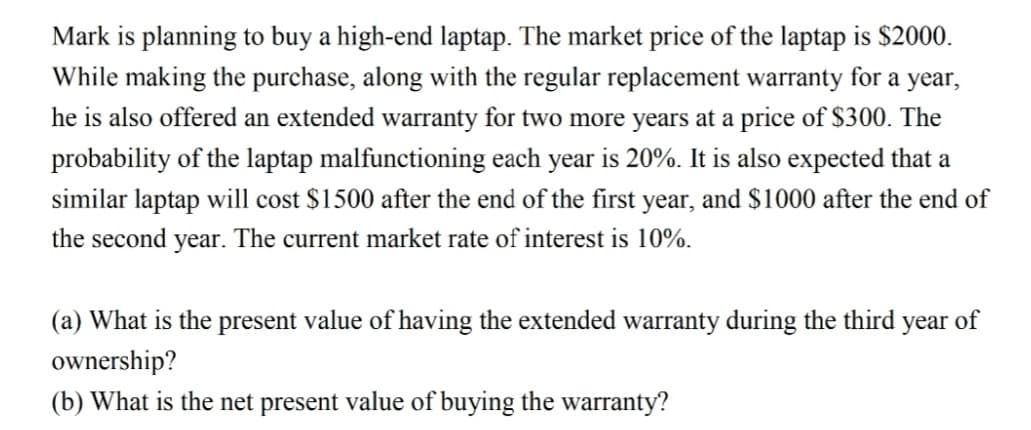

Mark is planning to buy a high-end laptap. The market price of the laptap is $2000. While making the purchase, along with the regular replacement warranty for a year, he is also offered an extended warranty for two more years at a price of $300. The probability of the laptap malfunctioning each year is 20%. It is also expected that a similar laptap will cost $1500 after the end of the first year, and $1000 after the end of the second year. The current market rate of interest is 10%. (a) What is the present value of having the extended warranty during the third year of ownership? (b) What is the net present value of buying the warranty?

Mark is planning to buy a high-end laptap. The market price of the laptap is $2000. While making the purchase, along with the regular replacement warranty for a year, he is also offered an extended warranty for two more years at a price of $300. The probability of the laptap malfunctioning each year is 20%. It is also expected that a similar laptap will cost $1500 after the end of the first year, and $1000 after the end of the second year. The current market rate of interest is 10%. (a) What is the present value of having the extended warranty during the third year of ownership? (b) What is the net present value of buying the warranty?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter22: Providing And Obtaining Credit

Section: Chapter Questions

Problem 3P: Del Hawley, owner of Hawleys Hardware, is negotiating with First City Bank for a 1-year loan of...

Related questions

Question

Transcribed Image Text:Mark is planning to buy a high-end laptap. The market price of the laptap is $2000.

While making the purchase, along with the regular replacement warranty for a year,

he is also offered an extended warranty for two more years at a price of $300. The

probability of the laptap malfunctioning each year is 20%. It is also expected that a

similar laptap will cost $1500 after the end of the first year, and $1000 after the end of

the second year. The current market rate of interest is 10%.

(a) What is the present value of having the extended warranty during the third year of

ownership?

(b) What is the net present value of buying the warranty?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT