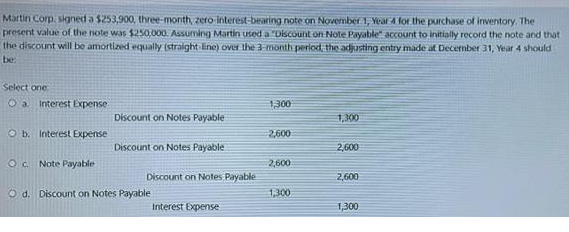

Martin Corp, signed a $253,900, three-month, zero interest-bearing note on November 1, Year 4 for the purchase of inventory. The present value of the note was $250,000. Assuming Martin used a "Discount on Note Payable" account to initially record the note and that i the discount will be amortized equally (straight line) over the 3-month period, the adjusting entry made at December 31, Year 4 should be: Select one: Oa. Interest Expense O b. Interest Expense Oc Note Payable Discount on Notes Payable Discount on Notes Payable Discount on Notes Payable Od. Discount on Notes Payable Interest Expense 1,300 2,600 2,600 1,300 1,300 2,600 2,600 1,300

Martin Corp, signed a $253,900, three-month, zero interest-bearing note on November 1, Year 4 for the purchase of inventory. The present value of the note was $250,000. Assuming Martin used a "Discount on Note Payable" account to initially record the note and that i the discount will be amortized equally (straight line) over the 3-month period, the adjusting entry made at December 31, Year 4 should be: Select one: Oa. Interest Expense O b. Interest Expense Oc Note Payable Discount on Notes Payable Discount on Notes Payable Discount on Notes Payable Od. Discount on Notes Payable Interest Expense 1,300 2,600 2,600 1,300 1,300 2,600 2,600 1,300

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 28E: On January 1, 2019, Northfield Corporation becomes delinquent on a 100,000, 14% note to First...

Related questions

Question

Transcribed Image Text:Martin Corp, signed a $253,900, three-month, zero interest-bearing note on November 1, Year 4 for the purchase of inventory. The

present value of the note was $250,000. Assuming Martin used a "Discount on Note Payable account to initially record the note and that i

the discount will be amortized equally (straight line) over the 3-month period, the adjusting entry made at December 31, Year 4 should

be:

Select one:

Oa. Interest Expense

O b. Interest Expense

Oc Note Payable

Discount on Notes Payable

Discount on Notes Payable

Discount on Notes Payable

Od. Discount on Notes Payable

Interest Expense

1,300

2,600

2,600

1,300

1,300

2,600

2,600

1,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage