Chapter1: The Role And Objective Of Financial Management

Section: Chapter Questions

Problem 15QTD

Related questions

Question

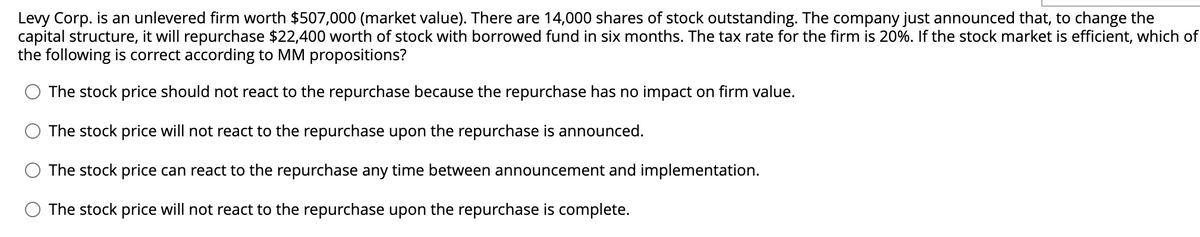

Transcribed Image Text:Levy Corp. is an unlevered firm worth $507,000 (market value). There are 14,000 shares of stock outstanding. The company just announced that, to change the

capital structure, it will repurchase $22,400 worth of stock with borrowed fund in six months. The tax rate for the firm is 20%. If the stock market is efficient, which of

the following is correct according to MM propositions?

The stock price should not react to the repurchase because the repurchase has no impact on firm value.

The stock price will not react to the repurchase upon the repurchase is announced.

The stock price can react to the repurchase any time between announcement and implementation.

The stock price will not react to the repurchase upon the repurchase is complete.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning