Math 4 You inherited a huge mango garden in Rajshahi from a distantly related great grandfather. It opens two choices for you: Choice (1): Farm for mango yourself and produce mango juice. Ya will invest 300,000BDT to set it up. But at every year end you will earn 600,000BDT (after deduction of all the taxes etc...) for the ne 5 years. Choice (2): Lease out the garden to a company. It pays you o00 00ORDT at the Ru

Math 4 You inherited a huge mango garden in Rajshahi from a distantly related great grandfather. It opens two choices for you: Choice (1): Farm for mango yourself and produce mango juice. Ya will invest 300,000BDT to set it up. But at every year end you will earn 600,000BDT (after deduction of all the taxes etc...) for the ne 5 years. Choice (2): Lease out the garden to a company. It pays you o00 00ORDT at the Ru

Chapter5: Gross Income: Exclusions

Section: Chapter Questions

Problem 52P

Related questions

Question

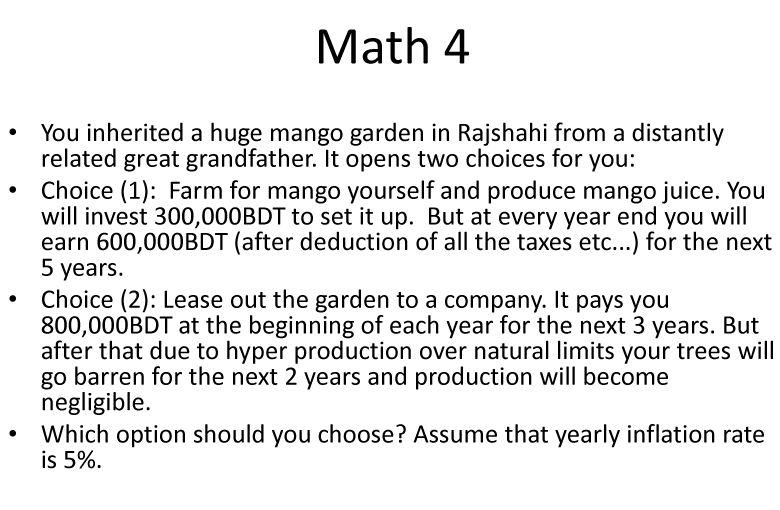

Transcribed Image Text:Math 4

You inherited a huge mango garden in Rajshahi from a distantly

related great grandfather. It opens two choices for you:

Choice (1): Farm for mango yourself and produce mango juice. You

will invest 300,000BDT to set it up. But at every year end you will

earn 600,000BDT (after deduction of all the taxes etc...) for the next

5 years.

Choice (2): Lease out the garden to a company. It pays you

800,000BDT at the beginning of each year for the next 3 years. But

after that due to hyper production over natural limits your trees will

go barren for the next 2 years and production will become

negligible.

Which option should you choose? Assume that yearly inflation rate

is 5%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning