Maya Womak wishes to purchase a(n) $645,000 house. She has accumulated a $125,000 down payment, but she wishes to borrow $520,000 on a 15-year mortgage. For simplicity, assume annual mortgage payments occur at the end of each year and there are no loan fees. E (Click the icon to view the present value factor table.) (Click the icon to view the present value annuity factor table.) Read the requirements Requirement 1. What are Womak's annual payments if her interest rate is (a) 8%, (b) 12%, and (c) 14%, compounded annually? (Round your final answers to the nearest whole dollar.) Begin by selecting the formula you will need answer this question for each of the three scenarios (a., b., and c.) Borrowings / Present value of ordinary annuity of $1 Annual payment 1a. What are Womak's annual payments if her interest rate is 8%, compounded annually? Requirements 1. What are Womak's annual payments if her interest rate is (a) 8%, (b) 12%, and (c) 14%, compounded annually? 2. Repeat number 1 for a 10-year mortgage. 3. Suppose Womak had to choose between a 15-year and a 10-year mortgage, either one at a(n) 12% interest rate. Compute the total payments and total interest paid on (a) a 15-year mortgage and (b) a 10-year mortgage.

Maya Womak wishes to purchase a(n) $645,000 house. She has accumulated a $125,000 down payment, but she wishes to borrow $520,000 on a 15-year mortgage. For simplicity, assume annual mortgage payments occur at the end of each year and there are no loan fees. E (Click the icon to view the present value factor table.) (Click the icon to view the present value annuity factor table.) Read the requirements Requirement 1. What are Womak's annual payments if her interest rate is (a) 8%, (b) 12%, and (c) 14%, compounded annually? (Round your final answers to the nearest whole dollar.) Begin by selecting the formula you will need answer this question for each of the three scenarios (a., b., and c.) Borrowings / Present value of ordinary annuity of $1 Annual payment 1a. What are Womak's annual payments if her interest rate is 8%, compounded annually? Requirements 1. What are Womak's annual payments if her interest rate is (a) 8%, (b) 12%, and (c) 14%, compounded annually? 2. Repeat number 1 for a 10-year mortgage. 3. Suppose Womak had to choose between a 15-year and a 10-year mortgage, either one at a(n) 12% interest rate. Compute the total payments and total interest paid on (a) a 15-year mortgage and (b) a 10-year mortgage.

Chapter11: Capital Budgeting Decisions

Section: Chapter Questions

Problem 7MC: Using the information provided, what transaction represents the best application of the present...

Related questions

Question

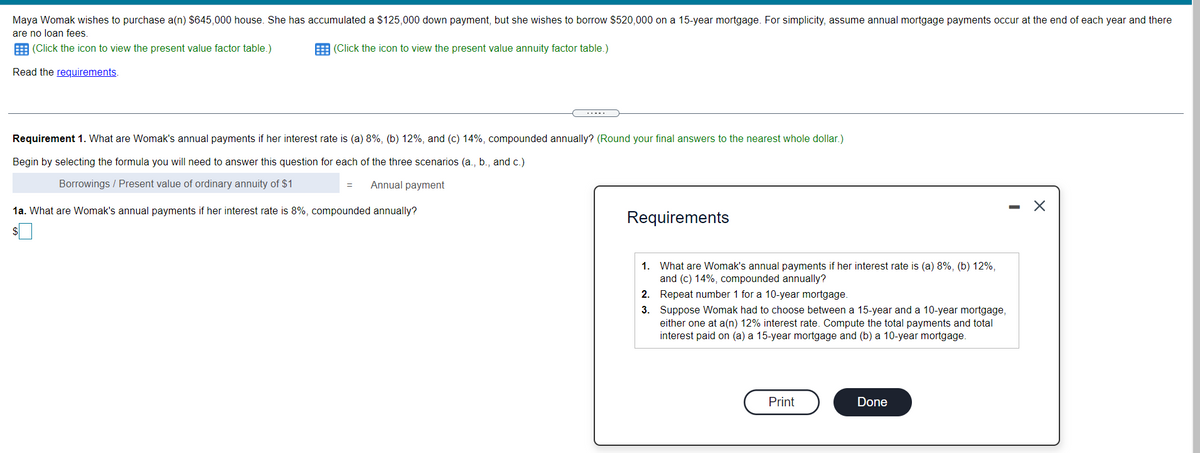

Transcribed Image Text:Maya Womak wishes to purchase a(n) $645,000 house. She has accumulated a $125,000 down payment, but she wishes to borrow $520,000 on a 15-year mortgage. For simplicity, assume annual mortgage payments occur at the end of each year and there

are no loan fees

E (Click the icon to view the present value factor table.)

E (Click the icon to view the present value annuity factor table.)

Read the requirements.

.....

Requirement 1. What are Womak's annual payments if her interest rate is (a) 8%, (b) 12%, and (c) 14%, compounded annually? (Round your final answers to the nearest whole dollar.)

Begin by selecting the formula you will need to answer this question for each of the three scenarios (a., b., and c.)

Borrowings / Present value of ordinary annuity of $1

Annual payment

1a. What are Womak's annual payments if her interest rate is 8%, compounded annually?

Requirements

1. What are Womak's annual payments if her interest rate is (a) 8%, (b) 12%,

and (c) 14%, compounded annually?

2. Repeat number 1 for a 10-year mortgage.

3. Suppose Womak had to choose between a 15-year and a 10-year mortgage,

either one at a(n) 12% interest rate. Compute the total payments and total

interest paid on (a) a 15-year mortgage and (b) a 10-year mortgage.

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning