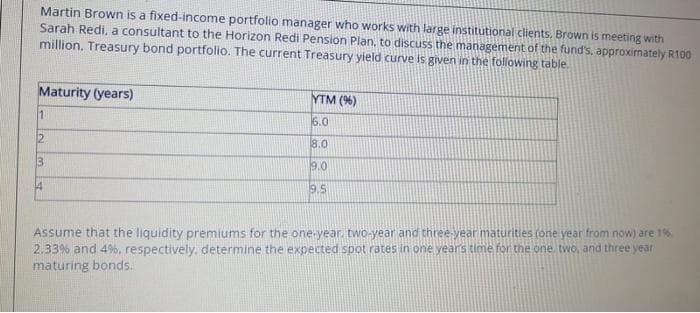

Martin Brown is a fixed-income portfolio manager who works with large institutional clients, Brown is meeting with Sarah Redi, a consultant to the Horizon Redi Pension Plan, to discuss the management of the fund's, approximately R100 million. Treasury bond portfolio. The current Treasury yield curve is given in the following table. Maturity (years) 1 2 3 4 YTM (%) 6.0 8.0 9.0 19.5 Assume that the liquidity premiums for the one-year, two-year and three-year maturities (one year from now) are 1%. 2.33% and 4%, respectively, determine the expected spot rates in one years time for the one two, and three year maturing bonds.

Martin Brown is a fixed-income portfolio manager who works with large institutional clients, Brown is meeting with Sarah Redi, a consultant to the Horizon Redi Pension Plan, to discuss the management of the fund's, approximately R100 million. Treasury bond portfolio. The current Treasury yield curve is given in the following table. Maturity (years) 1 2 3 4 YTM (%) 6.0 8.0 9.0 19.5 Assume that the liquidity premiums for the one-year, two-year and three-year maturities (one year from now) are 1%. 2.33% and 4%, respectively, determine the expected spot rates in one years time for the one two, and three year maturing bonds.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 4P

Related questions

Question

Transcribed Image Text:Martin Brown is a fixed-income portfolio manager who works with large institutional clients. Brown is meeting with

Sarah Redi, a consultant to the Horizon Redi Pension Plan, to discuss the management of the fund's, approximately R100

million. Treasury bond portfolio. The current Treasury yield curve is given in the following table.

Maturity (years)

1

12

3

4

YTM (%)

6.0

8.0

9.0

9.5

Assume that the liquidity premiums for the one-year, two-year and three-year maturities (one year from now) are 1%

2.33% and 4%, respectively, determine the expected spot rates in one years time for the one, two, and three year

maturing bonds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning