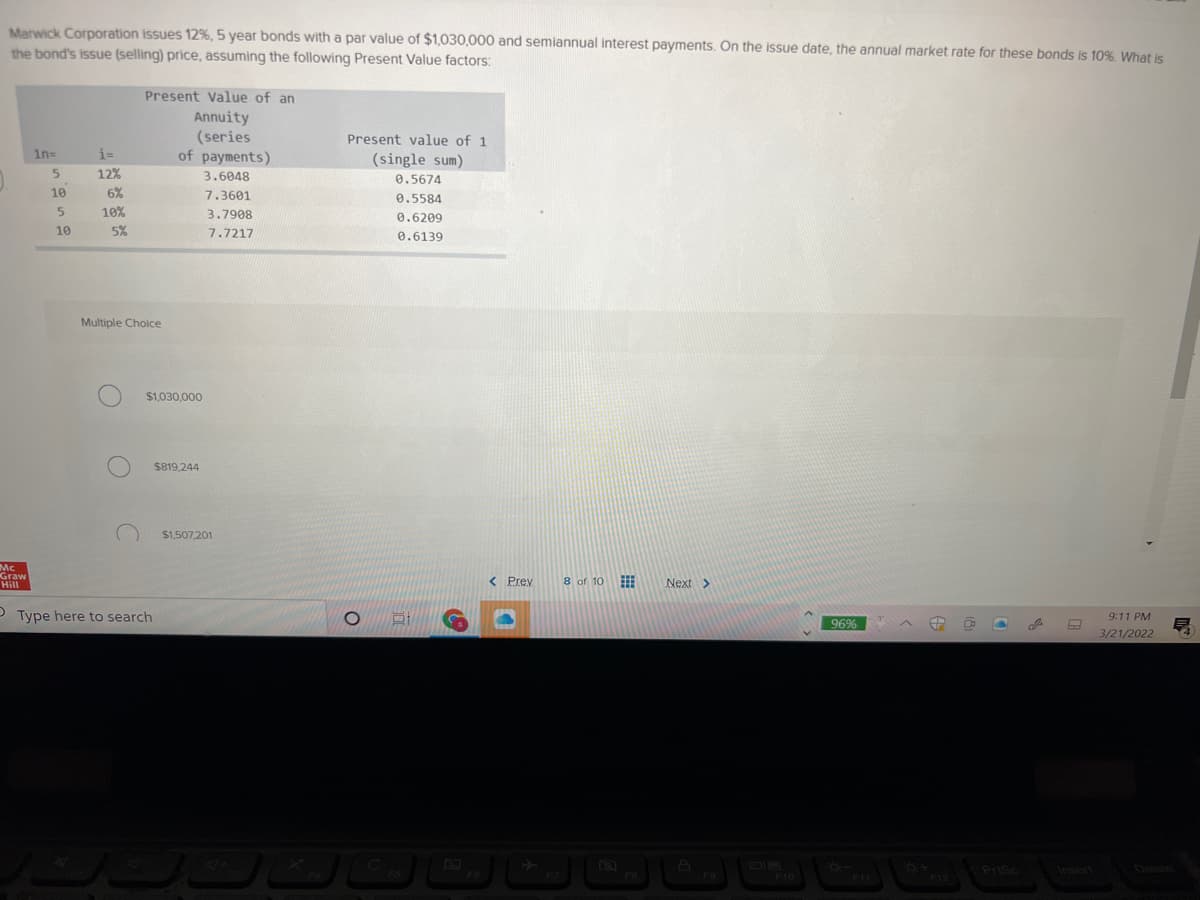

Marwick Corporation issues 12%, 5 year bonds with a par value of $1,030,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds the bond's issue (selling) price, assuming the following Present Value factors: Present Value of an Annuity (series of payments) Present value of 1 1n- (single sum) 5. 12% 3.6048 0.5674 10 6% 7.3601 0.5584 10% 3.7908 0.6209 10 5% 7.7217 0.6139 Multiple Choice

Marwick Corporation issues 12%, 5 year bonds with a par value of $1,030,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds the bond's issue (selling) price, assuming the following Present Value factors: Present Value of an Annuity (series of payments) Present value of 1 1n- (single sum) 5. 12% 3.6048 0.5674 10 6% 7.3601 0.5584 10% 3.7908 0.6209 10 5% 7.7217 0.6139 Multiple Choice

Chapter13: Long-term Liabilities

Section: Chapter Questions

Problem 3EB: Smashing Cantaloupes Inc. issued 5-year bonds with a par value of $35,000 and an 8% semiannual...

Related questions

Question

Transcribed Image Text:Marwick Corporation issues 12%, 5 year bonds with a par value of $1,030,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 10%. Wwhat is

the bond's issue (selling) price, assuming the following Present Value factors:

Present Value of an

Annuity

(series

of payments)

Present value of 1

1n=

i=

(single sum)

12%

3.6048

0.5674

10

6%

7.3601

0.5584

5.

10%

3.7908

0.6209

10

5%

7.7217

0.6139

Multiple Choice

$1,030,000

$819,244

$1,507,201

Mc

Graw

Hill

< Prev

8 of 10

Next >

O Type here to search

9:11 PM

96%

3/21/2022

PriSc

Insert

దుటపర్

F6

FB

F9

F10

FIL

F12

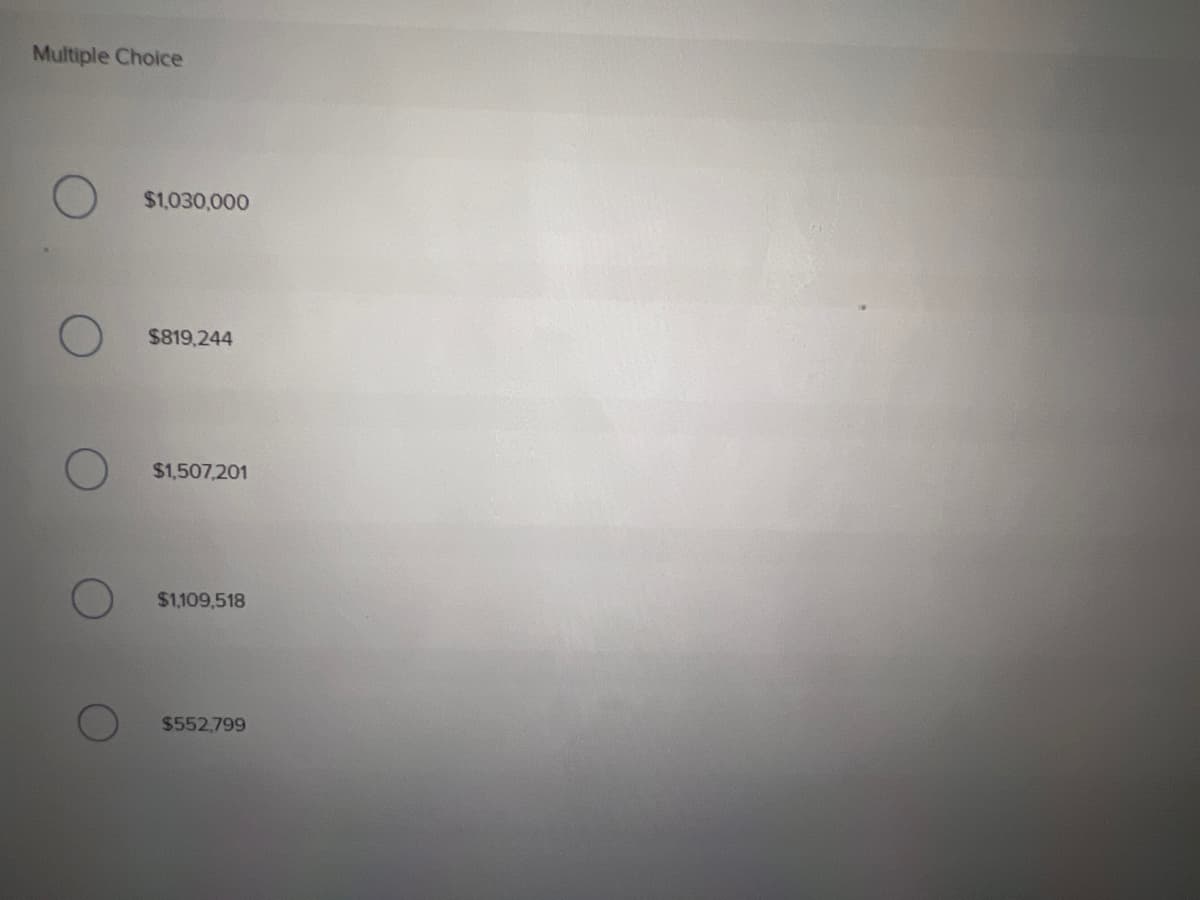

Transcribed Image Text:Multiple Choice

$1,030,000

$819,244

$1,507,201

$1,109,518

$552,799

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning