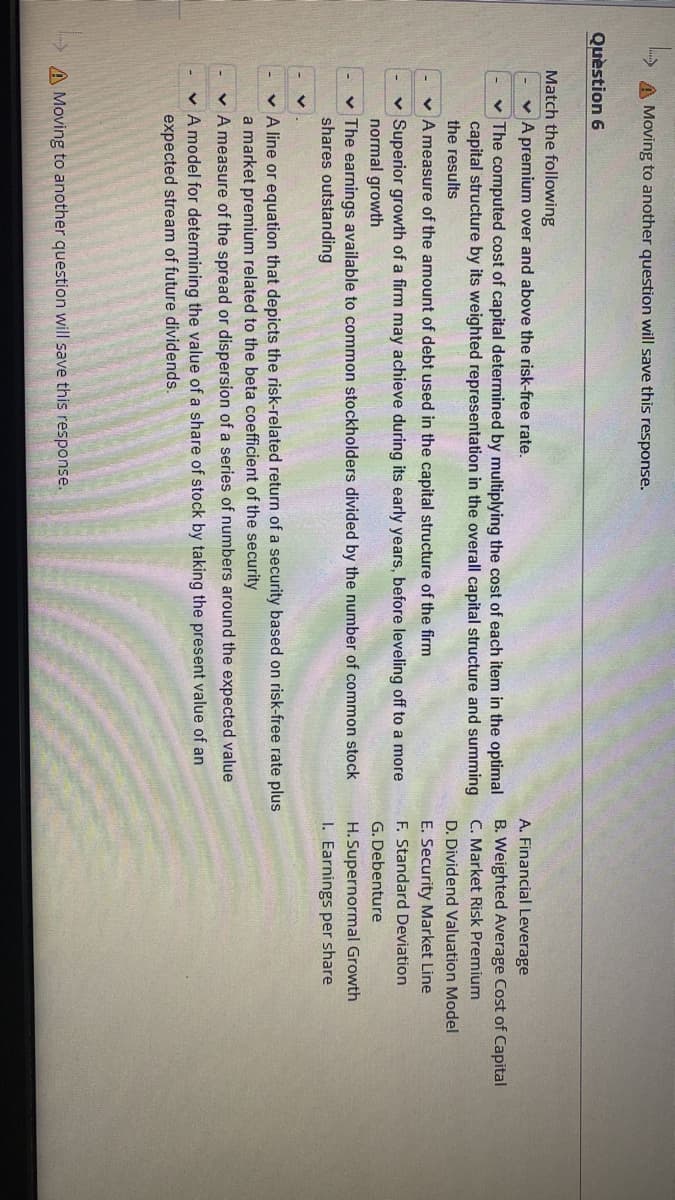

Match the following ✓ A premium over and above the risk-free rate. A. Financial Leverage ✓ The computed cost of capital determined by multiplying the cost of each item in the optimal B. Weighted Average Cost of Capital capital structure by its weighted representation in the overall capital structure and summing C. Market Risk Premium the results D. Dividend Valuation Model A measure of the amount of debt used in the capital structure of the firm E. Security Market Line F. Standard Deviation V Superior growth of a firm may achieve during its early years, before leveling off to a more normal growth G. Debenture ✓ The earnings available to common stockholders divided by the number of common stock shares outstanding H. Supernormal Growth 1. Earnings per share ✓ A line or equation that depicts the risk-related return of a security based on risk-free rate plus a market premium related to the beta coefficient of the security ✓ A measure of the spread or dispersion of a series of numbers around the expected value ✓ A model for determining the value of a share of stock by taking the present value of an expected stream of future dividends.

Match the following ✓ A premium over and above the risk-free rate. A. Financial Leverage ✓ The computed cost of capital determined by multiplying the cost of each item in the optimal B. Weighted Average Cost of Capital capital structure by its weighted representation in the overall capital structure and summing C. Market Risk Premium the results D. Dividend Valuation Model A measure of the amount of debt used in the capital structure of the firm E. Security Market Line F. Standard Deviation V Superior growth of a firm may achieve during its early years, before leveling off to a more normal growth G. Debenture ✓ The earnings available to common stockholders divided by the number of common stock shares outstanding H. Supernormal Growth 1. Earnings per share ✓ A line or equation that depicts the risk-related return of a security based on risk-free rate plus a market premium related to the beta coefficient of the security ✓ A measure of the spread or dispersion of a series of numbers around the expected value ✓ A model for determining the value of a share of stock by taking the present value of an expected stream of future dividends.

Chapter13: Capital Structure Concepts

Section: Chapter Questions

Problem 5P

Related questions

Question

100%

Answer this questions fast plz

Transcribed Image Text:A Moving to another question will save this response.

Match the following

✓ A premium over and above the risk-free rate.

✓ The computed cost of capital determined by multiplying the cost of each item in the optimal

capital structure by its weighted representation in the overall capital structure and summing

the results

✓ A measure of the amount of debt used in the capital structure of the firm

Superior growth of a firm may achieve during its early years, before leveling off to a more

normal growth

✓ The earnings available to common stockholders divided by the number of common stock

shares outstanding

A line or equation that depicts the risk-related return of a security based on risk-free rate plus

a market premium related to the beta coefficient of the security

✓ A measure of the spread or dispersion of a series of numbers around the expected value

✓ A model for determining the value of a share of stock by taking the present value of an

expected stream of future dividends.

A Moving to another question will save this response.

Question 6

A. Financial Leverage

B. Weighted Average Cost of Capital

C. Market Risk Premium

D. Dividend Valuation Model

E. Security Market Line

F. Standard Deviation

G. Debenture

H. Supernormal Growth

1. Earnings per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning