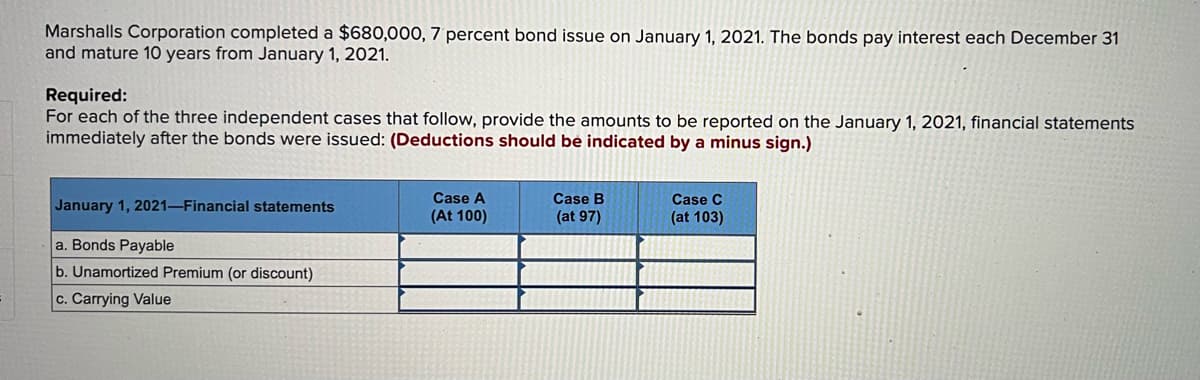

Marshalls Corporation completed a $680,000, 7 percent bond issue on January 1, 2021. The bonds pay interest each December 31 and mature 10 years from January 1, 2021. Required: For each of the three independent cases that follow, provide the amounts to be reported on the January 1, 2021, financial statements immediately after the bonds were issued: (Deductions should be indicated by a minus sign.) Case A (At 100) Case B Case C January 1, 2021-Financial statements (at 97) (at 103) a. Bonds Payable b. Unamortized Premium (or discount) c. Carrying Value

Marshalls Corporation completed a $680,000, 7 percent bond issue on January 1, 2021. The bonds pay interest each December 31 and mature 10 years from January 1, 2021. Required: For each of the three independent cases that follow, provide the amounts to be reported on the January 1, 2021, financial statements immediately after the bonds were issued: (Deductions should be indicated by a minus sign.) Case A (At 100) Case B Case C January 1, 2021-Financial statements (at 97) (at 103) a. Bonds Payable b. Unamortized Premium (or discount) c. Carrying Value

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 8RE

Related questions

Question

100%

Transcribed Image Text:Marshalls Corporation completed a $680,000, 7 percent bond issue on January 1, 2021. The bonds pay interest each December 31

and mature 10 years from January 1, 2021.

Required:

For each of the three independent cases that follow, provide the amounts to be reported on the January 1, 2021, financial statements

immediately after the bonds were issued: (Deductions should bé indicated by a minus sign.)

Case A

Case B

Case C

January 1, 2021-Financial statements

(At 100)

(at 97)

(at 103)

a. Bonds Payable

b. Unamortized Premium (or discount)

c. Carrying Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning