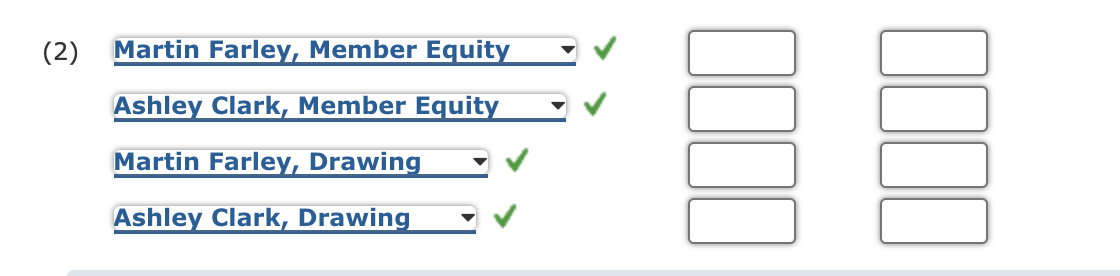

Martin Farley and Ashley Clark formed a limited liability company with an operating agreement that provided a salary allowance of $40,000 and $30,000 to each member, respectively. In addition, the operating agreement specified an income-sharing ratio of 3:2. The two members withdrew amounts equal to their salary allowances. Revenues were $668,000 and expenses were $520,000, for net income of $148,000. a. Determine the division of $148,000 net income for the year. Schedule of Division of Net Income Farley Clark Total Salary allowance 40,000 30,000 2$ 70,000 Remaining income 46,800 V 31,200 V 78,000 Net income 86,800 V $ 61,200 148,000 Feedback Check My Work a. Set up a column for each partner and a total column. Allocate salary allowances, then distribute the remaining income based on the income sharing agreement.

Martin Farley and Ashley Clark formed a limited liability company with an operating agreement that provided a salary allowance of $40,000 and $30,000 to each member, respectively. In addition, the operating agreement specified an income-sharing ratio of 3:2. The two members withdrew amounts equal to their salary allowances. Revenues were $668,000 and expenses were $520,000, for net income of $148,000. a. Determine the division of $148,000 net income for the year. Schedule of Division of Net Income Farley Clark Total Salary allowance 40,000 30,000 2$ 70,000 Remaining income 46,800 V 31,200 V 78,000 Net income 86,800 V $ 61,200 148,000 Feedback Check My Work a. Set up a column for each partner and a total column. Allocate salary allowances, then distribute the remaining income based on the income sharing agreement.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:目目

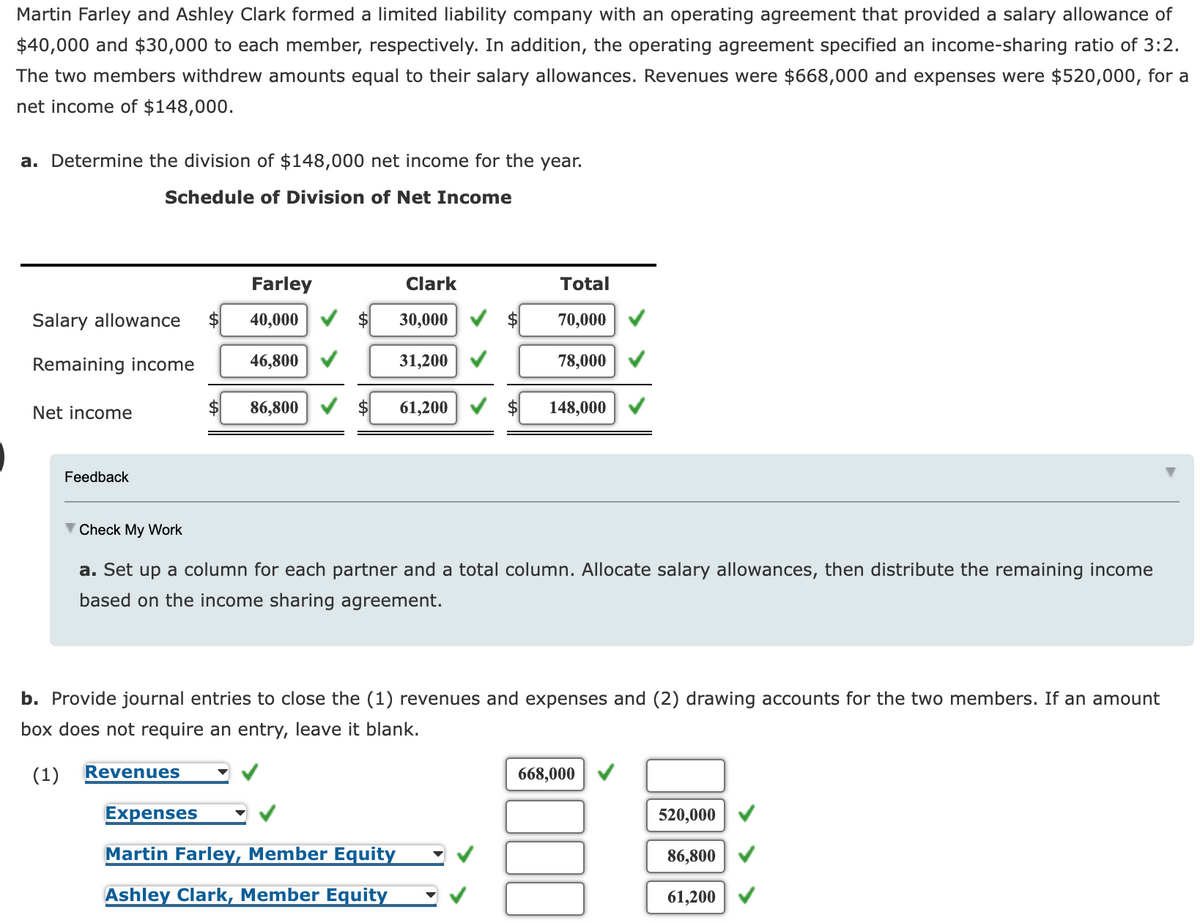

(2)

Martin Farley, Member Equity

Ashley Clark, Member Equity

Martin Farley, Drawing

Ashley Clark, Drawing

Transcribed Image Text:Martin Farley and Ashley Clark formed a limited liability company with an operating agreement that provided a salary allowance of

$40,000 and $30,000 to each member, respectively. In addition, the operating agreement specified an income-sharing ratio of 3:2.

The two members withdrew amounts equal to their salary allowances. Revenues were $668,000 and expenses were $520,000, for a

net income of $148,000.

a. Determine the division of $148,000 net income for the year.

Schedule of Division of Net Income

Farley

Clark

Total

Salary allowance

$

40,000

$

30,000

$

70,000

Remaining income

46,800

31,200

78,000

Net income

86,800

61,200

148,000

Feedback

V Check My Work

a. Set up a column for each partner and a total column. Allocate salary allowances, then distribute the remaining income

based on the income sharing agreement.

b. Provide journal entries to close the (1) revenues and expenses and (2) drawing accounts for the two members. If an amount

box does not require an entry, leave it blank.

(1)

Revenues

668,000

Expenses

520,000

Martin Farley, Member Equity

86,800

Ashley Clark, Member Equity

61,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you