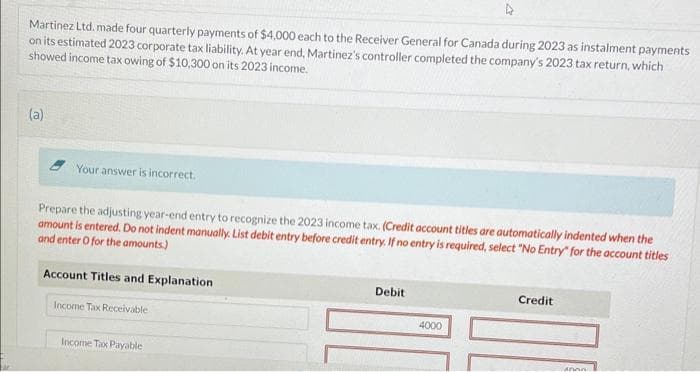

Martinez Ltd. made four quarterly payments of $4,000 each to the Receiver General for Canada during 2023 as instalment payments on its estimated 2023 corporate tax liability. At year end, Martinez's controller completed the company's 2023 tax return, which showed income tax owing of $10,300 on its 2023 income. (a) Your answer is incorrect. Prepare the adjusting year-end entry to recognize the 2023 income tax. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Account Titles and Explanation Income Tax Receivable Debit 4000 Credit

Martinez Ltd. made four quarterly payments of $4,000 each to the Receiver General for Canada during 2023 as instalment payments on its estimated 2023 corporate tax liability. At year end, Martinez's controller completed the company's 2023 tax return, which showed income tax owing of $10,300 on its 2023 income. (a) Your answer is incorrect. Prepare the adjusting year-end entry to recognize the 2023 income tax. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter O for the amounts) Account Titles and Explanation Income Tax Receivable Debit 4000 Credit

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 11MCQ

Related questions

Question

Please Explain Proper Step by Step and Do Not Give Solution In Image Format And Fast Answering Please And Thanks In Advance ?

Transcribed Image Text:Martinez Ltd. made four quarterly payments of $4,000 each to the Receiver General for Canada during 2023 as instalment payments

on its estimated 2023 corporate tax liability. At year end, Martinez's controller completed the company's 2023 tax return, which

showed income tax owing of $10,300 on its 2023 income.

(a)

Your answer is incorrect.

Prepare the adjusting year-end entry to recognize the 2023 income tax. (Credit account titles are automatically indented when the

amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles

and enter O for the amounts)

Account Titles and Explanation

Income Tax Receivable

Income Tax Payable

Debit

4000

Credit

Anna

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT