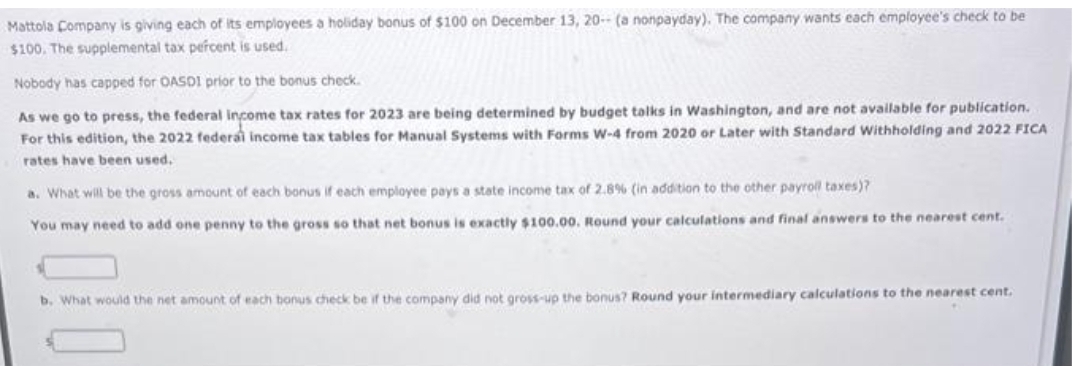

Mattola Company is giving each of its employees a holiday bonus of $100 on December 13, 20-- (a nonpayday). The company wants each employee's check to be $100. The supplemental tax percent is used. Nobody has capped for OASDI prior to the bonus check. As we go to press, the federal income tax rates for 2023 are being determined by budget talks in Washington, and are not available for publication. For this edition, the 2022 federal income tax tables for Manual Systems with Forms W-4 from 2020 or Later with Standard Withholding and 2022 FICA rates have been used. a. What will be the gross amount of each bonus if each employee pays a state income tax of 2.8% (in addition to the other payroll taxes)? You may need to add one penny to the gross so that net bonus is exactly $100.00. Round your calculations and final answers to the nearest cent. b. What would the net amount of each bonus check be if the company did not gross-up the bonus? Round your intermediary calculations to the nearest cent.

Mattola Company is giving each of its employees a holiday bonus of $100 on December 13, 20-- (a nonpayday). The company wants each employee's check to be $100. The supplemental tax percent is used. Nobody has capped for OASDI prior to the bonus check. As we go to press, the federal income tax rates for 2023 are being determined by budget talks in Washington, and are not available for publication. For this edition, the 2022 federal income tax tables for Manual Systems with Forms W-4 from 2020 or Later with Standard Withholding and 2022 FICA rates have been used. a. What will be the gross amount of each bonus if each employee pays a state income tax of 2.8% (in addition to the other payroll taxes)? You may need to add one penny to the gross so that net bonus is exactly $100.00. Round your calculations and final answers to the nearest cent. b. What would the net amount of each bonus check be if the company did not gross-up the bonus? Round your intermediary calculations to the nearest cent.

Chapter4: Income Tax Withholding

Section: Chapter Questions

Problem 2QD

Related questions

Question

Ff.216.

Transcribed Image Text:Mattola Company is giving each of its employees a holiday bonus of $100 on December 13, 20- (a nonpayday). The company wants each employee's check to be

$100. The supplemental tax percent is used.

Nobody has capped for OASDI prior to the bonus check.

As we go to press, the federal income tax rates for 2023 are being determined by budget talks in Washington, and are not available for publication.

For this edition, the 2022 federal income tax tables for Manual Systems with Forms W-4 from 2020 or Later with Standard Withholding and 2022 FICA

rates have been used.

a. What will be the gross amount of each bonus if each employee pays a state income tax of 2.8% (in addition to the other payroll taxes)?

You may need to add one penny to the gross so that net bonus is exactly $100.00. Round your calculations and final answers to the nearest cent.

b. What would the net amount of each bonus check be if the company did not gross-up the bonus? Round your intermediary calculations to the nearest cent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub